The Fed Is Pushing The Accelerator & The Brake Pedals At The Same Time

Authored by Simon White, Bloomberg macro strategist,

Collapsing velocity will lead to financial conditions continuing to tighten even as the Fed rapidly expands its balance sheet.

When banks are in trouble, it has a geared impact on the rest of the economy. In 2008, money velocity (essentially, how many times each dollar changes hands in a given period) collapsed as banks stopped lending; central banks responded by cutting rates to zero and massively expanding their balance sheets.

To no avail, however, and velocity kept falling until 2020 when it started to rise again – it’s no coincidence we now have an inflation problem. The remedy has created a new nightmare for policymakers as banks around the world are reeling from the fastest rate-hiking cycles seen for several decades.

Central banks are now back in the game of trying to arrest the fall in velocity – deteriorating their balance sheets – to avert the deep recession that would result. The signs are so far it is not working.

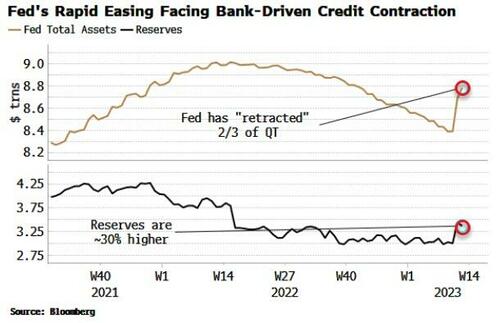

The Fed over the last two weeks has effectively reversed two-thirds of QT, if we look at the size of its balance sheet. But the key metric to watch is reserves – these are the higher-velocity part of the central bank’s liabilities, as they are the other side of the coin of bank deposits. Yet even reserves are 30% higher.

Despite the expansion, velocity is still falling. Why?

Deposits are leaving small banks, with some of them going to large banks (we’ll see how much when the latest data is released this evening). But the large banks don’t want them (observe their stubbornly-low deposit rates). Thus higher-yielding money-market funds will keep attracting funds.

Indeed, the latest data showed another rise in MMF assets, climbing by almost $250 billion over the last two weeks.

MMFs are a low velocity use of reserves, as they generally invest in bills and low-risk short-term loans. But an even lower velocity use is the RRP, where they are effectively neutralized.

The RRP is growing again, rising about $220 billion over the last week to new all-time highs of $2.65 trillion – expected given the facility offers a higher rate than T-bills (the curve is now very negatively sloped at the front).

There is very likely more banking distress to come as lenders harbor an estimated $2 trillion in losses in hold-to-maturity securities.

Unfortunately for the Fed, the current set-up means the accelerator and brake pedals are joined together.

Tyler Durden

Fri, 03/24/2023 – 15:05

via ZeroHedge News https://ift.tt/pKJwai0 Tyler Durden