Millennials Are Slowest Generation To Hit 50% Homeownership; Rest Of Generation Fears Forever Renters

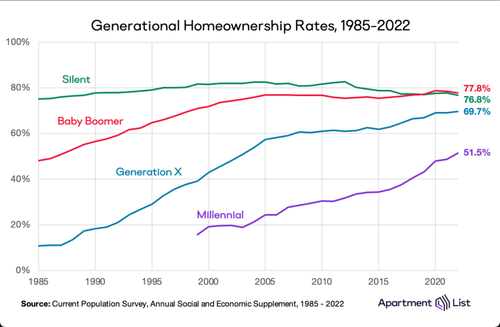

The millennial generation has finally reached a critical milestone of more than half owning their homes, according to a new report by the real estate site Apartment List, citing the latest data from the Census Bureau. Compared with other generations, millennials have reached the 50% mark slower than previous generations.

“For a generation whose identity has been shaped by a tumultuous relationship with the housing market, homeownership has been a lofty goal, growing exceedingly expensive and competitive compared to when their parents were coming of age,” Apartment List said. The current millennial homeownership rate is 51.5%, while all other generations are between 69% and 78%.

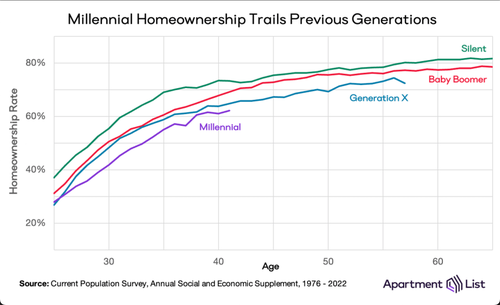

At the age of 30, 42% of millennials owned their homes, while Gen X had 48%, baby boomers had 51%, and silents had nearly 60%. This gap persists for even the oldest millennials in their early 40s.

Apartment List explained some of the reasons why millennial homeownership was suppressed in the last decade.

A handful of economic and cultural factors explain these generational gaps. The most significant was the Great Recession, which suppressed homeownership across all generations but was particularly damaging to millennials, whose early career trajectories were shaped by a historically unstable economy. During the economic recovery that followed, many millennials were drawn to centrally-located jobs in cities where starter homes became increasingly scarce and expensive. While many millennials purchased homes during these years, others spent more time living at home or in rentals, delaying major life events like homeownership, marriage, and childbearing when compared to earlier generations.

During Covid, millennials were panic buying homes with ultra-low mortgage rates.

In 2020, the COVID-19 pandemic drove an even deeper wedge between millennial homeowners and millennial renters. On the one hand, millennials purchased an outsized share of homes during the first two years of the pandemic, when mortgage rates fell below 3 percent. On the other hand, housing inventory dropped to all-time lows and for-sale prices skyrocketed more than 40 percent. For millennial renters who could not afford to buy a home in the earliest stages of the pandemic, homeownership opportunities waned dramatically in the years that followed. Mortgage rates spiked, bringing modest relief to list prices but pushing monthly ownership costs even higher.

We are surprised millennials have even reached the 50% mark. Perhaps their baby boomer parents have cosigned their mortgages or gifted them down payments as this heavily indebted generation struggles.

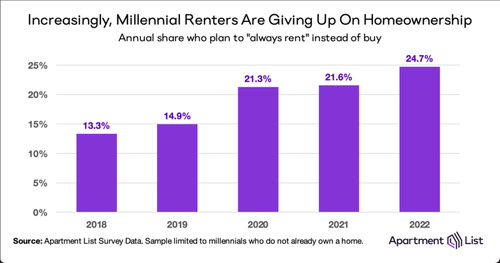

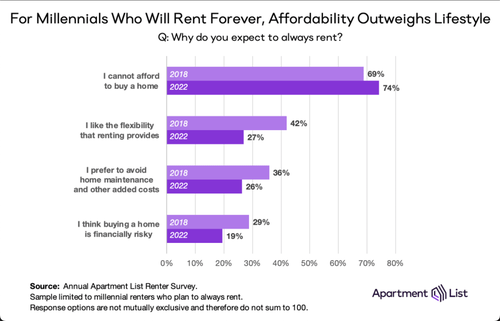

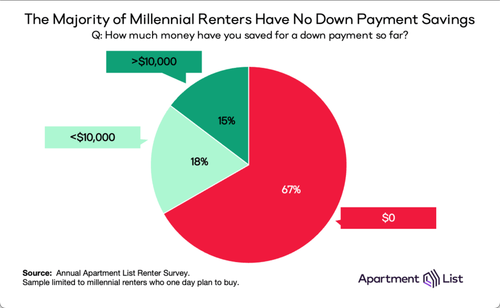

As for the other half of millennials, an increasing number are giving up on homeownership due to the housing affordability crisis.

Affordability continues to be the main factor of more and more millennials believing that they will be forever renters.

Not surprising at all.

Apartment List concludes by saying homeownership challenges might be even worse for the next generation, Z.

Currently, ages 25 and younger, the majority of gen Z renters have never known a healthy housing market, and in our renter survey already 20 percent describe themselves as “forever renters.”

Homeownership will be a Luxury…

Tyler Durden

Thu, 04/20/2023 – 20:40

via ZeroHedge News https://ift.tt/esJCaor Tyler Durden