Credit Suisse Sale Is Wake-Up Call For Bank Bulls

By Kesnia Galouchko and Michael Msika, Bloomberg Markets Live reporters and strategist

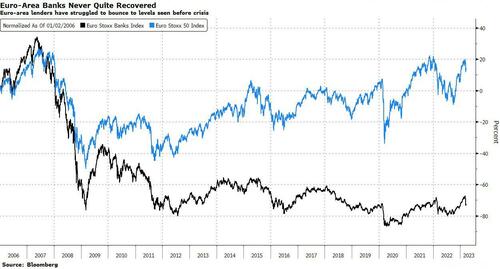

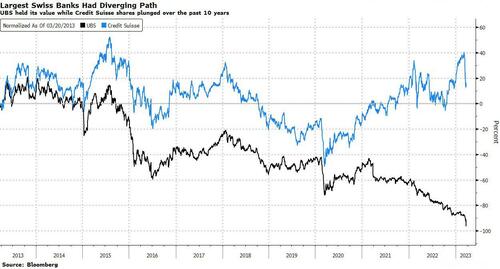

After years of being stuck in the doldrums, European bank stocks were finally having a moment, turning into a favorite trade on bets that they were the key winners from higher rates. But the sudden crisis around Credit Suisse, which resulted in its takeover by UBS, is a major wake-up call and a moment of reckoning for investors not only in the region’s banks but also the wider equity market, where financials have the biggest weighting.

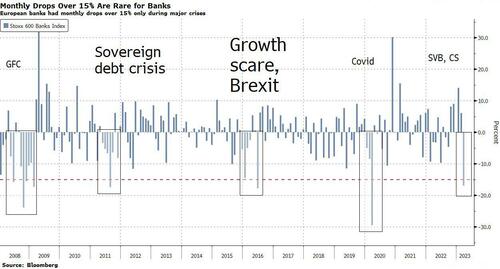

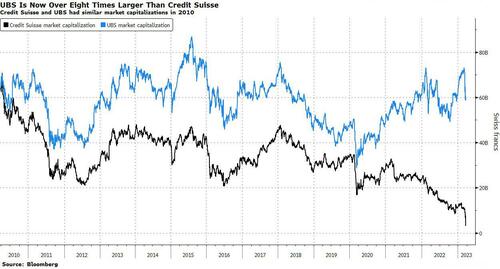

UBS agreed to buy Credit Suisse in a government-brokered deal aimed at containing a crisis of confidence in the first combination of two global systemically important banks since the financial crisis. The news underscored the vulnerability of the European banking sector and also posed questions about consolidation inside the industry, with the UBS takeover creating a financial juggernaut. Futures on Euro Stoxx Banks index were down nearly 5% today while Euro Stoxx 50 futures fell 1.4%.

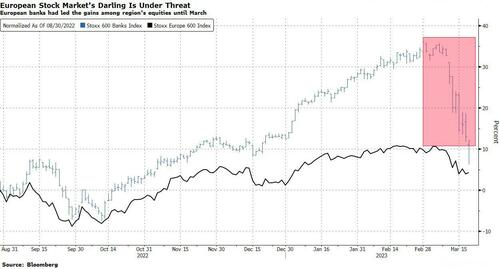

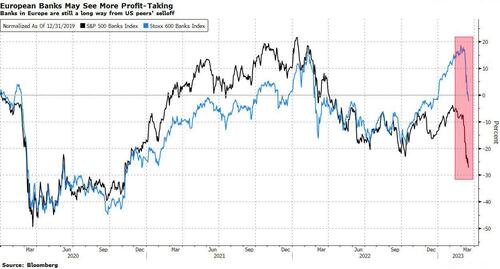

The Stoxx Europe 600 Banks Index rallied 45% from late September through the end of February and was one of the biggest drivers of the outperformance in European equities over the US market. Banks were seen as well capitalized, secure and cheap. A Bank of America survey of regional fund managers showed banks were the most popular sector overweight in February.

The sudden collapse of Silicon Valley Bank and closure of Signature Bank kicked off a slide in global banking shares last week, and investor confidence in European lenders quickly deteriorated, with the sector wiping out most of this year’s gains. Credit Suisse tumbled to a record low and faced massive client outflows after its largest shareholder, Saudi National Bank, said it wasn’t open to injecting further cash into the company.

“Many funds were long ‘the higher for longer’ trade via long European banks and short short-term bonds, which was very crowded,” said Ulrich Urbahn, head of multi-asset strategy at Berenberg. “The recovery potential for banking stocks is limited as many investors are more cautious now.”

He added that the outperformance of European stocks depends on the actions of central banks. Berenberg is slightly underweight equities and especially US stocks, sticking to a barbell strategy of being long quality growth stocks.

With all the rising concerns in the European banking sector last week, it’s curious to note that US stocks have been quite resilient, with the S&P 500 rising 1.4% while the Stoxx Europe 600 slumped in its worst weekly retreat since September. This could be because the Credit Suisse turmoil is seen as a Europe-specific issue but also because European equities had significantly outperformed the US this year.

“The winners are all investors, as a failed deal would be another potential catalyst for further volatility in all asset classes,” said Alberto Tocchio, a portfolio manager at Kairos Partners. “A tie-up will definitely restore some calm in Europe and banks might bounce short term; however volatility will remain high for some time.”

While UBS wasn’t originally too keen on buying Credit Suisse, the bank will now be in a dominant position in Switzerland with some interesting opportunities, Tocchio said. He added that the latest turmoil may also push the Federal Reserve to take a more dovish tone on Wednesday.

Over at Barclays, strategist Emmanuel Cau cautioned against overreacting to the headlines because European banks’ strong fundamentals shoudn’t be overlooked and they can recover some of their recent losses as long as central banks provide a credible backstop. However, today Barclays analysts cut their banking sector view from positive to neutral, saying increased regulatory scrutiny will weigh, and while a resolution to the Credit Suisse saga may be a near term positive, it’ll take time before things get better.

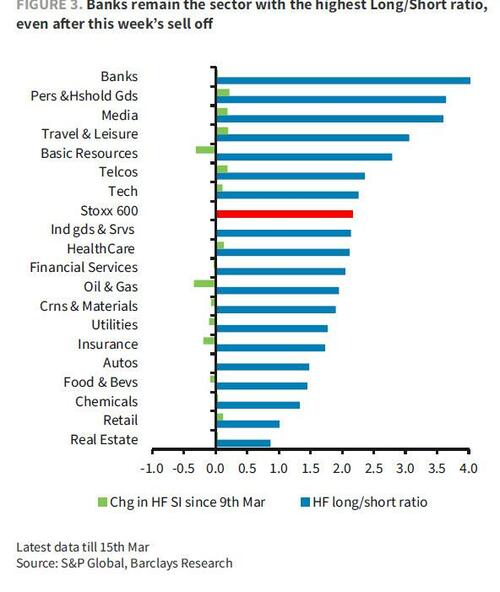

“EU banks were consensus long and last week’s selloff reflects more position unwind than fundamentals,” Cau said. Despite the sharp declines this month, positioning in EU lenders hasn’t come down significantly, and the banking sector still has the highest long-short ratio among Stoxx 600 industries, while most long-only clients are sticking to their overweights for now, according to Barclays. This suggests the balance of risk in terms of positioning is on the downside, according to the Monday note.

Barclays team said contagion risks should be manageable for now, but recommends a quality bias and favors BNP Paribas, HSBC, ABN Amro and Lloyds.

Tyler Durden

Mon, 03/20/2023 – 10:46

via ZeroHedge News https://ift.tt/jLJE3rH Tyler Durden