Will Very Narrow Breadth Lead To Broad Equity Upside?

Authored by Simon White, Bloomberg macro strategist,

Extremely narrow breadth has historically led to further index upside.

As discussed in my previous post, it is not inconceivable (but still unlikely) that the recent zeal for AI could avert a US recession.

Whether it does or not is really moot as an investor, what’s important is asset performance.

And on that basis, the AI rally is on more solid ground.

In short, narrow leadership often creates its own reality and ends up dragging the rest of the market along with it.

That’s may happen this time too.

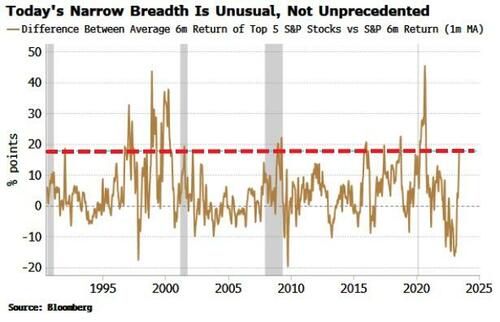

I looked at all the times the S&P 500 had been driven by as narrow leadership as we have today.

As the chart below shows, it’s not an uncommon occurrence.

If we look at all the times (going back to 1990) when then average six-month return of the top five stocks in the S&P (by market cap) was more than 20% points more than the index’s six-month return in the S&P (as it is today)…

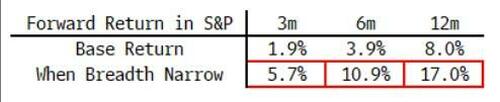

…we can see we typically get well above-average forward returns in the index.

Tyler Durden

Mon, 06/05/2023 – 06:30

via ZeroHedge News https://ift.tt/Ow5iPvh Tyler Durden