WTI Extends Losses After Across-The-Board Inventory Builds

Oil prices were weaker this morning following weak Manufacturing data and a poor ADP jobs report, and following last night’s across-the-board builds reported by API. Additionally, OPEC+ committee recommended keeping crude production steady as the oil market awaits clarity on demand in China and supplies from Russia.

“Everyone agrees that the situation is quite stable on the market,” Russian Deputy Prime Minister Alexander Novak, who represents the country at OPEC+ meetings, told the Rossiya 24 TV channel.

“Of course, we see a large number of uncertainties” ranging from inflation and interest rates to Chinese demand.

The nationwide ‘deep freeze’ has clearly been impacting the inventory data over the last few weeks. We suspect today could be the first ‘clean’ indication, but last night’s API data suggests it may not be over (or we have a serious demand dry up)…

API

-

Crude +6.33mm (-1mm exp)

-

Cushing +2.72mm

-

Gasoline +2.73mm

-

Distillates +1.53mm

DOE

-

Crude +4.14mm (-1mm exp)

-

Cushing +2.315mm

-

Gasoline +2.576mm

-

Distillates +2.32mm

The official EIA data confirmed API’s report of a major crude inventory build last week (the sixth straight weekly build). Cushing stocks rose for the 5th straight week and Distillates saw the largest build since early December…

Source: Bloomberg

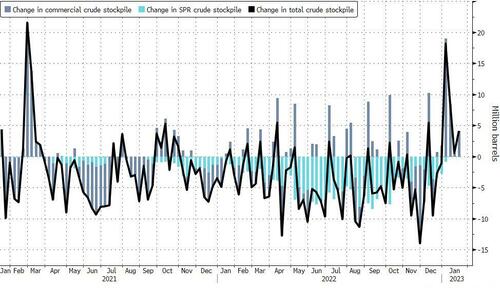

With no crude withdrawn from, or put into, the Strategic Petroleum Reserve for a second week, the overall nationwide crude build was all in commercial inventories…

Source: Bloomberg

Overall US crude stockpiles are the highest since June 2021…

Source: Bloomberg

Stocks at the Cushing hub are also at their highest since July 2021…

Source: Bloomberg

US crude production remained flat at 12.2mm b/d (post-COVID highs) while the rig count has begun to rollover…

Source: Bloomberg

WTI was trading down around $78.75 and extended losses after the builds were reported…

“The main driver for oil lately has been the potential for a resurgence of oil demand out of China, which may continue into February considering how Chinese economic momentum picked up in the overnight PMI reports,” said Colin Cieszynski, chief market strategist at SIA Wealth Management.

Finally, we note that after almost two straight years of collapse in participation in the oil markets, futures open interest has skyrocketed back in January…

Source: Bloomberg

Of course, a more hawkish Fed later today and higher interest rates could be bearish for crude since the moves are designed to slow down the economy and lead to a drop in demand.

Tyler Durden

Wed, 02/01/2023 – 10:36

via ZeroHedge News https://ift.tt/IFpstPY Tyler Durden