Bitcoin, Bullion, & Bond Yields Higher As Credit Market Rejects Bank Bailout ‘Bullishness’

Another weekend, another few 10s of billions of dollars/euros (or more) thrown at the wall, and the result was… a lot of headline sound and fury and ‘resilience’ and ‘safe’ and ‘no exposure’… and little shift in trading positions.

As repo guru Scott Skyrm, Executive Vice President at Curvature Securities, noted:

Just three weeks ago I sent my annual “Ides of March” commentary and guess what?

The Ides of March struck again!

Now that a second crisis hit the market, I wonder if this is the beginning of a larger crisis or the end of a small crisis.

If you recall, the Financial Crisis really begin in 2007.

The first leg was the Liquidity Crisis of August 2007.

The second leg was the collapse of Bear Stearns in March/Apirl 2008,

and the final leg was the collapse of Lehman in September 2008.

If we believe the next financial crisis could follow a similar pattern, then here are some questions:

Was SVB the Bear Stearns and Credit Suisse the Lehman?

Or, are SVB and Credit Suisse the first round (like the Liquidity Crisis of 2007) and there’s a larger crisis on the horizon?

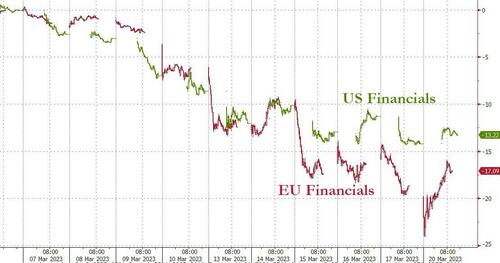

US and EU financial stocks ended the day marginally higher – not exactly ‘reassuring’ that the problem is fixed…

Source: Bloomberg

UBS CDS widened (to 11 year highs, and was put on watch negative by S&P Global Ratings) while the stock rebounded from an ugly 16% plunge at the open…

Source: Bloomberg

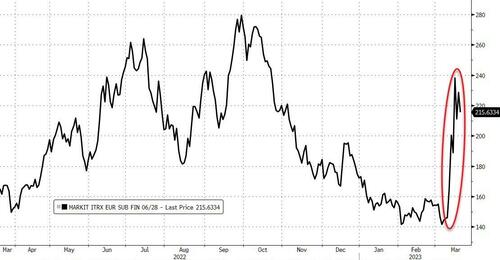

Broad European financial system credit risk barely budged on the weekend’s news…

Source: Bloomberg

And across the pond, First Republic Shares crashed (-48%) to a new record low, despite last week’s $30 billion despite inflow bailout…

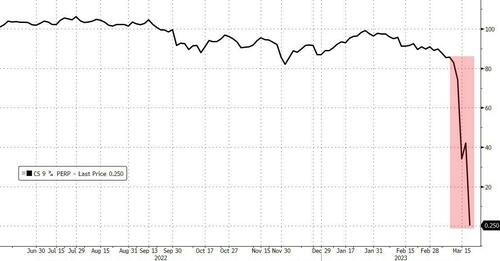

Could be worse – you could have been a CS AT1 bondholder who thought you were above equity in the capital structure…

Source: Bloomberg

Those bonds went full Keyser Söze…

The broad US equity markets rallied on the day (though Nasdaq lagged and was basically unchanged). Relief rally on Sunday futures open, then selling through the Asia session. Europe saw a bid into the US cash open when Nasdaq went sideways while the rest of the majors drifted higher…

US Regional bank stocks barely managed gains on the day…

Office REITs were hoping for a big up day… but ended ‘meh’ after plunging for 8 straight days…

Source: Bloomberg

A squeeze was ignited at the cash open but it faded fast with “most shorted” stocks ending lower on the day…

Source: Bloomberg

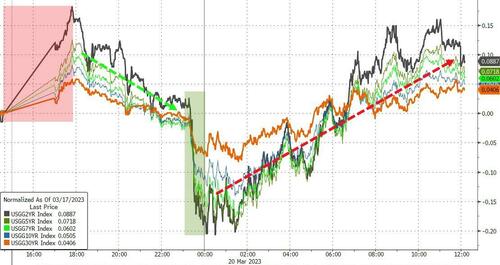

Treasury yields closed higher across the curve today but only after a wiled roller-coaster overnight with the short-end underperforming. Note the violent panic bid in USTs as Asia closed and the non-stop selling through the European and US sessions…

Source: Bloomberg

2Y Yields tagged 4.00%, puked down to near 3.60% before exploding back all the way up to 4.00% – an 80 bps swing intraday…now that is a wild ride for a day at the short-end… (liquidity is non-existent)

Source: Bloomberg

Inflation expectations (swaps) have tumbled in the last week or two since SVB and CS spoiled the party…

Source: Bloomberg

The dollar dumped to one-month lows…

Source: Bloomberg

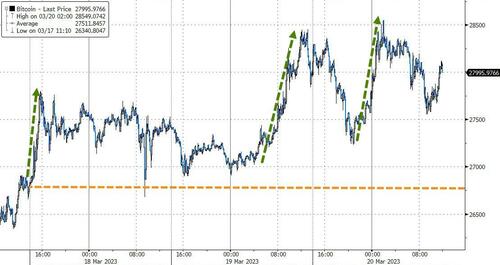

Bitcoin hit a 9-month high intraday, above $28,000…

Source: Bloomberg

Gold topped $2000 intraday, but couldn’t hold it. The precious metal still

Oil prices followed a similar path to everything else, diving overnight, then ramping higher during Europe and US sessions to close green…

Interestingly, Gold surged up to a key level relative to oil today (1oz of gold can buy 30 barrels of oil) – a level it has only reached in crisis moments…

Source: Bloomberg

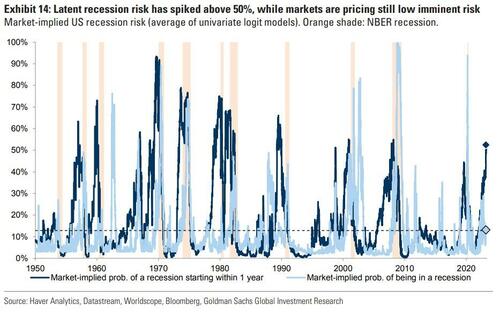

Finally, Goldman warns that market-implied recession risk for the next 12 months has picked up above 50% with Fed pricing being a core driver. Historically this drove more equity drawdown risk, especially if risky assets were reflecting little recession risk – currently, they imply only a 13% probability of being in a recession.

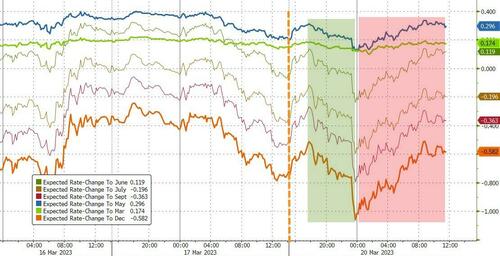

In light of that, we note that Fed rate-hike expectations rose notably today. After slipping lower overnight (as you might expect given the banking system fragility) probabilities then reversed as Europe opened – for no clear reason – ending higher on the day with expectations for a hike this week rising (hawkish) and the terminal rate in May also rising…

Source: Bloomberg

The market is now pricing a 70% chance of 25bps from The Fed this week. Former NYFed President Bill Dudley proclaimed:

“The case for zero is: do no harm, we know the banking system is under stress so why would you continue to raise rates when the banking system is under stress.”

Is the market thinking that The Fed thinks it’s solved the financial crisis so time to refocus on the inflation ‘issue’? We do not from the above chart that the terminal rate (now in May) is just 30bps above current levels (at 4.875%) and after that almost 100bps of rate-cuts are priced in by year-end.

Translation – a huge capitulation by The Fed… big recession AND/OR global financial crisis escalates?

Tyler Durden

Mon, 03/20/2023 – 16:02

via ZeroHedge News https://ift.tt/vHCa5jo Tyler Durden