Goldman Sachs Warns ESG Investors Against Rushing To Divest From Oil And Gas

Authored by Tsvetana Paraskova via OilPrice.com,

Investors focused on the ESG rush to divest from oil and gas should focus instead on investment in renewables and other forms of low-carbon energy supply, Michele Della Vigna, Goldman Sachs’s head of natural resources research, told Bloomberg on Monday.

“The focus on decarbonization is correct, but I think it needs to be driven by more investment, not divestment,” Della Vigna told Bloomberg in an interview.

“The key is to move away from divesting oil and gas towards more investment in renewables and in low carbon.”

The ESG investors need to quickly ramp up investment in renewables to prevent a collapse in the overall energy supply, according to Goldman’s Della Vigna.

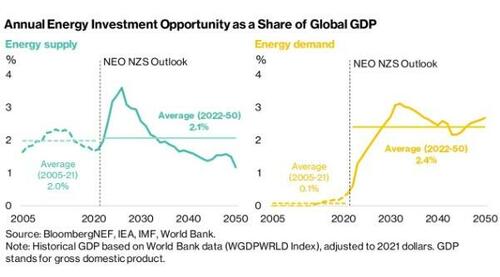

The investment bank sees capex on energy increasing by 15% in 2023, or by as much as 30%, considering inflation.

“What needs to happen is an acceleration of renewable spending on one side, but also normalization of the spending in hydrocarbons on the other,” Della Vigna told Bloomberg.

Earlier this year, the chief executive of the world’s largest oil firm, Saudi Aramco, said that ESG investment, if outright biased against the oil and gas industry, is a threat to energy affordability and energy security.

“In my view, an increased emphasis on ESG is a move in the right direction,” Saudi Aramco’s CEO Amin Nasser said in February.

“However, if ESG-driven policies are implemented with an automatic bias against any and all conventional energy projects, the resulting underinvestment will have serious implications. For the global economy. For energy affordability. And for energy security,” Aramco’s top executive added.

Last month, the International Energy Agency (IEA) said that investment in solar power generation is set to eclipse investment in oil production in 2023 for the first time ever. For 2023, the IEA expects total investments in energy at $2.8 trillion, of which $1.74 trillion will go to clean energy and technologies and the remaining $1.05 trillion to fossil fuels.

“For every dollar invested in fossil fuels, about 1.7 dollars are now going into clean energy. Five years ago, this ratio was one-to-one,” IEA Executive Director Fatih Birol said.

The underinvestment in the energy sector “is very concerning,” Della Vigna said. “And although energy CapEx is rising, I don’t think it’s rising fast enough to fill in the gap of 10 years of underinvestment.”

He also questioned ESG investors’ tendency to focus on absolute emissions as a guide for allocating capital, rather than emissions intensity, which measures an entity’s carbon footprint relative to its total revenue.

“Anything that pushes companies to produce less energy, like just focusing on absolute emissions, for them, I think, runs the risk of prolonging this energy crisis,” he said.

Tyler Durden

Mon, 06/05/2023 – 13:10

via ZeroHedge News https://ift.tt/Z7OwL8Q Tyler Durden