Trader Makes Huge $80 Million Bet Fed Is Wrong Again, Will Cut Below 4.2% By Year End

Earlier this week, we quoted Bloomberg trader and market commentator Vince Cignarella who said that “In More Than 40 Years Of Trading, Never Have I Witnessed A Market Fighting The Fed As Boldly As This One” and judging by Powell’s remarkable verbal pivot yesterday, there was good reason for that: the market was spot on, and Powell appears to have conceded that inflation will run much hotter, as he refuses to push back against risk prices any more.

So now that Powell pussied out, it’s open season on the residents of Marriner Eccles, and as Bloomberg reports a trader has put on a massive bet that the Fed will soon cave on promise that it will not cut rates this year, but will instead start slashing rates at a frenzied pace later this year.

The $80 million bet which was placed via options tied to the Secured Overnight Financing Rate, or SOFR, underscores the sentiment shift across markets that not only is the Fed’s tightening cycle almost over, but that the next step will be an accelerating easing campaign.

As Bloomberg’s Edward Bolingbroke observed, an unidentified investor started amassing the position in the morning and continued buying through the afternoon as Fed Chair Jerome Powell expressed confidence that inflation was improving.

The trade’s $80 million outlay would turn into a $400 million profit if the Fed were to cut its benchmark rate to 2.5% by the end of the year. A lesser amount of cuts, to 3.8%, would lead to a $100 million gain, according to Bloomberg’s Option Scenario Analysis function.

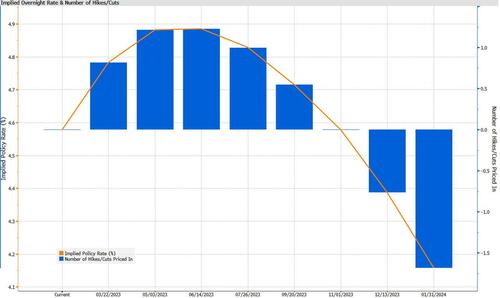

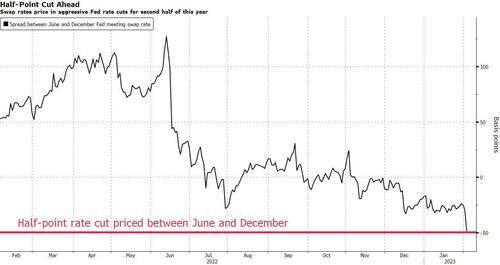

While the market is certainly pricing in aggressive rate cuts by year end – a 50bps cut to 4.4% in December from a 4.9% June peak, is now very much a given – a plunge to 2.5% in Fed Funds would be unprecedented and even a drop to 3.8% would require some unexpected shock to startle the Fed. The breakeven for the trade at expiry is a yield level of approximately 4.2%, so it is only profitable if the Fed cuts below this level.

As Bolingbroke explains, the $80 million SOFR bet was placed via a December 2023 SOFR call spread, where the owner of the position is long one strike equivalent to a 4.5% yield and short a higher strike equivalent to a 2.5% yield, where the maximum profit would be reached. Thursday’s preliminary Chicago Mercantile Exchange open interest data suggested the trade was a new position. Those options expire December 15, two days after the Fed’s final policy meeting of 2023.

Of course, once you start fighting the Fed – successfully – you don’t stop until you win, and on Thursday, another big SOFR options trade hit the tape, amounting to about $50 million. It stands to benefit from a continued collapse in volatility through the end of the year that would coincide with the steep rate cuts priced into markets.

Tyler Durden

Thu, 02/02/2023 – 13:46

via ZeroHedge News https://ift.tt/ArtEZuF Tyler Durden