Investors Surge Back Into Oil At Fastest Pace In 5 Years

By John Kemp, senior market analyst

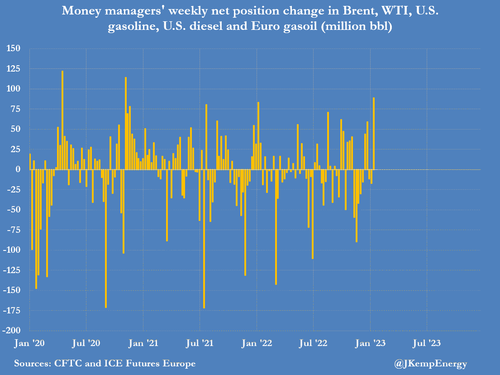

Portfolio investors have piled back into petroleum futures and options at the fastest rate for more than two years as concerns about a global business cycle downturn have eased.

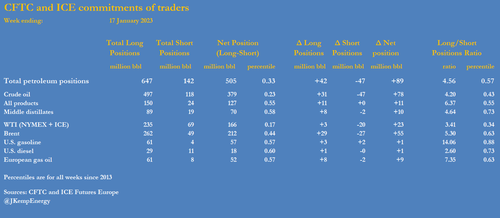

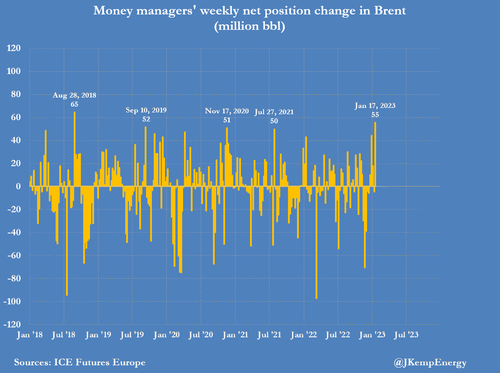

Hedge funds and other money managers purchased the equivalent of 89 million barrels in the six most important petroleum contracts over the seven days ending on Jan. 17.

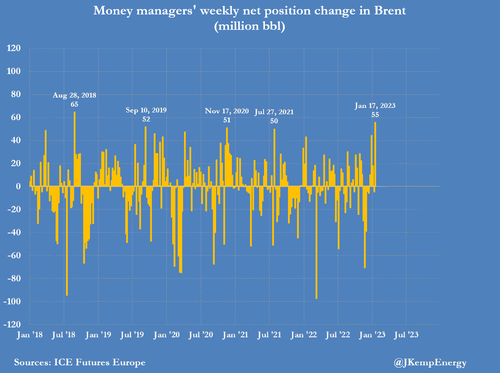

Purchasing was the fastest since November 2020 (shortly before the first successful coronavirus vaccine trials were announced) and before that April 2020 (when the first lockdowns started to be eased). The wave of buying was led by crude (+78 million barrels), especially Brent (+55 million), with smaller buying in NYMEX and ICE WTI (+23 million).

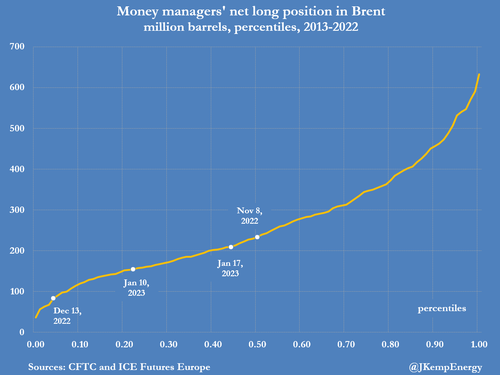

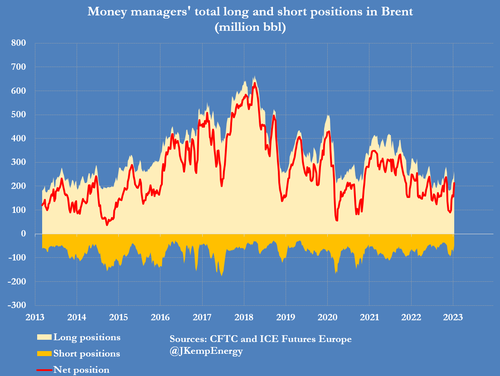

Total Brent positions climbed to 212 million barrels (44th percentile for all weeks since 2013) up from 157 million (22nd percentile) on Jan. 10 and a recent low of just 89 million (4th percentile) on Dec. 13.

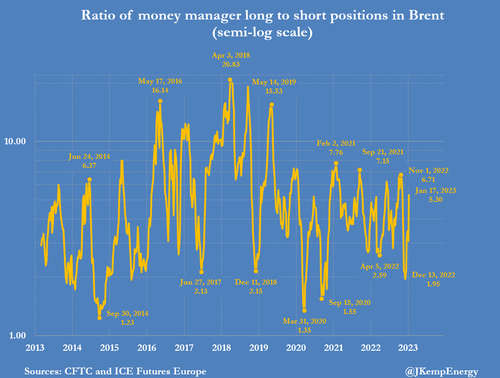

Bullish long positions outnumbered bearish short ones in Brent by a ratio of 5.30:1 (63rd percentile) up from 3.07 (28th percentile) on Jan. 10 and 1.95 (6th percentile) on Dec. 13.

The increase in investors’ Brent positions was the largest since August 2018 and the sixth-largest out of 514 weeks since the time series began in 2013.

The sudden turn around seems to have been driven by a combination of low initial positioning and a sudden increase in confidence about the outlook for the global economy and oil consumption. Recent inflation data have shown the rate of price increases is moderating, which has raised hopes for an early peak in the interest rate cycle.

With gas and electricity prices declining in recent weeks, some major forecasters now expect the euro zone as well as the United States to avoid a formal recession in 2023. China also appears to be pressing ahead with re-opening the economy after three years of intermittent and disruptive lockdowns.

Given the speed of transmission, the current infection wave is likely to be completed by the end of February or early March. By April, there is likely to be a very large increase in domestic and international passenger travel by air, rail and road, driving a large increase in fuel consumption.

China’s re-opening industrial economy is also likely to stimulate domestic diesel consumption and spill-over stimulus to other economies in Asia.

Ironically, the biggest risk to the economy and oil consumption is that the economic revival rekindles inflationary pressures and forces the major central banks to persist in raising interest rates longer and higher.

Tyler Durden

Tue, 01/24/2023 – 11:24

via ZeroHedge News https://ift.tt/rX1Gn6B Tyler Durden