US Manufacturing Surveys Signal Accelerating Stagflation In January

The health of the US manufacturing sector continued to decline at the start of 2023, according to the latest PMI data from S&P Global (albeit deteriorating at a very slightly reduced rate compared to December from 46.2 to 46.9) and the ISM data was even worse, falling to 47.4 (below the 48.0 expectation and down from 48.4) – the weakest since May 2020…

With only labor prints supporting macro surprise data, these Manufacturing indicators do nothing to support any ‘soft landing’ signals…

Source: Bloomberg

That is the 3rd straight month of ‘contraction’ (sub-50) for Manufacturing.

Under the hood, the PMI shows rising inflation, weaker production, and lower orders – screaming ‘stagflation’ – and ISM’s data confirms the rebound in prices…

Source: Bloomberg

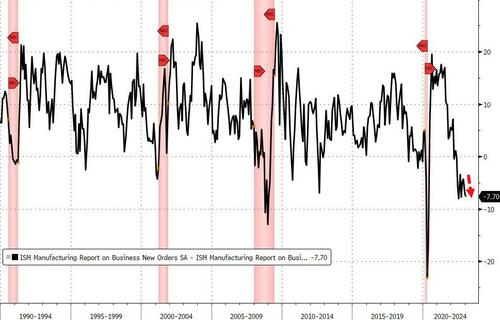

Additionally, ISM new orders relative to inventories continue to sink in a ‘recessionary’-signaling manner…

Source: Bloomberg

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

“Despite rising in January, the PMI remains at one of the lowest levels recorded since the global financial crisis, indicating a worryingly steep rate of decline in the health of the goods producing sector. Production has now fallen for three successive months, signalling a sharp fall in output which is now becoming increasingly evident in the official statistics and suggesting that the manufacturing sector has become a major drag on GDP.

“New orders are also slumping as demand from both domestic and export customers comes under increasing pressure from a mix of inflation and slower economic growth. The drop in orders also means that excess capacity is developing, which has in turn meant companies have scaled back their hiring and purchasing, and are also increasingly focusing on reducing their inventory levels.

“Improved supply chains and weaker demand should meanwhile help keep a lid on manufacturing price pressures in the months ahead, though a slight uptick in the survey’s input cost and selling price gauges in January suggests that the road to lower inflation could be bumpier than previously anticipated, reflecting still elevated prices for many raw materials relative to pre-pandemic levels and sustained upward wage pressures.”

Finally, as a reminder, it is only the labor market data that has materially supported the ‘strong’ macro argument among market participants, dominating the weakness in ‘soft’ survey and industrial data in recent weeks…

Source: Bloomberg

Does The Fed really want a ‘strong’ labor market?

Tyler Durden

Wed, 02/01/2023 – 10:03

via ZeroHedge News https://ift.tt/qxSl7Xb Tyler Durden