Crypto Crumbles As SEC Sues Binance, ‘CZ’

In a not-so-surprising headline, WSJ reports that the SEC on Monday sued Binance, the world’s largest cryptocurrency exchange, alleging the overseas company operated an illegal exchange in the U.S.

The SEC lawsuit also named Changpeng Zhao, Binance’s founder and controlling shareholder, as a defendant. The SEC filed the case in federal court in the District of Columbia.

As a reminder, the CFTC sued Binance and Zhao himself in late March for allegedly violating derivatives regulations, and accused it of having “sham” compliance.

Binance also faces a Justice Department investigation over its program to detect money laundering, according to people familiar with the matter.

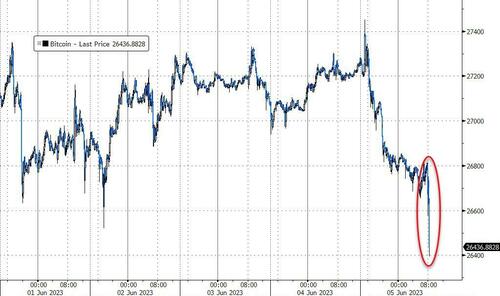

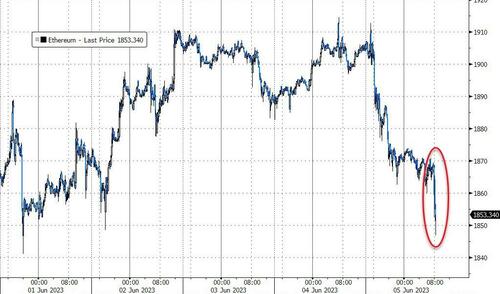

As usual, the initial kneejerk reaction to any regulatory headline is to ‘sell’ crypto.

Bitcoin is extending losses below $27,000…

And Ethereum accelerated below $1900…

Binance own token BNB is plunging…

Additionally, Bloomberg reports that Binance’s payments partner in Australia had abruptly cut it off, meaning local customers couldn’t deposit Aussie dollars on the platform via bank transfer.

The hit to business was immediate, with Binance halting all Aussie trading pairs about two weeks later, along with bank withdrawals of the local currency.

Add one more headache to the swelling list of challenges facing Richard Teng, the civil servant-turned-crypto executive who’s seen as a possible heir to Binance’s embattled chief executive officer, billionaire Changpeng “CZ” Zhao.

Binance still handles more trading than all other top centralized crypto exchanges combined, yet never has its position seemed so precarious.

Binance regained a bit of market share in May📈

Overall, volumes are way down since the start of the year, ever since the exchange halted its zero fee #BTC trading program. pic.twitter.com/hgMSHbgOry

— Kaiko (@KaikoData) June 1, 2023

In a tweet, Zhao said Binance hadn’t seen the complaint and would respond once it did.

“Our team is all standing by, ensuring systems are stable, including withdrawals, and deposits,” he added, referring to the possibility of customers pulling funds.

Tyler Durden

Mon, 06/05/2023 – 11:35

via ZeroHedge News https://ift.tt/W3xmQEL Tyler Durden