Submitted by QTR’s Fringe Finance

Somebody once described equity pricing to me as a dog that walks on a leash with a man, down a path through the woods.

The path represents the underlying fundamentals of the company or the market, and the dog represents investor sentiment and market valuation about said company or market.

As the man walks down the “fundamentals” path, the dog strays wildly, side-to-side, on the leash. First to the far left side of the path, then back to the right – and in the interim, everywhere in between. It’s distracted, chases woodland creatures, tries to smell items and is just generally excitable. That’s investor behavior.

The one constant is that, at the end of the day, the dog always winds up walking down the path in the same direction as the owner. The point being that no matter how far he temporarily strays from one side to the next, the fundamentals continue to dictate the long-term course.

I found this to be an apt analogy for how I feel about equity markets heading into this week. My longer-term readers know that I still continue to believe equity markets are wildly overpriced and eventually will cripple under the reality of 5% interest rates, persistent inflation, a debt-strapped consumer and depleted savings.

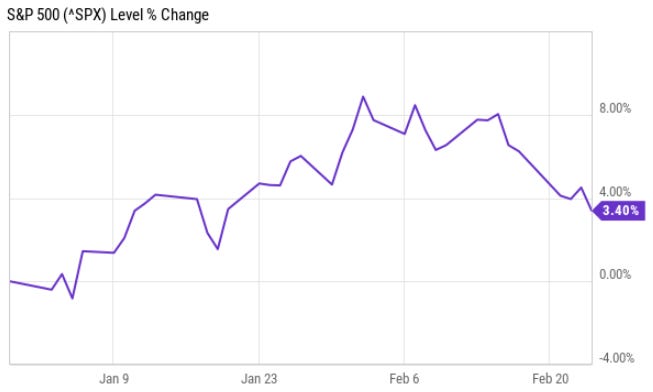

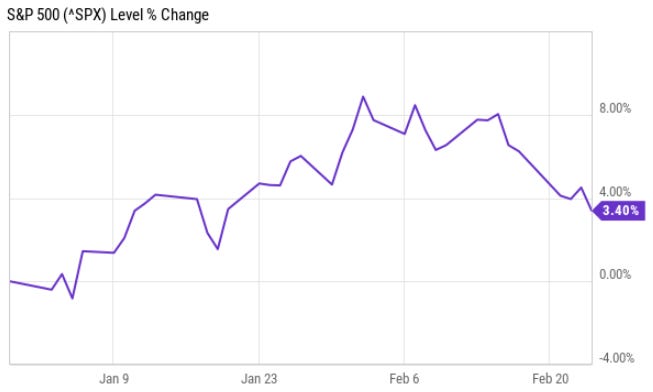

But once again, another week has gone by where my prophecy of a market decline has not been fulfilled – in any meaningful fashion, at least. The market was down about 3% last week, but is still up 3.4% for the year.

Among the pieces I’ve written over the last couple months are several talking about the fact that, even though I haven’t been proven immediately right on a number of my prognostications, waypoints in the midst of our “walk through the woods” continue to indicate to me that the market remains on the same “path” I figured it would be on heading into the year.

And so sometimes I feel the need to write these annoyingly repetitive thoughts in order to keep myself sane. Sometimes I do it in order to remind myself that patience is needed for my thesis to play out and sometimes I write because current events continue to reaffirm my stance. This piece is all three.

My content over the last couple of months has been replete with the thoughts of those I respect, like my friend Kenny Polcari, who believe that interest rate hikes aren’t going to pause or pivot anytime soon. In fact, Kenny often cites Fed governor Jim Bullard (who is on the hawkish end of the Fed spectrum) like I do to make unpopular points you don’t often see in the mainstream media – like the idea of rates possibly going to 6%.

Putting aside the fact that I think that 6% rates would be a mathematically guaranteed path to economic destruction, those are the types of theses that one has to pay attention to now, I believe.

Today’s piece is free to read. If you have the means and would like to support my work, I’d be humbled if you became a subscriber: Get 50% off forever

The Fed has been consistent in its stance that it is looking for a trend of inflation coming down before it reevaluates its monetary policy stance. And while we had a couple of promising prints to end 2022 and start 2023, this past week’s data failed to keep with that trend. The PCE deflator and the Fed minutes this week seemed to offer little solace regarding the Fed’s future stance on rates

Source: Barron’s

The natural inclination for investors at this point is to try and twist a pretzel of a narrative that somehow ends in the Fed easing relatively soon. I can’t fault the market or investors for having this mindset – it is a product of 20 years of easy money policy to expect that everything will just “work out” somehow. To some psychological degree, it is still “swimming downstream” or “traveling with the wind at your back” to believe that everything is going to be fine and that the Fed is going to be able to achieve a soft landing.

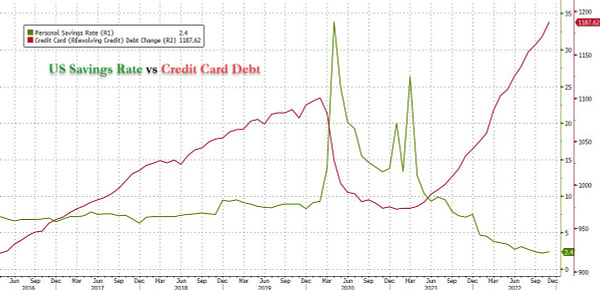

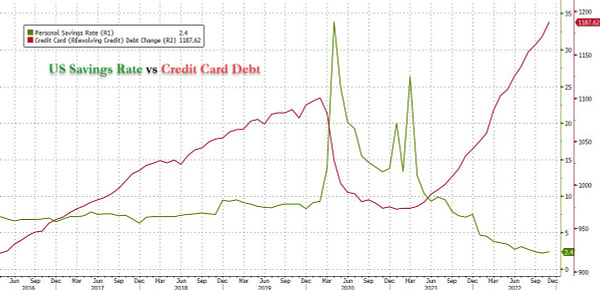

But the uncomfortable and unfortunate reality of things is that the market likely hasn’t yet digested the full effects of the rate hikes we’ve already had, let alone future rate hikes, or even holding the funds rate where it is right now for longer. Again, those economic realities have seen personal savings zapped while debt charges to all-time highs. As Zero Hedge posted in January 2023:

And then there are other trends that appear to be screaming out that reversion to the mean is coming. For example, look at this chart of 10Y real rates versus the S&P 500 forward PE that Zero Hedge posted last week:

And remember last week I pointed out the fact that the bond market appeared to be in the midst of a historic panic attack wherein, if historical norms are to be observed, it appears to be signaling an imminent and intense recession. The spread between the two year and the 10 year treasury today has moved to almost 90bps, the largest spread since 1981.

And so, make no doubt about it, if we stay the “path”, there will be a tipping point wherein consumers are simply tapped out and market valuations are forced to contract both as a result of less spending, and also eventually a shift in market psychology.

This past week’s data continues to reaffirm that the Fed has no impetus to ease up on its strategies and it certainly doesn’t confirm that the Fed has been successful in halting inflation for the long term.

The market simply remains a dog that has wandered off the path toward the side of euphoria, optimism and bullishness, despite the underlying direction of the economic path it’ll be forced to travel down. The idea that the market is up this year, while the Fed has done nothing to alter or change its course and the underlying data doesn’t support such a move, is stunning to me.

The market and the economy become two distinctly separate entities during a period of quantitative easing. When there’s free money flooding the market, the market does whatever it wants regardless of the underlying economy. During a period of tightening, like now, the opposite happens: the market becomes tethered again to the economy. This means an optimistic market can no longer be the tail that wags the economic dog. Instead, investors are being force-fed a reversion back to reality that they may not even have had time to stop and taste yet.

As the drill sergeants said in the mess hall during the movie Renaissance Man, “We eat now, we taste it later!”

This means that despite the market being optimistic, it’s not changing my opinion for the outcome of this year. Rather, I think this optimistic start to the year will only be viewed historically as a bear market rally and a temporary and marked dislocation from fundamentals.

Remember: the market reacts to the Fed’s moves with a lag. This means that any turmoil we see over the next couple of months will likely have started with Fed policy changes that were made months ago. And if the Fed holds course, this literally means not that the worst is almost over, but rather that the worst may not have even started yet.

The market and the economy are the two feet of the man walking down the path. So far, only the stock market shoe has dropped. When the other shoe drops, it’ll become clear what direction we are truly walking in, dog in tow.

I continue to believe the sectors and equities I am personally invested in for the year will give me an advantage versus just pouring money into index ETFs throughout the year. As I have said in many of my pieces, I strongly believe markets in 2023 are going to be driven by both a residual crash coming from this year’s rate hikes and then an eventual Fed pivot, which will be late and down the line, with a fair amount of geopolitical risk on the side.

When I put together my 23 Stocks To Watch In 2023 (Part 1 here, Part 2 here), I tried to keep all of this in mind – I wanted to create a somewhat diversified, risk adverse, plan for myself heading into the new year. Whether or not I’m right, we’ll know in about 10 months.

QTR’s Disclaimer:

I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning in varying size. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.