Deflation Or Inflation?

By Russell Clarke, author of The Capital Flows and Asset Markets,

The Economist remains undefeated in its ability to top tick market trends!

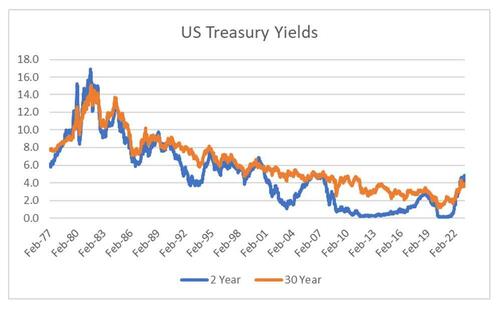

Last month the Economist published this cover. From this date, 2 year Treasury yield has fallen from 5% to 3.7% today.

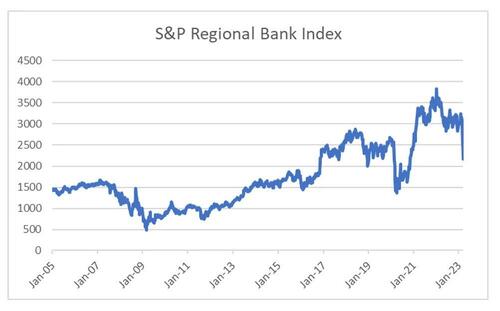

The cause of so much deflationary angst is the meltdown in US (and now European banks). Collapsing regional bank shares in 2007, Covid and now are all seen as a deflationary signal.

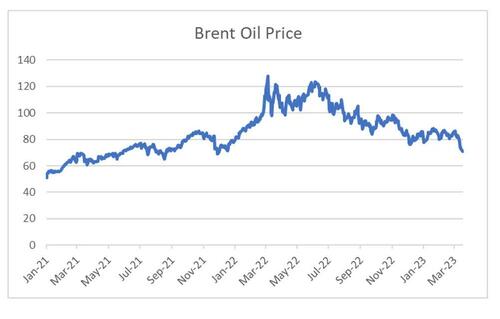

Add to this a collapsing banks share prices, and an oil price in 70s, you have a perfect deflation set up.

However I think China has really changed the game here.

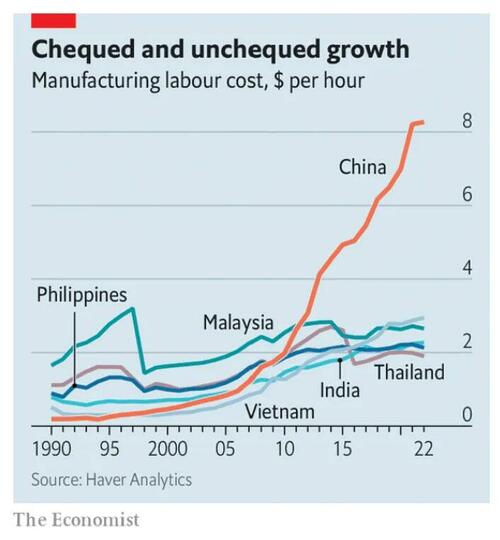

To see how much China has changed the game, look at how well China has managed to raise wages. Malaysia and Thailand were both forced to devalue in 1998 to remain competitive.

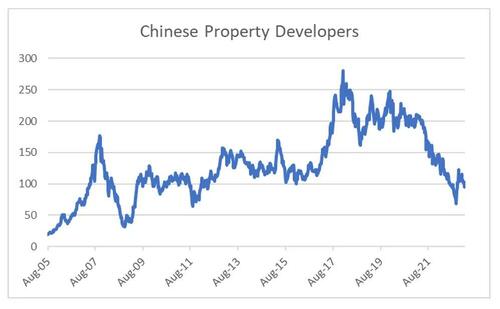

A classic pro-capital market response has been to devalue when domestic companies get into trouble. Chinese property developers have been suffering for awhile now, and China continues to run a strong currency policy. That is corporate pain (ie falling profits) is not seen as a good reason to devalue in China.

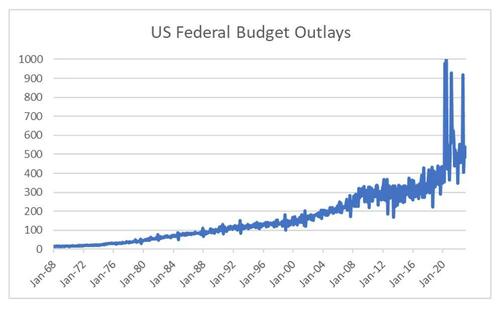

Pressure from China, and need to retool the US energy system means that government spending restraint is non-existent. Betting on deflation is implicitly implying some sort of austerity. Unlikely in my view.

For me the banking crisis stems from banks not being able to fund at 0% anymore. Banks just can’t compete with 2 year treasuries (full disclosure I moved all my cash to short term bonds a few month ago, even while still shorting TLT).

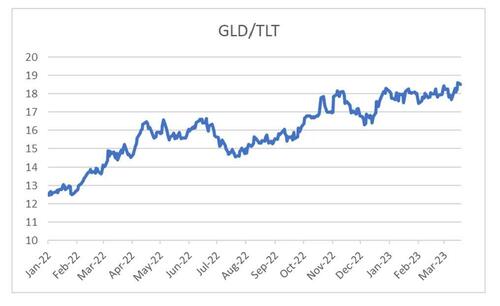

My pro-labour, inflation trade of GLD/TLT continues to perform well.

I think the world has changed. China happily crushed property developers as they were benefiting relatively few people. They have not devalued, as it would benefit relatively few people, and they broke up the tech companies as the benefited relatively few people. The US is going the same way, because that is where the votes are. Muscle memory says deflation, but it still looks like inflation to me.

Tyler Durden

Mon, 03/20/2023 – 15:00

via ZeroHedge News https://ift.tt/R1Y5LTN Tyler Durden