Stocks & Bonds Rally Despite Rising Terminal-Rate & Inflation Expectations

Mixed bag of data this morning with an upside surprise in home sales (driven by a dip in mortgage rates which has now reversed entirely) and weak headline durable goods orders (because Boeing didn’t sell a shitload of planes this month), along with some ugliness in the Dallas Fed sentiment survey summed by this respondent’s comment: “There is nothing positive with respect to the economy.”

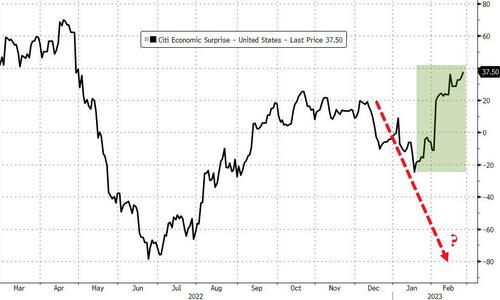

However, overall, macro data continues to upset any hopes of a Fed Pivot…

Source: Bloomberg

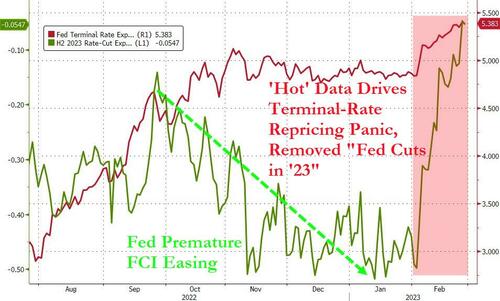

And so, rate-cut expectations have almost entirely been priced out for this year (from over 50bps of cuts priced-in at the start of Feb to just 3bps now)…

Source: Bloomberg

But stocks didn’t care with Nasdaq leading the charge higher (and The Dow lagging but still green). Some late day selling stalled at the S&P 50DMA but wiped out most of the gains from all the majors except Nasdaq…

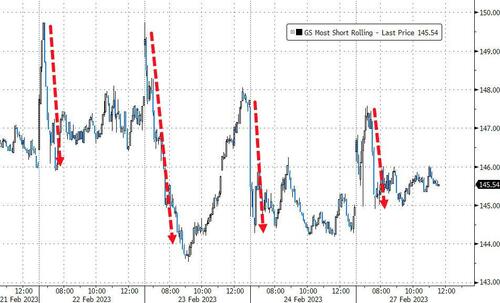

For the 4th day in a row, any early short-squeeze attempts were sold into…

Source: Bloomberg

So while today’s gains were not the classic short-squeeze, the 0DTE gamers were active, buying calls aggressively out of the gate (lifting stocks), but as SPY hit 400 (SPX 4000 ish), 0DTE put-buying swept in and dragged the market lower. Around 1130ET (as the S&P neared it 50DMA) the put-buying stalled and call-buying soared, lifting the index off the day-session lows. That ‘buying’ wave stalled around 1230ET and put-buying (with no response from calls) began around 1330ET (after a quick pump up to 4,000) and weighed the index down enough to test the 50DMA once again late on

Learn more about the Hiro indicator here…

SpotGamma explains that early action in the clip below:

4,000 was a key level all day…

…testing the 50DMA (3979) and bouncing…

Notably, JPMorgan’s traders suggest the 200DMA (~3940) represents the largest CTA level and could trigger ~$50bn of selling.

Gamma was about $35bn towards puts, which represented about $10bn of selling. Given the market’s action, vol-targeters and levered ETFs may contribute ~$5bn of selling.

And Goldman’s traders confirmed:

“CTA supply should accelerate as we’ve moved through all of the trigger levels in the SPX and could see $16-20bn over the next month/$50bn in global equities”

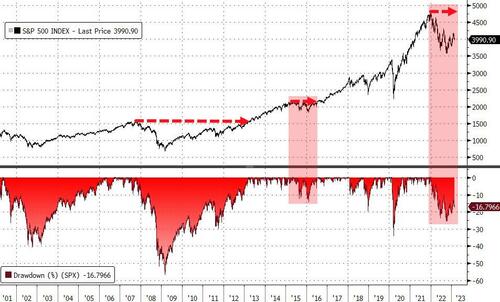

While stocks closed green on the day, the bear market in the S&P 500 shows no sign of ending anytime soon – and investors now have a grim milestone to mark. As Bloomberg notes, the index has gone for 287 sessions without a record, which surpassed a 285-day streak that ended in 2016 for the longest stretch since the financial crisis.

Source: Bloomberg

And with the gauge still down 17% from its all-time high, the dry spell will likely have months, if not quarters, to run.

Treasury bonds were bid from early in the US session (after overnight selling), with yields lower across the curve but the long-end underperforming and the belly bid most…

Source: Bloomberg

The 10Y yield charged higher again with everyone anticipating 4.00%… but once again it failed at around 3.98% and slipped lower…

Source: Bloomberg

Inflation expectations continue to rise, with 1Y swaps now back above 3.00%…

Source: Bloomberg

The dollar ended lower thanks to GBP gains on UK-EU Brexit agreements over Northern Ireland, reversing at the exact payrolls print highs from January…

Source: Bloomberg

Bitcoin pumped-n-dumped up towards $24k but never made it before reversing lower…

Source: Bloomberg

Gold managed modest gains on the day after trading notably lower overnight…

Oil prices had a volatile day with WTI ending lower, unable to hold a $76 handle…

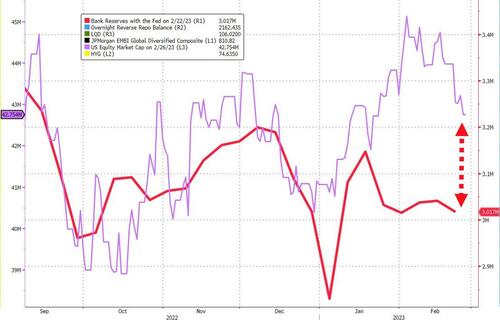

Finally, is US equity market cap set to catch down to Fed reserve levels once again as pivot-prayers evaporate into the ether?

Source: Bloomberg

Tyler Durden

Mon, 02/27/2023 – 16:00

via ZeroHedge News https://ift.tt/Qf0udAt Tyler Durden