How Will Markets Respond To This Ongoing “Surprise” Turn In The Economy

By Peter Tchir of Academy Securities

Surprise, Surprise

There is one chart I keep turning to, the Citi Economic Surprise Index.

The surprise index started rolling over in the middle of December. For a month, no matter what expectations were, the actual data was worse. Then, since the middle of January, the data has started outperforming expectations. Part of that is because expectations were lowered, making it easier to beat. That also happens with earnings estimates, which are dropped to the point that typically 70% or more of companies beat their expectations (Q1 has been at the low end of the range last time I checked). But a lot of the data was simply good, especially on the job front.

What did I miss in the turning of the economy? That is the question we explore today and how markets will respond to this ongoing “surprise” as many missed this turn in the economy.

Geopolitical “Surprises”

As Academy prepares to host our 2nd annual San Diego Geopolitical Summit there are a lot of very interesting things to discuss.

-

Friday’s Around the World piece updates the War in Ukraine, China and Unintended Consequences (also explored in 999 Luftballons), Iran and their relationship with China, and the tragic Earthquake in Turkey.

-

Chips, rare earths and critical minerals, and their processing will be discussed along with the topic of World War v3.1 (as opposed to World War III).

-

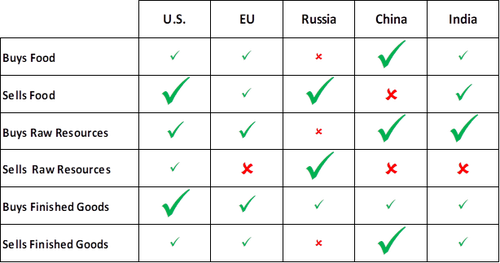

Finally, China’s 12 point plan for peace will be discussed. The 1st point “Respecting the sovereignty of all countries” seems to be written in such a way Taiwan might not benefit from China adhering to this point. It is an interesting way of trying to paint the West, now, as war mongers, rather than Russia. But, for me, and I suspect markets, the big question is will China start selling weapons to Russia? Any last vestige of pretense about the direction China wants to go, will be shed, if they go down that path. There is a wide range of opinions, even within the Geopolitical Intelligence Group, on the subject, which should make for an exciting conversation. I for one, think this “plan” is the air cover China needs to sell weapons. They can tell the world, listen, we are trying for peace, and it isn’t our fault there isn’t peace, so we have to sell weapons to balance the situation (or something along those lines). Probably, from preliminary discussions on the topic, the most contentious issue is how much that would hurt the Chinese economy. For that part of the engagement, I’m sticking with Who Needs Who from almost a year ago.

Yes, it is crude and simplistic, but wherever Russia has an “x”, China has a “check” and vice versa.

It seems that either we get the “surprise” of peace talks being announced in the very near term (which would be a surprise because Zelensky seems so against it, and Putin can’t really afford to “lose”) or after some “appropriate waiting period” we get the “surprise” of China selling arms to Russia.

Back to the Economy

With the economic data taking a turn for the better (both on an absolute basis and relative basis), what is next?

I guess, as a curmudgeon, we can start by questioning some of the data.

-

Inflation measures have ticked higher. That is undeniable. Does it mean inflation is about to return to prior levels? Is this just a “normal” bounce in the data which is rarely smooth? Does the bounce preclude inflation turning back down in the coming weeks and months? No, in fact, while respecting the uptick in inflation, I remain more concerned that we’ve pushed too hard on the inflation fight already (and are about to push harder) which will turn out to be a mistake.

-

Don’t fight the American consumer. That is probably the biggest area of contention right now. On one side, spending remained robust. The services side hasn’t shown any evidence of slowing down. Last Tuesday, Global Services PMI popped above 50 and helped keep the composite PMI above 50, and almost 3 points higher than consensus. That was important, and could defy my view that we had a wave of pent up services demand, that like the goods demand wave of 2021 and early 2022, will fade.

-

On the other hand, credit metrics are not looking great for the consumer. Credit card debt has been rising rapidly. Many pointed out, that for awhile, it was still below trend, after consumers had reduced debt during covid, but it seems now to be back above trend. Delinquencies, especially in certain segments of the auto lending category are ticking up. Could the consumer be tapping out?

-

Inventories remain an issue. Despite all the hype about consumer spending (where the bulls tend to conveniently pick and choose when to use nominal versus inflation adjusted data) inventories remain above trend. I’d be more concerned about inflation if we didn’t have this inventory overhang, with evidence of a consumer who is reaching their limits.

-

-

Jobs. The most “surprising” data of the year, at least for me, was the Non-Farm Payroll data for January. It was a Simply “Stunning” Report. I still have difficulty reconciling much of that report with anything else. I’m betting on some major disappointment for February (or more likely, substantial revisions). In any case, the February report tends to be “cleaner” than the January one, so we will see.

-

Earnings season is almost done, meaning we will have to find something else to focus on every day. There is no shortage of economic data this week, but we will all miss the daily excitement around earnings.

-

Volatility, Liquidity and 0DTE. We clarified some of our views on zero day to expiration options in Is 4,000 More Than Just a Round Number? Daily options have become the #1 topic of discussion, after Fed policy, for more and more of the market. I think they amplify moves.

Back to the Markets (and the Fed)

It is difficult to extricate markets from the Fed at this point. But as we wrote on Friday, we may have entered the 5th Stage of Rate Hike Grief – Acceptance.

Have we entered the “acceptance” stage?

-

Markets held their own, on Thursday with some inflation fears and while they sold off on Friday, stocks managed to bounce on a key technical level and never seemed to panic.

-

There is no denying that the Fed will be more cautious on hikes. The size and timing will be data dependent. Yes, inflation has ticked higher, but a lot has been accomplished and there is still a “lag” effect that hasn’t fully impacted the market.

-

We might get some “negative” surprises in the data. As economists ratchet up expectations, we could get some “disappointing” data on a relative front. We might, and I expect we will see some disappointing data on the absolute front as well. I am convinced that coming into the week we are in a “bad news” is “good news” for the market, and since I expect some “bad news” I like being bullish stocks and bonds!

-

Has “good” news been “accepted”? Even if we get strong economic news, will bond markets sell-off hard, dragging equities down with them? I don’t think so (though with 0DTE, we might get an explosive move post data, but unless something changes for me, I’d be fading any sell-off).

-

Bottom Line

I like owning stocks and bonds here. I’m looking for a bounce in both (3.7% on 10s and 4,200 on the S&P 500).

In the meantime, I might be going to San Diego in the only week March, ever, that San Diego has worse weather than Connecticut! Now that is surprising!

Tyler Durden

Sun, 02/26/2023 – 17:00

via ZeroHedge News https://ift.tt/5cd6hAz Tyler Durden