China Stocks Surge After Politburo Meeting More Dovish Than Expected

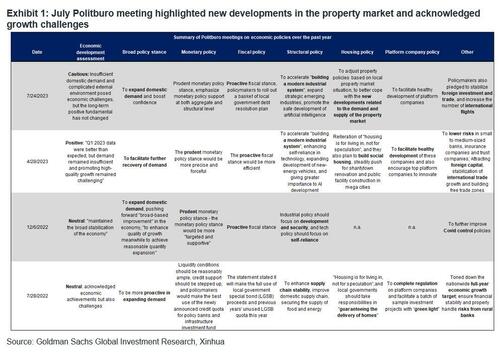

The Politburo of the Chinese Communist Party held its July meeting today, and according to the statement, policymakers acknowledged the insufficient domestic demand and economic growth difficulties, and in particular highlighted the new developments related to supply and demand of the housing market: “Housing is for living in, not for speculation” was deleted from today’s statement. The authority pledged to strengthen countercyclical policy adjustment, and push forward high-quality development.

Main points:

- When assessing the recent economic developments, the authority shifted to a more cautious tone compared with the positive tone in the April Politburo meeting. Policymakers acknowledged challenges in economic development, and in particular the insufficient domestic demand, corporates’ operating difficulties, hidden risks in key areas of the economy, as well as complicated external environment. The statement also highlighted the zigzag path of economic recovery post reopening, but still claimed that economic growth in 1H this year had laid a solid foundation for achieving the full year growth target. Premier Li Qiang recently stated that the economy was on track to reach the growth target this year.

- In terms of macro policy stance, policymakers pledged to strengthen countercyclical adjustments. Specifically, the statement emphasized proactive fiscal policy and prudent monetary policy, similar to the April statement. Policymakers reiterated the need to keep RMB exchange rate broadly stable at equilibrium levels, which is consistent with PBOC’s recent comments, but new relative to the April Politburo meeting statement. The authority urged local government to accelerate special bond issuance and usage. To further reduce local government debt risks, policymakers flagged that they would roll out a basket of local government debt resolution plan.

- In terms of policy focus areas, the July statement highlighted the need to support consumption, and in particular automobile, electronics and home related consumption, as well as sports, entertainment and culture consumption. (Some consumption measures have already been announced.) Policymakers also pledged to stabilize foreign investment and trade, increase the number of international flights and provide sufficient protection for the transportation needs of China-EU railway.

- On the property market, “housing is for living in, not for speculation” was deleted from today’s statement, but it was mentioned in the April statement. Instead, policymakers stated they would adjust property policies based on the local property market situation, to better cope with the new developments related to the demand and supply of the property market. Note that this assessment of the property market is new relative to the April meeting statement, but is similar to the comments from PBOC on July 14th. Policymakers would push for shantytown renovation and public facility construction in mega cities.

- Today’s meeting continued to emphasize the importance of industrial policies and also vowed to push for healthy development of platform companies. Moreover, policymakers pledged to activate the capital market and boost investors’ confidence. Today’s statement also reiterated the importance of employment, and policymakers would view employment stability as one of their strategic goals.

- The July Politburo meeting statement was viewed as slightly more dovish than expected, mainly reflected in the neutral statement of the current economic situation, the deletion of “housing is for living in, not for speculation” and the acknowledgment of new developments in the property market. The mention of “a basket of local government debt resolution plan” is also new. As the July Politburo meeting would set the tone for policy stance in 2H of this year, the new assessment of the economic situation, property market and local government debt would imply further policy easing measures in the next few months. Specific easing measures would still need to be announced by other government institutions such as Ministry of Finance, NDRC and PBOC. Wall Street generally continues to expect a combination of monetary, fiscal, property and consumption support measures to be rolled out in the next few months.

In summary, Goldman’s China strategist Maggie Wei wrties that the Politburo assessment of the economic growth situation and description around the property market as slightly more dovish than expected, though both Goldman – and everyone else – still await specific easing measures after today’s statement.

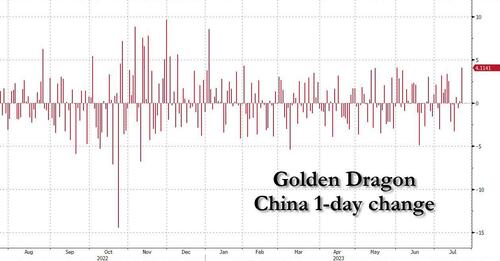

Still, Chinese stocks traded in the US surged, and the Nasdaq Golden Dragon China Index of US-listed Chinese stocks jumped as much as 5.1%, its biggest intraday gain since March after the Politburo signaled more support for the housing sector, even though they fell short of announcing mass-scale stimulus to support a waning economic recovery. Among the mover: Alibaba +4.4%, Baidu +5.8%, PDD Holdings +4.2%, JD.com +4%, NetEase +2.7%, Trip.com +3.9%, Nio +13%, Li Auto +2.9%; KE Holdings, a platform that facilitates housing transactions, gains 8%

Future contracts on Hong Kong’s Hang Seng Index rally, while the offshore yuan pared all losses against the US dollar.

Tyler Durden

Mon, 07/24/2023 – 17:20

via ZeroHedge News https://ift.tt/W3nO5lP Tyler Durden