Tesla Slides After Margins Tumble; Goldman Explains “Why It’s Not Down More”

Update: Goldman’s Scott Feiler noted that TSLA was in focus after hours on the trading desk: “Why is it not down more?”

Feiler notes that the focus from bears is on both the gross margins miss (~170 bps) and the FCF miss.

The one counterpoint he highlights is “almost all investors we spoke to expected some level of GM miss, and the question was just magnitude.”

Our trading desk is seeing shorts in the after-market.

GS research was watching the 20% gross margin bogey closely and they came in around 70-100 bps below that.

Ultimately, we think this is a net negative for TSLA’s stock but not much changes for long-term bulls on the demand picture.

We think the bigger focus should actually be for peers/industry margin dynamics, as they spent the first few paragraphs of their release/presentation talking not of slowing demand, but of looking at unit economics from their peers and seeing this as an opportunity for themselves.

Feiler added that they think TSLA is making a clear attempt to pressure peers:

They lowered prices in the US ~6 times already this year, the question is why?

Was it due to demand concerns or just to lean in, because they could?

In the first line of their press release, they seem to address this debate head on.

They highlight that they “see this year as a unique opportunity for Tesla. As many carmakers are working through challenges with the unit economics of their EV programs, we aim to leverage our position as a cost leader.

They make it further clear this is a market share grab by saying “Our near-term pricing strategy considers a long-term view on per vehicle profitability given the potential lifetime value of a Tesla vehicle.”

For now, given that the imp[lied expectations were for a +/-12% swing in TSLA after hours, the 3-4% after-hours decline remains a positive…

We will see what happens when the call starts.

Tesla Q1 Earnings Call and Q&A → https://t.co/THWUwxgvYT

— Tesla (@Tesla) April 18, 2023

* * *

it has been quite a week for Elon Musk: from getting interviewed by Tucker Carlson, to trying to launch his new SpaceX Starship rocket from Boca Chica, on Thursday morning, and cutting prices across Tesla’s vehicle lineup in January ahead of – oh yes – today’s main event, Tesla earnings…. where just one thing matters now that Tesla is in a vicious market share war: margins, margins, margins.

After all, Musk has made it clear that he is willing to sacrifice profit margins to chase volume: “The desire for people to own a Tesla is extremely high,” Musk said at the company’s investor day March 1. “The limiting factor is their ability to pay for a Tesla.”

So far, the rush to sell as many cars is working: Tesla closed its first quarter with record deliveries hitting over 423,000 units worldwide, but that’s still less than what the automaker produced. Tesla has used price cuts throughout the quarter, aiming to reach more of the mass market, and as Bloomberg calculated today, the latest price cut makes the Tesla Model Y nearly a third cheaper than it was at the start of the year, in part due to the introduction of a new lowest level trim.

Then throw in the fact that its two most popular models — the Tesla Model 3 and Model Y — are freshly eligible for the Inflation Reduction Act’s new clean car tax credits, and you’ve got an automaker increasing volume and lowering costs to outperform not only its EV competitors but eat into the overall automotive market. With the new price cuts and tax credits, the lowest trims of both models should be available below $40,000 in the US.

On the topic of margins, Tesla’s CFO Zach Kirkhorn said on the last earnings call that the company was forecasting that it would be able to stay above 20% automotive gross margins (excluding leases and regulatory credits) and a $47,000 average selling price across all models.

And while everyone knows there will be a dip in margins from the Q1 price cuts, what analysts are looking for is whether Tesla stayed above that guidance — and if so, by how much? The answer to that would determine just how much the stock would swing, with options expecting a move of +/- 12!

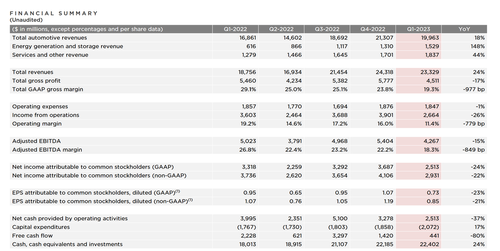

With that in mind, this is what Telsa just reported for Q1 just moments ago:

- Revenue $23.33B, missing Est. $23.35B, and up 24% Y/Y

- Adj. EPS 85c, missing Est. 86c, down 21% Y/Y

- Total GAAP Margin 19.3%, missing Est. 21.2%, and down a whopping 977bps from 29.1% a year ago

- Free Cash Flow $441M, missing Est. $3.24B

- Tesla Expects to Remain Ahead of L-T 50% CAGR on Production

And visually:

Some commentary from the company on several items:

Revenue: Total revenue grew 24% YoY in Q1 to $23.3B. YoY, revenue was impacted by the following items:

- + growth in vehicle deliveries

- + growth in other parts of the business

- – reduced ASP YoY (excluding FX impact)

- – negative FX impact of $0.8B

Profitability: Operating income decreased YoY to $2.7B in Q1, resulting in a 11.4% operating margin. YoY, operating income was primarily impacted by the following items:

- + growth in vehicle deliveries (despite margin headwind from underutilization of new factories)

- + gross profit growth in Energy business as well as Services & Other

- – reduced ASP YoY

- – higher raw material, commodity, logistics and warranty costs

- – cost of production ramp of 4680 cells

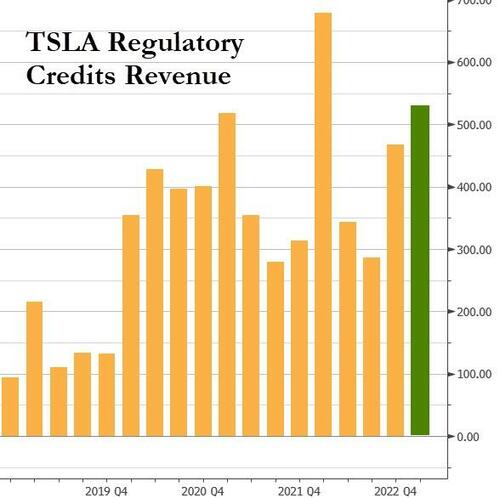

- – lower credit revenue

Cash: Quarter-end cash, cash equivalents and investments increased sequentially by $217M to $22.4B in Q1, driven mainly by free cash flow of $441M, partially offset by other financing activities, including debt repayments

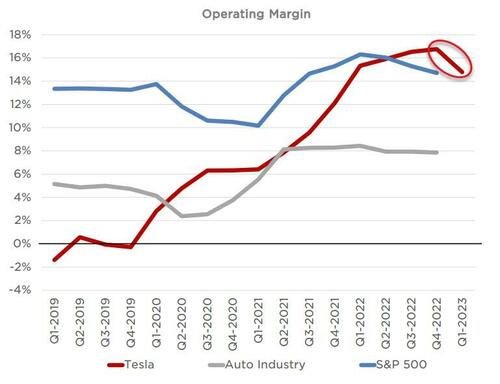

Focusing on the “margins, margins, margins”, it is clear that the price war for market share came at the expense of margins, which dropped sharply; operating margins also slumped, if not as much as total, and dropped to 11.4% from 16.0% Q/Q and from 19.2% Y/Y.

Perhaps what was more notable than what was mentioned is what wasn’t: and here Tesla’s automotive gross margin, which many people were really looking for in this report, was missing for the first time in a while.

Without automotive gross margin to evaluate, it’s worth remembering that last quarter Tesla’s CFO Zach Kirkhorn said that the company’s management team is “most focused” on operating margin which as noted above dropped year-over-year from 19.2% to 11.4%, a decline that was due to “reduced ASPs; higher raw material, commodity, logistics, and warranty costs; the cost of ramping 4680 cell production; and lower credit revenue, offset by higher vehicle deliveries and gross profit growth in energy/services.”

Tesla added that although it implemented price reductions on many vehicle models across regions in the first quarter, “our operating margins reduced at a manageable rate. We expect ongoing cost reduction of our vehicles, including improved production efficiency at our newest factories and lower logistics costs, and remain focused on operating leverage as we scale.”

And speaking of market share price war, Telsa did not beat around the bush and said that’s precisely what it is doing:

In the current macroeconomic environment, we see this year as a unique opportunity for Tesla. As many carmakers are working through challenges with the unit economics of their EV programs, we aim to leverage our position as a cost leader. We are focused on rapidly growing production, investments in autonomy and vehicle software, and remaining on track with our growth investments.

Our near-term pricing strategy considers a long-term view on per vehicle profitability given the potential lifetime value of a Tesla vehicle through autonomy, supercharging, connectivity and service. We expect that our product pricing will continue to evolve, upwards or downwards, depending on a number of factors.

Regulatory credits increased to $521MM, down from $679MM a year ago but the highest in one year. While that is not an insignificant number, it is not clear if it’s primarily ZEV or if it includes IRA manufacturing credits.

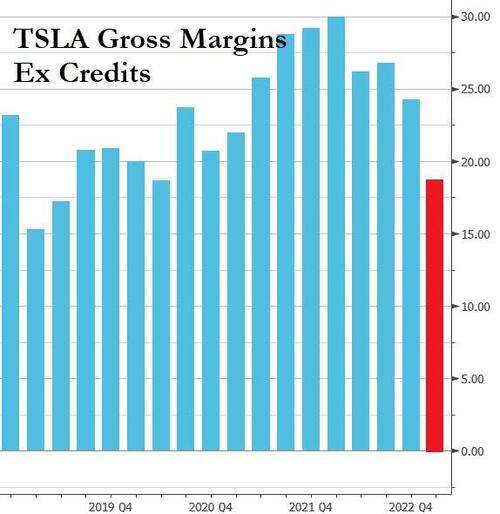

Excluding credits, Gross margins dropped below 20% for the first time since the Covid crash. As Gene Munster notes, “a 19% automotive gross margin for the quarter (excluding regulatory credits) means Tesla missed CFO Zach Kirkhorn’s forecast from last quarter that Tesla would be able to stay above 20%.”

That said, Robert Baird’s Ben Kallo said that “the miss that everyone’s going to focus on is on the gross margin of 19.3%… I don’t want to put a lipstick on a pig like they say, but Tesla has the best margins. They can cut prices and box out other people.”

And linked to the ongoing price war is a concerning increase in global inventory which rose to 15 days, up from 13 days in Q4.

As noted above, Tesla’s free cash flow fell to $441 million, which was way under the consensus estimate and down 80% year-over-year. Without the regulatory credits this quarter, Tesla’s FCF would have been negative.

Elsewhere, Tesla’s solar deployments fell sharply quarter-over-quarter to 67 megawatts from 100 megawatts. (the company had deployed at least 94 megawatts in the final three periods of last year). Tesla attributes the quarter-over-quarter slowdown to “volatile weather and other factors.” As Bloomberg notes, there have been a myriad atmospheric rivers that pummeled California — the biggest rooftop solar state — over the winter and early spring would affect installs.

Turning to vehicles, In the earnings report, Tesla shared some big milestones for the Tesla Model Y:

- Model Y was the top-selling vehicle in Europe during the first quarter of 2023.

- In the US it was the best-selling vehicle — excluding the pickup category. That’s a pretty big caveat, given how popular vehicles like the Ford F-150 and Chevrolet Silverado are.

- According to Bloomberg, “it’s undeniably impressive for the Model Y as its sales continue to increase. Last year, BNEF had the Model Y selling 754,000 units, making it the highest-selling EV globally.”

Meanwhile, Model S and Model X deliveries hit their lowest point since Q3 2021, which was after Tesla launched the redesigned versions of both vehicles. The company shipped just 10,695 of the S and X combined in the first quarter this year.

Discussing its operations, Tesla said that its “balance sheet and net income enable us to continue to make these capital expenditures in line with our future growth. In this environment, we believe it makes sense to push forward to ensure we lay a proper foundation for the best possible future.”

Finally, turning to the company’s outlook, there was little new here:

- Volume: “We are planning to grow production as quickly as possible in alignment with the 50% CAGR target we began guiding to in early 2021. In some years we may grow faster and some we may grow slower, depending on a number of factors. For 2023, we expect to remain ahead of the long-term 50% CAGR with around 1.8 million cars for the year.”

- Cash: “We have sufficient liquidity to fund our product roadmap, long-term capacity expansion plans and other expenses. Furthermore, we will manage the business such that we maintain a strong balance sheet during this uncertain period.”

- Profit: “While we continue to execute on innovations to reduce the cost of manufacturing and operations, over time, we expect our hardware-related profits to be accompanied with an acceleration of software-related profits. We continue to believe that our operating margin will remain among the highest in the industry.

- Product: “Cybertruck remains on track to begin production later this year at Gigafactory Texas. In addition, we continue to make progress on our next generation platform”

As noted earlier, the option market was expecting a swing as much as 12% in either direction ahead of earnings, but the data provided by Tesla was less exciting it seems and the stock was down about 3% after hours, sliding as low as $171.61 after closing north of $180, although if yesterday’s NFLX rebound is any indication, what is said on the call may have a far greater impact on how the stock trades after hours.

Tyler Durden

Wed, 04/19/2023 – 16:33

via ZeroHedge News https://ift.tt/KpRnTzm Tyler Durden