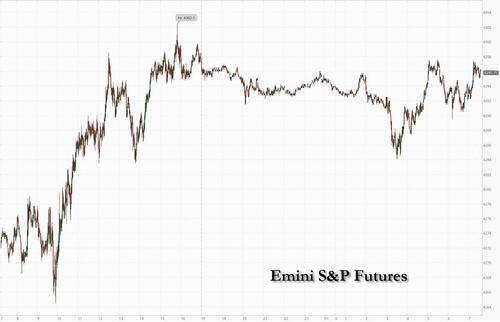

S&P Futures Hit 4,300 After Entering Bull Market

After the S&P closed in a bull market from its October 2022 lows yesterday, futs were again paralyzed, their 4th consecutive session with virtually no changes in the overnight session. As of 8:00am ET, S&P futures were up 1 point or less than 0.05% to 4,300 while Nasdaq futures were also modestly in the green; bond yields are 2-4bp higher this morning, most markedly at the short end. The Bloomberg dollar index is strengthening while oil prices are edging higher after yesterday’s drop. Gold prices are little changed, while iron ore continues its weekly ascent.

In premarket trading, Tesla shares jumped 4.5%, up more than 130% from its January lows, and was on track to rise for an 11th straight session as General Motors Co. announced it’s joining the company’s charging network. GM advanced 3.5%. Target Corp. shares retreated 1.3% after Citigroup Inc. analysts cut their rating, citing slower foot traffic and tough competition. Carvana rose as much as 7.6% in premarket trading, following a record 56% surge on Thursday after the extremely shorted used-car retailer said its operations were improving in the second quarter. Here are some other notable premarket movers:

- Adobe shares rise 2.5% in premarket trading after Wells Fargo upgrades the stock to overweight and lifts its price target to a Street-high, citing greater confidence in tailwinds from artificial intelligence.

- Braze shares gained as much as 14% in premarket trading on Friday, after the infrastructure software company raised its forecast for the year. Oppenheimer analysts said Braze is executing well in a challenging operating environment.

- DocuSign shares rose as much as 9% in premarket trading on Friday, after the e- signature software company reported first-quarter results that beat expectations and raised its full-year forecast. Analysts said the results were impressive and the outlook for next quarter seems conservative.

- Planet Labs fell 18% postmarket after the satellite imaging company cut its revenue forecast for the full year and sees a wider adjusted Ebitda loss.

Yesterday, jobless claims surprised to the upside, which pushed yields lower and sent stocks higher after expectations of a June rate hikes were doused; in equities, we also saw some reversion to the recent RTY v. NDX outperformance. SPX closed at 4293, implying 20% gains since the October low; entering a bull market. Overall, today’s macro calendar remains quiet as investors are waiting for CPI, Fed, ECB, and BOJ next week, and may explain why investors are reluctant to take big positions ahead of next week’s looming interest-rate decisions. Unexpected hikes from two central banks this week have raised speculation that policymakers may have to keep interest rates higher for longer. Meanwhile, US data pointing to a cooling labor market has supported the consensus view that the Fed is likely to pause.

“The backdrop of late has been one of heightened macro uncertainty, but with inflation still running uncomfortably high,” ING rates strategists led by Benjamin Schroeder wrote in a note. “Our house view is that the Fed is already at its peak policy rate, though with the caveat that a higher CPI reading could still eke out a hike next week. In any case, the Fed is likely to leave the door open to more.”

“If you look at where the market sits now in absolute terms, it’s not too hard to make a case that it’s justified at current levels,” said Matt Britzman, equity analyst at Hargreaves Lansdown. “The worry is how fast it’s risen and the concentration within a select few names. A pullback at the top wouldn’t be too much of a surprise as markets take a breather.”

European stocks erased early gains on Friday and headed for a weekly decline as investors monitored a deteriorating economic outlook, while chemicals makers slumped following a glum forecast from Croda International Plc. The Stoxx 600 Index was down 0.4%; chemicals dropped 2%, with Croda International Plc set for its worst day since 2000 after saying it expects customer destocking in consumer and industrial end-markets to persist into the second half of the year. Utilities and real estate shares gained. Here are the most notable European movers:

- Orsted rises as much as 4.5% following the Danish wind-farm operator’s capital markets day. Oddo upgrades to neutral and says worst-case scenarios are now “off the radar screen”

- Ceconomy shares rise as much as 5.7% after BNP Paribas Exane upgraded the German consumer electronics retailer to outperform from neutral, saying that the company now has the right set-up

- Norsk Hydro shares rise as much as 2.1% after Morgan Stanley said the Norwegian aluminum company’s offer for Warsaw-listed Alumetal is still attractive, despite the higher price

- ALK-Abello rises as much as 2.6% after Danske Bank raised its recommendation to buy, saying Thursday’s positive data release from the allergy drugmaker’s dust mite allergy tablet is a relief

- Network International shares rise as much as 6%, to 385p, after Brookfield Asset Management offered to buy the company for 400p per share in a deal recommended by the company’s directors

- Croda shares drop as much as 16% in early London trading to the lowest since July 2020 after the ingredients maker’s pretax profit forecast fell well short of the consensus analyst estimate; Shares in chemicals makers see wide drops following the downbeat trading update from Croda, with fragrance and flavor maker Givaudan as much as -3.2%, Symrise -4.1%, BASF -2.6%, Bayer -2%

- Boohoo shares drop as much as 4.9% to the lowest since Jan. 3 after Numis Securities cut its rating on the online fast fashion retailer to reduce from hold, citing risks ahead

Earlier in the session, Asian stocks rose, with the regional benchmark heading for a second week of gains amid a rally in technology shares in Japan, South Korea and Taiwan. The MSCI Asia Pacific Index rose as much as 0.8%, driven by gains info technology shares. Samsung, TSMC and Sony were among the biggest boosts. Chinese equities underperformed as data showed the nation’s inflation remained close to zero in May as the economy’s recovery weakened, Hang Seng stocks were modestly firmer after early tech gains evaporate. Still, overseas investors are increasingly optimistic about A shares, as evidenced by growing inflows, according to a report in the Financial News, which is backed by the People’s Bank of China.

Japan’s Nikkei 225 rose nearly 2%, set to cap its ninth-straight week of gains – the longest stretch of gains since 2017 – ahead of the Bank of Japan’s policy decision next week and annual general meetings later this month. The Topix jumped 1.3% as Japanese shares resume gains after two-day slide. Heavy foreign buying amid easy-money policy, company reforms and signs of stable inflation have helped drive the world’s best rally so far this year among major markets. “In addition to relative advantages for earnings and macro climate, the Japanese market has many catalysts,” MBC Nikko strategist Hikaru Yasuda wrote in a note. “This should mean overseas investors are unlikely to pull out soon, so we look for buying interest to spill over from large-cap exporters to domestic-demand stocks.” Kospi, Taiex and ASX 200 indexes were also in the green.

In FX, the Turkish lira extended its decline to an all-time low against the dollar, taking its weekly drop to 11%, after Erdogan appointed a former First Republic Bank CEO as his new central bank head. The yuan weakened after Chinese producer prices fall the most since 2016, adding to PBOC easing speculation. The Bloomberg Dollar Spot Index rose 0.1% but was poised to end the week 0.5% lower, marking its second week of losses on expectations the Federal Reserve is nearing the end of this hiking cycle. The USDJPY is up 0.4%, boosted by short covering in the dollar during Asian trade; EURUSD down 0.2%.

In rates, treasury yields ticked higher on Friday, with the 10-year rate at 3.75% and with yields cheaper by 2bp to 5bp across the curve near session highs after yesterday post-initial claims jump. Yields were cheaper by ~5bp across front-end of the curve with 2s10s, 5s30s spreads flatter by 1bp and 2bp on the day; 10-year yields around 3.75%, cheaper by 3.5bp vs Thursday close with bunds and gilts outperforming by 1.5bp and 3.5bp in the sector. The yield on the two-year Treasury yield rose 4bps to 4.55%; traders are betting on a roughly 30% possibility that the Fed will raise interest rates at its meeting on Wednesday, while the possibility of a hike at its July meeting stands around 90%. Front-end-led losses flatten spreads ahead of next week’s Fed meeting, where around 8bp of rate-hike premium remains priced into Fed-dated swaps. Supply concession may emerge ahead of Monday’s heavy auction schedule, including 3- and 10-year note sales. No significant events are scheduled for Friday’s US session. Elsewhere, Australian yields about 4-5bps weaker across the curve. JGB futures remain rangebound.

In commodities, WTI crude rose to $71.50; gold quiet at $1,964. Saudi Crown Prince MBS reportedly threatened major economic pain on the US economy last fall amid the oil feud, according to Washington Post. Russian Ambassador to Turkey says they continue consultations, but there are no grounds which exist for a grain deal renewal, via Ria. Oh, and confirming yesterday’s big fake news, Iran’s IRNA confirmed there is not a temporary deal to replace the JCPOA on the agenda.

It’s a quiet day ahead with nothing major scheduled in the US, data releases include Italian industrial production for April, and the Canadian employment report for May. Otherwise from central banks, we’ll hear from ECB Vice President de Guindos, along with the ECB’s de Cos and Centeno.

Market Snapshot

- S&P 500 futures down 0.2% to 4,290.50

- MXAP up 0.8% to 164.96

- MXAPJ up 0.6% to 520.42

- Nikkei up 2.0% to 32,265.17

- Topix up 1.5% to 2,224.32

- Hang Seng Index up 0.5% to 19,389.95

- Shanghai Composite up 0.6% to 3,231.41

- Sensex down 0.3% to 62,682.10

- Australia S&P/ASX 200 up 0.3% to 7,122.51

- Kospi up 1.2% to 2,641.16

- STOXX Europe 600 little changed at 460.34

- German 10Y yield little changed at 2.43%

- Euro down 0.2% to $1.0764

- Brent Futures down 0.3% to $75.70/bbl

- Gold spot down 0.2% to $1,961.64

- U.S. Dollar Index up 0.18% to 103.53

Top Overnight News from Bloomberg

- US stock futures indicated a pause after the S&P 500’s rally to a bull market, while the dollar headed for its biggest weekly loss in a month on bets that the Federal Reserve is nearing the end of its hiking cycle.

- Most economists expect the Federal Reserve to pause interest-rate increases next week for the first time in 15 months and leave policy on hold through December, even as it confronts a resilient US economy and persistent inflation.

- The S&P 500’s journey to a bull market is unprecedented in many ways, not least of which is that it was completed amid growing warnings about a global recession.

- UBS Group AG sealed an agreement with the Swiss government to cover 9 billion francs ($9.9 billion) of losses it could incur from the rescue of Credit Suisse Group AG, clearing a major hurdle to closing the historic takeover.

- China’s inflation remained close to zero in May, giving the central bank scope to ease monetary policy as calls grow louder for more interest rate cuts to spur the economy’s recovery.

- Bank of Japan officials see little need to adjust its yield curve control program at a policy meeting next week given improvement in the functioning of the bond market and the smooth shape of the yield curve, according to people familiar with the matter.

- A clutch of Russia’s top tycoons are reaping billions of dollars worth of dividends, getting payouts from their companies even in the face of sanctions over the war in Ukraine.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly higher following the gains on Wall St where the S&P 500 entered a bull market and tech outperformed as yields declined due to labour market concerns after Initial Jobless Claims spiked to the highest level since October 2021. ASX 200 was led by strength in the tech and the mining industries but with upside capped by pressure in the energy sector after oil prices dropped on reports that Iran and US were near an interim deal on nuclear enrichment and oil exports which was later refuted by the White House. Nikkei 225 spearheaded the advances amongst the major indices with the index back above the 32,000 milestone. Hang Seng and Shanghai Comp. were indecisive after weaker-than-expected Chinese inflation data continued to point to an uneven economic rebound, although there were some hopes of a thawing in US-China relations with Secretary of State Blinken’s delayed trip to Beijing said to be in planning for next week.

Top Asian News

- US Secretary of State Blinken’s long-delayed Beijing trip is now in planning for next week, according to Politico.

- BoJ Governor Ueda said they will patiently maintain current monetary easing and noted that by supporting the economy, they can create a positive economic cycle where wages rise on a nominal and real basis. Ueda also stated that retaining BoJ’s ETF holdings is among the options, but added that what they will do with their holdings in the event of an exit is something that must be discussed at the BoJ’s policy meeting at the time.

- BoJ reportedly said to still see a need to continue monetary stimulus, via Bloomberg citing sources; hitting price goal as out of sight, little need to tweak YCC in June. Reportedly sees inflation as stronger than expected.

- PBoC Governor says Q2 GDP YY growth is expected to be high, primarily due to base effects, CPI expected to gradually increase in H2, will be above 1.0% YY by December.

European bourses are contained as the complex once again struggles for direction amid a lack of fresh/scheduled catalysts, Euro Stoxx 50 -0.2%. Sectors are mixed with Basic Resources outperforming amid broader metals action while Chemicals lag after a Croda profit warning. Stateside, futures are slightly in the red with action very much contained given the mentioned lack of fresh drivers thus far and scheduled, ES -0.1%.

Top European News

- UK is to introduce a floor for oil and gas windfall tax with Chancellor Hunt expected to confirm plans to introduce a floor on the 35% levy so that it will only apply if oil and gas prices are above a certain level, according to FT.

FX

- Yen bulls out-doved by BoJ sources as USD/JPY rebounds further from sub-139.00 lows towards 140.00.

- DXY boosted by Yen retreat and index back over 103.500 from 103.310 at one stage.

- Norwegian Krona boosted by hotter than forecast inflation data, with EUR/NOK towards base of 11.6500-11.7700 range.

- Yuan back under pressure on the back of soft Chinese CPI and PPI metrics, as USD/CNY and USD/CNH eye 7.1300 and 7.1400 respectively.

- Loonie underpinned around 1.3350 vs Greenback pre-Canadian labour market report and post-BoC surprise hike.

- PBoC set USD/CNY mid-point at 7.1115 vs exp. 7.1122 (prev. 7.1280)

- Turkish President Erdogan appointed Hafize Gaye Erkan as the Central Bank Governor and appoints former Governor Kavcioglu as head of the banking watchdog, according to Reuters.

Fixed Income

- Bonds out of lock-step approaching end of the week and awaiting big risk events including Fed, ECB and US CPI data.

- Bunds meander within 133.85-51 range, Gilts outperform between 95.99-96.58 bounds and T-note lags near 113-13 trough vs 113-23 peak.

- JGBs underpinned after BoJ sources report chiming with guidance signalling no YCT tweak in June.

Commodities

- Crude benchmarks are posting upside of circa. USD 0.20/bbl on the day and reside towards the upper-end of exceptionally narrow sub USD 1.00/bbl parameters.

- Price action which is well within the bounds of recent sessions, nonetheless the complex is set to see the week out with downside of just over USD 3.00/bbl, with the bulk of this occurring on Monday post-OPEC+.

- Spot gold is essentially unchanged and has been gradually drifting off Thursday’s WTD best of USD 1970/oz, where the 21-DMA also resides, as the USD continues to firm up.

- Base metals are generally contained and are proving to be a touch more resilient vs their precious counterparts against the USD’s strength and are perhaps gleaning support from the increasing calls for official Chinese support.

- Saudi Crown Prince MBS reportedly threatened major economic pain on the US economy last fall amid the oil feud, according to Washington Post.

- Russian Ambassador to Turkey says they continue consultations, but there are no grounds which exist for a grain deal renewal, via Ria.

Crypto

- US SEC Chair Gensler commented that the crypto market is full of Ponzi schemes and frauds which can only be cleaned up with securities regulations, according to Cointelegraph.

- Binance US said it is suspending US currency deposits in the aftermath of the SEC lawsuit and its banking partners are preparing to pause fiat USD withdrawal channels as soon as June 13th, according to Reuters

Geopolitics

- US President Biden said the US will have funding for Ukraine for as long as it takes, according to FT. It was also reported that the US Pentagon is readying a new USD 2bln Ukraine air defence package, according to Reuters.

- Two reportedly injured in a drone strike in Voronezh, Russia, via Reuters citing regional governor.

- Russian General Staff Chair Gerasimov invites his Chinese counterpart to visit Russia, adding relations are at the highest level, joint army training between China and Russia is important, should be ongoing.

- There is reportedly not a temporary deal to replace the JCPOA on the agenda, via IRNA.

US Event Calendar

- Nothing major scheduled

DB’s Jim Reid concludes the overnight wrap

I got a lot of responses but no workable solution to my plea for help on Wednesday given that my free time was starting to be totally eliminated by kids sports, clubs and activities. Let me give you tomorrow’s itinerary as an example of the relentlessness. 9am: The 3 kids have a group golf lesson that I take them too while my wife sets up a parents vs teachers vs pupils mini netball tournament at the kids’ school. 11am: I rush to take Maisie for her swimming lesson and swim with the twins while she does that. 1145am: After getting all dried and changed we go to the school to watch the netball tournament where my wife has her annual match. 1pm: I leave for a football tournament with the twins that starts at 2pm and goes on until 5pm. I then stuff food down them and we rush to see Maisie perform in her artistic swimming summer performance at 530pm. She has two shows. The second one starts at 730pm and after she finishes her second run I take the twins home to bed and my wife and Maisie get home at 930. Maisie then has to have her artistic swimming hair gel showered/hosed off and at 10pm my wife and I collapse on the sofa with a glass of wine and some TV. 10:15pm I nod off on the sofa and my wife pokes me and says she’s not telling me what I missed.

If you’re still awake yourself after that download, yesterday was one of those days where although markets were hit by a succession of bad news, the S&P 500 (+0.62%) shrugged these off and entered bull market territory at the close, with a +20.04% gain from its October 2022 low. To show the extreme forces helping us along, the NYFANG+ index is up +65.6% from that point and up +79.7% from it November lows just before the launch of ChatGPT.

In terms of the bad news, in the US, the weekly jobless claims were at their highest since October 2021. In the Euro Area, data revisions showed the economy did in fact experience a winter technical recession after all. And even when it came to the weather, we got confirmation that an El Nino event was now underway, with predictions still pointing to a strong one developing as we move deeper into the year. The weaker data did drive a bond rally though, with yields on 10yr Treasuries coming down -7.7bps to 3.72%.

The main catalyst for the bond moves were those US jobless claims, which saw a big jump to 261k over the week ending June 3. That was well above the 235k reading expected by the consensus, and it takes claims up to their highest level since late-2021, back when Covid was still a significant factor affecting the economy. Another worrying feature was the size of the jump, where the +28k increase on the previous week was the largest since July 2021, so these are not your typical moves we see each week.

The big question now is whether this release is just a blip, or whether it might foreshadow a broader softening in the labour market that culminates in wider job losses. Our economists suggested that two states made up 86% of the increase in non seasonally adjusted claims with Minnesota up +97.5% w/w and Ohio up +61.2% w/w. So for now this might suggest caution when reading too much into the data, a bit like with the Massachusetts fraudulent filings a few weeks ago.

That didn’t prevent a big rally in Treasuries though, in part since investors grew more confident that the Fed would finally hit the pause button on its rate hikes after 10 successive increases. Indeed, futures pricing for a June hike came down to 28%, having been at 35% on Wednesday after the Bank of Canada’s surprise hike. In turn, that meant yields fell back across most of the curve, with the 2yr yield down -4.2bps to 4.515%, and the 10yr yield down -7.7bps to 3.72%. Yields really are in a bit of a yo-yo mood at the moment albeit within a relatively constrained range. This morning in Asia, Treasuries have slightly lost ground again with 10yr yields +1.3bps higher as we go to print.

With investors pricing in a rate pause, that helped equities to recover some ground, and tech stocks led the gains, helping the NASDAQ (+1.02%) and the FANG+ Index (+2.04%) outperform again. The tech performance led the S&P 500 to again outperform its equal weight equivalent (+0.04%). In stark contrast, the small-cap Russell 2000 (-0.41%) lost ground, whilst S&P energy stocks (-0.44%) struggled after Brent crude oil prices (-1.29%) closed at a one-week low of $75.96/bbl. In the meantime, European equities were stuck in the middle, with the STOXX 600 posting a very modest -0.02% decline.

Speaking of Europe, the big news was revised data showing that the Euro Area had in fact experienced a winter recession after all. That was confirmed by the latest Q1 GDP reading, which unexpectedly showed a -0.1% contraction, having initially been a +0.1% expansion in the flash estimate. Coming off the back of another -0.1% contraction in Q4, that meant the Euro Area has contracted for two consecutive quarters and met the common technical definition of a recession, even if it was the mildest possible. For markets, there was little direct relevance given the news was backward looking, and the ECB is still widely expected to proceed with a 25bp rate hike at their meeting next Thursday. In fact, the main driver for European sovereign bonds were the US jobless claims, with yields reversing on the print with 10yr bunds (-5.4bps), OATs (-5.9bps) and BTPs (-9.9bps) yield all closing notably lower.

Most Asian equity markets are struggling to gain traction this morning. As I type, Chinese stocks are mixed with the Hang Seng (+0.05%) swinging between gains and losses while the CSI (-0.11%) is slightly lower and the Shanghai Composite (+0.02%) flat after the release of inflation data (more on this below). Elsewhere, the Nikkei (+1.61%) is strong, reversing some of its losses in the previous two sessions with the KOSPI (+0.92%) also climbing higher. Outside of Asia, US stock futures tied to the S&P 500 (-0.08%) are marginally down after the S&P 500 notched its highest close for 2023.

Coming back to China, producer deflation continued in May for the eighth consecutive month with the producer price index (PPI) declining -4.6% y/y in May (v/s -4.3% expected), the steepest drop since June 2016 as weakening demand is weighing on the fragile economic recovery. It followed a further decline from -3.6% in April. Meanwhile, the consumer price index (CPI) rose in line with market expectations, up +0.2% y/y in May after a +0.1% rise the previous month.

One thing that could influence inflation later in the year is the El Niño. The US’ Climate Prediction Center confirmed that El Niño conditions had emerged in May, with the latest weekly indices above the threshold for an El Niño event. The question now is how severe this episode may be, and their forecasts are seeing a 56% chance of a strong El Niño later in the year (up from 54% last month). As a recap, an El Niño event is where unusually warm sea surface temperatures in the eastern Pacific cause the jet stream to move south. That creates changes in weather patterns and ecosystems, but is unfortunately correlated with a higher frequency of natural disasters like flooding. So historically they’ve had negative effects on the harvest and food supply, and risk putting renewed upward pressure on food prices and inflation. Definitely one to keep an eye on as we move through the year.

With all this negative news piling up, one area that really benefited was gold (+1.31%), where the weak claims data led to its best daily performance in over a month. And similarly, silver (+3.50%) experienced its best day in over two months. And with commodities taking on heightened importance, our colleague Michael Hsueh has just published a timely handbook (link here) that takes a deep analytical dive into the various precious metals. He expects them to remain front and centre of global markets in the coming years.

To the day ahead now, and data releases include Italian industrial production for April, and the Canadian employment report for May. Otherwise from central banks, we’ll hear from ECB Vice President de Guindos, along with the ECB’s de Cos and Centeno.

Tyler Durden

Fri, 06/09/2023 – 08:12

via ZeroHedge News https://ift.tt/CISmrkB Tyler Durden