Cash Pours Out Of ESG Funds, Led By $5 Billion In Outflows From ESGU

As the banking sector portends actual problems within the financial system, virtue signaling seems to be falling down the average asset manager’s list of priorities…would could have guessed?

At least that’s what the action in ESGU appears to be showing. The fund, the iShares ESG Aware MSCI USA ETF, is one of the largest and most well known ways for portfolio managers to gain exposure to “ESG” investing via ETF.

It looks as though it is first on the list of things to be thrown out the window as asset managers and retail investors scramble for liquidity. Bloomberg ETF expert Eric Balchunas has noted that the sector, and its most well known ETF, are experiencing significant outflows.

Balchunas wrote last week that on Friday, the ESGU ETF “saw a record smashing $4b in outflows”. That was followed by another $1 billion on Monday.

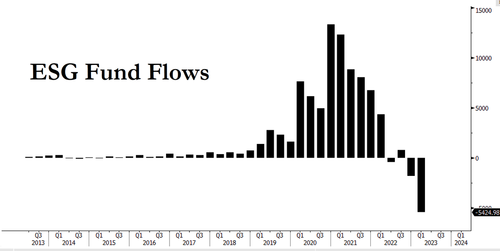

He said he thought the outflows could wind up triggering additional outflows: “The bomb out of ESGU on Friday is a big blow to the ESG ETF Category in that it really adds to the ongoing reversal in flows, which tends to go hand in hand with narrative.”

The bomb out of $ESGU on Friday is a big blow to the ESG ETF Category in that it really adds to the ongoing reversal in flows, which tends to go hand in hand with narrative pic.twitter.com/O8PO7HUMFL

— Eric Balchunas (@EricBalchunas) March 20, 2023

The outflows then continued on Monday this week:

Wow, another $1b came out of $ESGU yesterday and went into $QUAL, that makes a $5b-ish single trade, which pretty sure is largest ever in ETF history and it may not even be over yet. pic.twitter.com/tX00KPj6lq

— Eric Balchunas (@EricBalchunas) March 21, 2023

The fund’s goal is to “obtain exposure to large- and mid-cap U.S. stocks, tilting towards those with favorable environmental, social and governance (ESG) ratings.”

As its prospectus says, the fund leaves out companies that deal in “civilian firearms, controversial weapons, tobacco, thermal coal and oil sands.”

But maybe we’re at the stage where carbon footprint once again (and rightly) has fallen in the pecking order to good old fashioned value and free cash flow.

Tyler Durden

Wed, 03/22/2023 – 06:55

via ZeroHedge News https://ift.tt/kVlKZfC Tyler Durden