There’s A Non-Zero Chance AI Rally Leads To A Soft Landing

Authored by Simon White, Bloomberg macro strategist,

The AI rally is boosting semiconductor stocks, which are traditionally a highly cyclical leading indicator of economic growth. A soft landing (or just a very mild recession) is still unlikely, but less so than it was a few months ago.

The share performance of highly-cyclical semiconductor firms has always given a good advance read on economic activity. Today, semis are pointing to an upturn in one of the most leading data points of sentiment, ISM new orders.

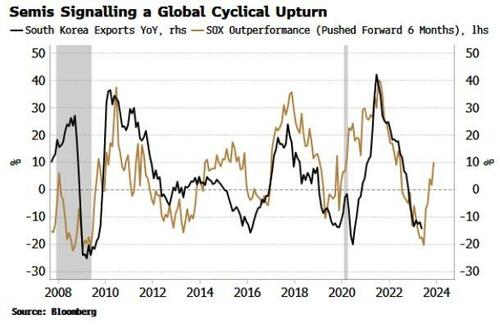

Similarly, semis are also pointing to a global cyclical upturn. South Korean exports are themselves a highly cyclical barometer of global activity and semis’ rise suggest they should soon do likewise.

One must be careful when using single inputs like this. It’s well known the rally in semis is being driven by AI speculation, and it is also fairly well understood that stocks like Nvidia now look overvalued.

Furthermore, it’s folly not to weigh up the rally in semis with the weight of other evidence that the US will soon enter a recession, if it’s not already in one (as I have discussed frequently).

Nonetheless, it’d be remiss to ignore altogether a hitherto reliable leading signal of economic growth, that may be telling us something we’re missing.

It’s common for one sector (eg housing, oil, etc) to lead us into a recession, and it’s not unusual for a sector to lead us out of one too.

Tyler Durden

Sun, 06/04/2023 – 10:30

via ZeroHedge News https://ift.tt/9UH2Guy Tyler Durden