Indicators That Show The Recession Is Now

Authored by Jeffrey Tucker via The Epoch Times,

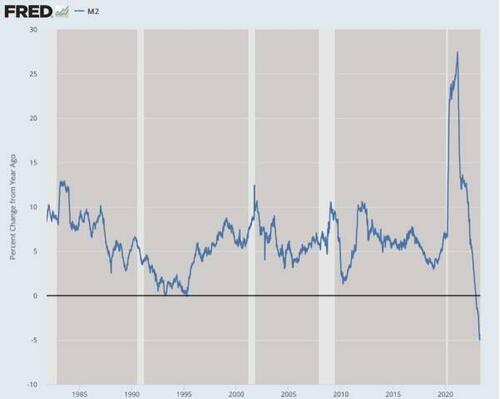

I’m not going to be one of those prognosticators who finds evidence of my predictions regardless of the facts. True, I said two months ago that the U.S. economy would be in a solid statistical recession by late summer. This is based on existing industrial trends and weakened labor markets at the high end but most especially by the declining money supply as measured by M2, the only indicator left.

Since financial deregulation, and the redefinition of what constitutes money, we’ve never seen anything like this, nothing close to it. The Fed likes to bury news of the money supply even though maintaining and managing is its only job. It does matter, just like the supply of everything else. And right now it is actually sinking.

Previous increases in 2020 through 2021 have become part of commercial life, endemic in virology or inebriated in substance abuse. The real shock comes when you take the punch bowl away, which is what has been happening. We are at 5 percent declines per annum—not yet like the 10 to 15 percent we saw at the onset of the Great Depression but this is a possible repeat eventually.

(Data: Federal Reserve Economic Data [FRED], St. Louis Fed; Chart: Jeffrey A. Tucker)

The Fed has a major problem. It must let rates rise to meet some termination point, which means above the rate of inflation. But in so doing, it creates the conditions that lead to a genuine decline in the supply of money itself, which creates serious upheaval of an unpredictable sort. There is no winner in this game.

Keep in mind that this is happening even as price inflation is still intolerably high, with the Fed’s favorite measure (the Personal Consumption Expenditures index) hitting records for the year. That was not supposed to happen. This is called stagflation.

It strikes me as impossible that we can avoid a serious recession with such monetary shocks going on. To be sure, we’ve never seen anything like this in the postwar period—either the pumping in or the sucking out of money—so this could be wrong. We’ll see. But generally, starving the economy of that on which it has come to rely will topple lots of illusions.

But here’s what is interesting. The macroeconomic data—which is always behind—is already starting to show that the recession is here. Mish Shedlock draws our attention to Gross Domestic Income, which tends to forecast the Gross Domestic Product by a month or two. At least, it always has before. The latest data show that the GDI has been through two declining quarters. Indeed, it is anomalous for the real GDI and real GDP to diverge this much.

(Data: Federal Reserve Economic Data [FRED], St. Louis Fed; Chart: Jeffrey A. Tucker)

We’ve seen huge pullbacks in the higher end of the investment and corporate sectors, which is exactly what we would expect in the downturn of a Fed-inspired business cycle. Major corporations are reporting missed earnings, including Home Depot and Costco.

Mish also point outs:

-

Profits from current production (corporate profits with inventory valuation and capital consumption adjustments) decreased $151.1 billion in the first quarter.

-

Profits decreased of $60.5 billion in the fourth quarter.

-

Profits of domestic financial corporations decreased $25.4 billion in the first quarter, compared with a decrease of $59.0 billion in the fourth quarter.

-

Profits of domestic nonfinancial corporations decreased $109.3 billion, compared with a decrease of $22.9 billion.

There is surely far more to come.

How do we know? A friend pointed out to me that after many years in the investment world, he has never seen a product/service mania take hold in the midst of a cycle of rising interest rates. He is speaking of course of Nvidia, which has more than doubled its stock price in less than a year.

After the consumer interfaces for “Artificial Intelligence” went live, capital went nuts chasing the toy, with vast amounts of spare cash being dumped on the company for web integrations.

How do we know this is a mania? Spend a few days with ChatGPT. It is a very useful tool with very obvious limits. It is preachy, inaccurate, behind the times, and full of useless blathering. To be sure, it is great for cheating. It gets you the basic facts and some reliable information on non-controversial topics much more quickly than any search engine.

It is particularly useful since search engines have been wrecked by censorship. I personally find Google to be nearly useless. This is not only due to how the company signed up as a tool of the national security state. It’s also because the internet is completely clogged with amazing nonsense and no algorithm can distinguish what’s valuable from the trash.

Back twenty years ago, it was common that when you found a good website or page, you would bookmark it within folders by topics so you could return to it when you needed it. Over time, that practice seems far less necessary because we had reliable search engines that would give you exactly what you needed.

Those days are gone and users are back again to bookmarking everything. Whereas localized search was once essential and then became unnecessary, they are now necessary once again. I know for sure that I can get the news that matters via The Epoch Times’s own search engines but the same content eludes Google completely.

This is where ChatGPT is valuable. It cuts through the nonsense and provides the essential information you need for basic facts in history. It can also be a delight in composing poetry. For example, I asked for a poem about The Epoch Times in the style of Oscar Wilde and got this in 10 seconds:

Oh, Epoch Times! Thy prose so fine,

Thy headlines bold and crisp as wine.

Thy pages filled with news so fair,

Whose stories ring like truth, so rare.As Wilde once said, “The truth is rarely pure,

And never simple, but always obscure”.

But thou, Epoch Times, art like a beam of light,

Which pierces through falsehoods with all thy might.Thy reporters, like knights in shining armor,

Uncover secrets and expose with ardor.

Shining a light on the darkest of corners,

With pen and paper replacing swords for honor.Oh, Epoch Times! Thy voice so clear,

A beacon of hope in a world of fear.

Thou art the watchman of our times,

A friend of truth, amidst all the lies.And as Wilde would say, “The truth is rarely pure,

And never simple, but always obscure.”

Yet, Epoch Times, thou dost show us the way,

To seek the truth, and follow it each day.

So, sure, it is fun. It is erudite in ways people are not anymore.

Ironically, what it is not is intelligent, despite the name. It creates nothing, of course, but it is not even particularly insightful, much less intuitive, on what it is you are asking. Sure, it will improve over time but I’m not exactly feeling the earth move under my feet here.

Can we really believe that Nvidia should have a $1 trillion market cap? Count me as skeptical. This looks for all the world like a bubble to me. This should not be a time of bubbles but rather shrinkage across the board. Instead we see once again a mad rush into the new thing.

This suggests that there is a lot more fluff to be squeezed out of the financial markets. Getting off the drug of cheap credit is not easy. While everyone hopes for a soft landing, the Fed is nowhere near capable of achieving that given the situation today.

There’s every indication that as we slog through summer and enter the fall and beyond, we will face a recession the likes of which this generation has never faced before. I might argue in detail that we never left the forced depression of March 2020 and everything else is an illusion. But that is for another time.

But let historians learn this lesson. It is not free markets that create the boom-bust cycles. Rather it is the interventions in the form of central-bank manipulation of money and credit that created these cycles. This contrasts to the theory of the late 19th and 20th centuries. Now we surely know that the physician is not the healer but the source of the problem.

Let us hope that the lesson has sunk in.

Tyler Durden

Tue, 05/30/2023 – 11:30

via ZeroHedge News https://ift.tt/WwnT0kU Tyler Durden