Tighter Lending Doesn’t Bode Well for Soft Landing

Authored by Simon White, Bloomberg macro strategist,

The outlook for credit is increasingly at odds with the soft(er)-landing scenario that has been gaining credence. Credit markets and retail stocks are among assets that look most vulnerable to downside.

US banks have reported tightening lending standards across the board in the latest Fed Senior Loan Officer Survey released yesterday.

Banks reported tightening their standards on C&I loans to all sizes of firms over the fourth quarter. Many banks also reported tightening loan covenants and collateralization requirements.

This latest survey confirmed the trend that banks want to lend less and borrowers want to borrow less. The chart below shows this will continue, as when banks tighten standards, demand for loans falls.

The survey reported loan-standard tightening in commercial real-estate, residential real-estate and consumer loans, including credit cards. Credit-card lending has surged since the pandemic making up for the shortfall in lower-income households who have likely used up most of their pandemic savings.

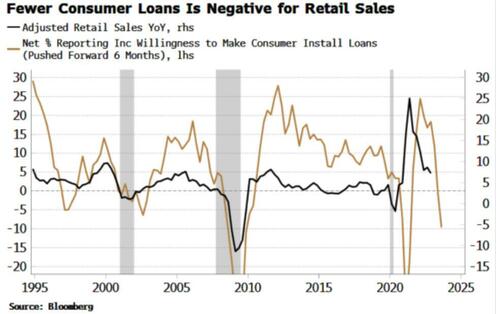

The tightening in consumer loans points to continued weakness in retail sales. This leaves the retail sector, one of the best performing this year, looking exposed to correcting lower.

Tyler Durden

Wed, 02/08/2023 – 11:26

via ZeroHedge News https://ift.tt/0aGjJ8i Tyler Durden