Rent Inflation Approaches Two-Year Low Amid Cooling Market

Federal Reserve Chair Jerome Powell and his entire team should be cognizant of the fact that rents have been declining for many months. Despite this, Powell has been examining laggard data that persistently appears inflated.

The latest CoreLogic report adds to the mounting evidence of leading rental market indicators showing rent inflation has been cooling for the ninth consecutive month in January, as the yearly growth rate slid to the lowest point since 2021.

Single-family homes across the US experienced a 5.7% increase in value compared to the previous year. Each of the 20 major metropolitan regions monitored by CoreLogic saw annual rent growth in the single-digit range for the first time since the end of 2020.

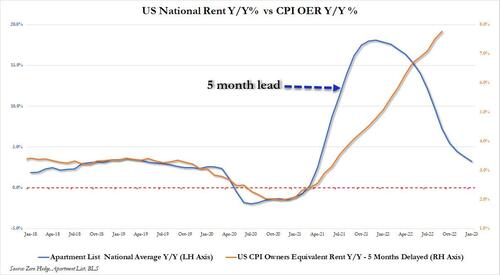

Despite the high-frequency rent data from CoreLogic and other research firms indicating a clear deceleration, this slowdown has not yet been reflected in the Fed’s consumer-price data due to delays in the calculation process.

Back in September, when looking at various leading rental market indicators, we reported that “Manhattan Apartment Rents Finally “Plateau” After Red-Hot Summer” a trend reversal that was also observed at the national level as we observed in “Nationwide Rents Drop For First Time In Two Years.” With rents peaking in August, two months later, the rental drop accelerated, as we discussed in “Just Tumbled The Most On Record As Economy Craters.”

Last month we penned a note, “Apartment Rents Slide Across All US Cities Amid “Crush” Of New Supply,” but outlined the Fed’s shelter inflation data is well behind the curve (as usual).

The good news is that with a long delay, the coming supply of new apartments – especially in places where housing inventory remains unusually low to the benefit of home sellers – will give renters more choices, making it not only more difficult for landlords to hike rents at rates seen last year.

Tyler Durden

Tue, 03/21/2023 – 21:05

via ZeroHedge News https://ift.tt/TwUriOK Tyler Durden