Bed, Bath And Beyond Bludgeoned Below A Buck, But Still Not Bankrupt

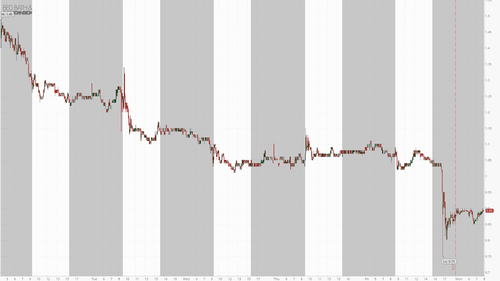

Shares of Bed, Bath and Beyond are getting the “Credit Suisse treatment” this morning, plunging under $1 as the struggling retailer continues an incessant yet increasingly difficult search for rescue funding.

The retailer’s latest plans include a reverse stock split and overseeing its shares getting tossed from the S&P SmallCap 600 Index, where it will be replaced by Lumen Technologies, according to a Monday morning Bloomberg wrap up.

Earlier this month, the company had “lowered the price threshold of its deal with hedge fund Hudson Bay Capital to $1 until April 3, securing an extra $100 million of extra funding,” Bloomberg wrote.

The company is seeking approval for a reverse split between 1-for-5 and 1-for-10, with the final ratio to be determined by the Board. Shares are now down more than 95% over the past year.

We have to give the company (which has already missed interest payments on its bonds) an “A” for effort, as it continues to somehow avoid filing for what feels like should be an inevitable bankruptcy, filling a last ditch effort for financing last month, as we noted.

The company announced last month a plan to offer series A convertible preferred stock and warrants, raising over $1 billion. Wedbush wasn’t enthused about the prospect of saving the company last month:

“We see these capital-raising transactions as a ‘last gasp’ to survive before filing for bankruptcy protection where the common equity would likely be worthless,” Wedbush analyst Seth Basham wrote.

“In the event the transactions are successful, BBBY common shares could rise as they are trading like options on the company’s survival, but the ultimate value would be undermined by this highly dilutive offering of preferred stock that would have priority over the common shares”

A look into the company in early February claimed the company only has itself to blame for its dire financial straits. “Executives were mired in minutiae as the chain barreled toward bankruptcy,” the report says, citing former employees. For example, last summer the company’s executives urged white collar workers to return to the office four days a week despite the fact that many were already coming in.

The article laid out how every solution the company tried only led them further into financial ruin. Even firing 20% of its workforce and shuttering 150 of its 770 stores before securing new financing didn’t help the business.

Tyler Durden

Mon, 03/20/2023 – 09:15

via ZeroHedge News https://ift.tt/394CxJm Tyler Durden