Adani Stock, Bonds Meltdown As Credit Suisse Halts Margin Loans

Turmoil remerged in the Adani group Wednesday after a top Swiss bank stopped accepting bonds from companies tied to Gautam Adani’s corporate empire for margin loans.

Bloomberg reported Credit Suisse Group AG halted the acceptable of bonds of Adani’s companies as collateral for margin for banking clients. This news led to further declines in Adani shares and dollar bonds.

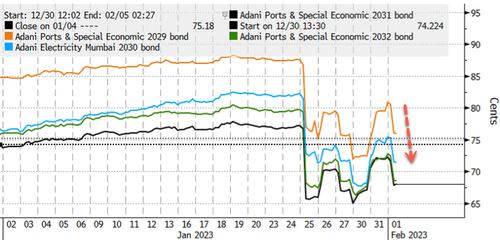

The Swiss lender’s private banking arm has assigned a zero lending value for notes sold by Adani Ports and Special Economic Zone, Adani Green Energy and Adani Electricity Mumbai Ltd., according to people familiar with the matter, who asked not to be identified discussing private information. It had previously offered a lending value of about 75% for the Adani Ports notes, one of the people said.

When a private bank cuts lending value to zero, clients typically have to top up with cash or another form of collateral and if they fail to do so, their securities can be liquidated. –Bloomberg

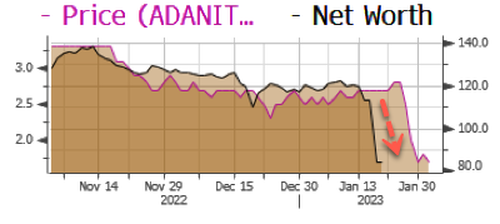

Shares of Adani Enterprises crashed, closing down by more than 28%. Market cap losses across all Adani companies hit $93 billion since US short-seller Hindenburg Research accused it of corporate fraud one week ago.

Hindenburg’s allegations sparked a crisis of confidence for Adani despite Adani Enterprises completing a $2.5 billion follow-on stock sale Tuesday, which briefly calmed investors.

“Caution on Adani group stocks has increased after the news on action taken by Credit Suisse.

“This can put a financing hurdle for the group’s further growth,” said Sameer Kalra, founder of Target Investing in Mumbai.

Dollar bonds of Adani Group also plunged.

Peter Garnry, head of equity strategy at Saxo Bank A/S, said the problem now is “the dynamics are becoming a self-reinforcing negative feedback loop and investors are now just dumping the shares and asking questions later.”

Garnry added: “This is potentially a bigger problem for Indian equities which have done so well during the pandemic as China pursued its zero Covid policy. The long-term ramifications could be quite negative.”

The worsening rout in Adani weighed on India’s broader equity benchmarks.

The contagion has been quick, and so has the wipeout of Adani’s personal wealth, plummeting by $44 billion to about $72 billion in one week, according to the latest Bloomberg data.

Adani is no longer the richest person in Asia.

Tyler Durden

Wed, 02/01/2023 – 06:55

via ZeroHedge News https://ift.tt/nelECqK Tyler Durden