Key Events This Extremely Busy Week: Buckle Up For Fed, ECB, BOJ, PMIs, GDP, PCE And 48% Of S&P Reporting

Buckle up as we have 48% of S&P’s market cap reporting this week not to mention the Fed (Wednesday afternoon), ECB (Thursday morning), and BOJ (Thursday night/Friday morning).

The big event will be the 11th, and according to DB’s Jim Reid and most other banks, final, Fed hike of this cycle on Wednesday. However the ECB (Thursday) and BoJ (Friday) meetings are also big events. In a busy week, some other highlights include the global flash PMIs today, the ECB bank lending survey (tomorrow), US Q2 GDP (Thursday), US core PCE, US ECI alongside German and French CPI (all Friday).

In terms of earnings, big tech, oil majors and notable semiconductor firms will be the highlights with 165 S&P 500 and 200 Stoxx 600 companies reporting this week. Watch out for Microsoft, Alphabet (tomorrow) and Meta (Wednesday) after some slightly disappointing tech earnings last week.

Going through the three big central bank meetings and other highlights in more detail now.

The Fed will almost certainly hike +25bps on Wednesday which the market expects to be the final hike in the cycle. A September hike is priced at 33%, albeit up from 22% the previous week. With two CPIs and payrolls to come before then there is plenty of incoming data to confirm or dispute that assumption. The key for this meeting is if and how much the Fed messaging changes given recent softer inflation data. DB economists suggest that there is little downside at this stage for the Fed to do anything other than maintain a hawkish bias even if they acknowledge the progress.

Over in Europe, the ECB will also decide on rates on Thursday. The ECB is expected to deliver a +25bps hike, taking the deposit rate to what DB economists see as a terminal level of 3.75%, even if they see a hike in September as a genuine possibility. Aside from the ECB meeting, the Eurozone bank lending survey tomorrow is important in order to see how lending standards have moved from what are currently tight and restrictive levels. The Fed’s SLOOS equivalent is out next week and is also very important. These are key pillars in the recession argument and if they stay tight risks continue to build. A surprise big improvement will put a dent in the argument.

The BoJ will close out the busy week for central banks with a decision on Friday and will also release their quarterly Outlook Report. DB’s Chief Japan economist previews the meeting here and sees some policy revision as a c.40% probability event, but continues to expect no change in monetary stance as his baseline. For the Outlook Report, he expects the BoJ to increase the inflation outlook for FY2023 but lower it for FY 2024, continuing to emphasize downside risks, but with no changes to the growth outlook.

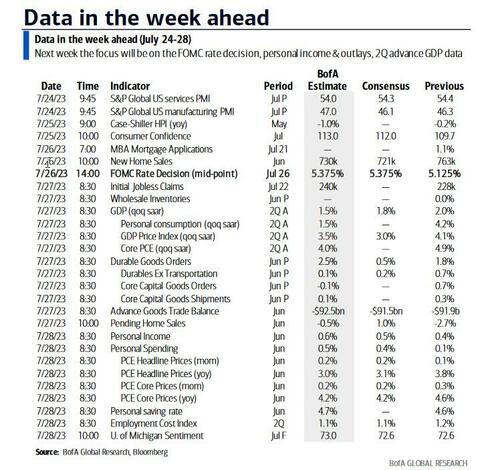

Turning to the week’s economic indicators, several important gauges will be out in the US. This includes the preliminary Q2 GDP reading on Thursday as well as the employment cost index and personal income and spending on Friday along with the all important monthly core PCE. Other data in focus will include Conference Board’s consumer confidence gauge (tomorrow), new home sales (Wednesday) and durable goods orders (Thursday).

Outside of the global flash PMIs today, a number of sentiment gauges will also be out in Europe, including the Ifo survey for Germany (tomorrow) and consumer confidence for France (Wednesday) and Germany (Thursday).

Germany and France publish preliminary CPI releases for July on Friday. Q2 GDP for France will be due that day as well. DB expects the headline gauge for the Eurozone to come in at 5.3% YoY (vs 5.5% YoY in June) and core at 5.4% (5.5%).

Corporate earnings releases will also compete for investors’ attention with key big tech players, oil majors, semiconductor companies as well as some large European corporates, including those in healthcare and luxury, all reporting this week. The highlight will be big US tech, with Microsoft, Alphabet (tomorrow) and Meta (Wednesday). The three companies make up almost $5tn in market cap, or c.12% of S&P 500, and have enjoyed YTD gains ranging from around 36% for Alphabet to c 145% for Meta, helping propel the Nasdaq 100 to +41% YTD. Elsewhere in tech, Samsung, NXP semiconductors, Intel, Lam Research and SK Hynix will be among the companies reporting. Our US equity analysts preview the earnings season for semiconductors here, cautioning on the AI optimism.

Another notable group to release earnings will be the big oil firms. The list of companies reporting includes Exxon and Chevron on Friday in the US as well as Shell, TotalEnergies on Thursday and Eni on Friday in Europe. Elsewhere, Rio Tinto, Anglo American and Vale will be on investors’ radars.

In terms of Consumer stocks, results are due from Coca-Cola, P&G, Mondelez and McDonald’s, among others. Automakers releasing earnings include GM and Ford in the US and Porsche, Mercedes-Benz and Volkswagen in Europe. Otherwise, Raytheon, GE and Honeywell will be among notable industrials firms reporting.

Other European corporates reporting include healthcare firms AstraZeneca, Roche and Sanofi as well as a number of key European luxury firms such as LVMH tomorrow. Nestle and BASF will also report. The earnings and data highlights are in the day-by-day calendar at the end as usual. It’s certainly a busy week all round.

Courtesy of DB, here is a day-by-day calendar of events:

Monday July 24

- Data: US, UK, Japan, Germany, France and the Eurozone July PMIs, US June Chicago Fed national activity index, Japan June nationwide department store sales

- Earnings: Cadence Design Systems, NXP Semiconductors, Ryanair, Domino’s Pizza, Software AG

Tuesday July 25

- Data: US July Conference Board consumer confidence, Richmond Fed manufacturing index, business conditions, Philadelphia Fed non-manufacturing activity, May FHFA house price index, Germany July ifo survey

- Central banks: Eurozone Bank Lending Survey

- Earnings: Microsoft, Alphabet, Visa, LVMH, Danaher, Texas Instruments, NextEra Energy, Verizon, Raytheon, Unilever, General Electric, EssilorLuxottica, General Motors, ADM, Biogen, Dow Inc, Anglo American, Deutsche Boerse, Spotify, Snap, EQT, Ares Capital

Wednesday July 26

- Data: US June new home sales, Japan June PPI services, France July consumer confidence, Eurozone June M3

- Central banks: Fed decision, BoC summary of deliberations

- Earnings: Meta, Coca-Cola, Thermo Fisher Scientific, Union Pacific, Boeing, Airbus, Porsche AG, Rio Tinto, AT&T, Equinor, Lam Research, Fiserv, GSK, Enel, SK Hynix, Chipotle, Stellantis, Hess, Hilton, Orange SA, Nissan, Carrefour, Puma, Mattel

Thursday July 27

- Data: US Q2 GDP, core PCE, June durable goods orders, advance goods trade balance, wholesale and retail inventories, pending home sales, July Kansas City Fed manufacturing activity, initial jobless claims, Italy July manufacturing confidence, consumer confidence, economic sentiment, June hourly wages, Germany August GfK consumer confidence

- Central banks: ECB decision

- Earnings: Mastercard, Samsung Electronics, Nestle, Roche Holding, L’Oreal, AbbVie, McDonald’s, Shell, Linde, Comcast, T-Mobile US, TotalEnergies, Intel, Honeywell, Bristol-Myers Squibb, Schneider Electric, Mondelez, Air Liquide, Mercedes-Benz, Iberdrola, HCA Healthcare, Volkswagen, Boston Scientific, Kering, Vale, Ford, Hershey, STMicroelectronics, Keurig Dr Pepper, Holcim, PG&E, Royal Caribbean, Ferrovial, ArcelorMittal, Telefonica

Friday July 28

- Data: US Q2 employment cost index, June personal income and spending, PCE deflator, July Kansas City Fed services activity, Japan July Tokyo CPI, Italy June PPI, May industrial sales, Germany July CPI, France July CPI, Q2 GDP, June PPI, Eurozone July services, industrial, economic confidence, Canada May GDP

- Central banks: BoJ decision

- Earnings: Exxon Mobil, P&G, Chevron, Hermes, AstraZeneca, Sanofi, Keyence, Vinci, Colgate-Palmolive, Eni, BASF, Engie, Capgemini, Leonardo

* * *

Finally, looking at just the US, Goldman notes that key economic data releases this week are the Q2 GDP report on Thursday and the core PCE and ECI reports on Friday. The July FOMC meeting is this week, with the release of the statement at 2:00 PM ET on Wednesday, followed by Chair Powell’s press conference at 2:30 PM.

Monday, July 24

- 09:45 AM S&P Global US manufacturing PMI, June preliminary (consensus 46.1, last 46.3)

- 09:45 AM S&P Global US services PMI, June preliminary (consensus 54.0, last 54.4)

Tuesday, July 25

- 09:00 AM S&P Case-Shiller 20-city home price index, May (GS +0.7%, consensus +0.70%, last +0.91%)

- 09:00 AM FHFA house price index, July (consensus +0.6%, last +0.7%)

- 10:00 AM Conference Board consumer confidence, July (GS 113.0, consensus 112.0, last 109.7): We estimate that the Conference Board consumer confidence index increased to 113.0 in July.

- 10:00 AM Richmond Fed manufacturing index, July (consensus -10, last -7)

Wednesday, July 26

- 10:00 AM New home sales, June (GS -5.0%, consensus -5.0%, last +12.2%)

- 02:00 PM FOMC statement, July 25-26 meeting: As discussed in our FOMC preview, the FOMC is widely expected to deliver a 25bp hike at its July meeting this week. We believe the key question is how strongly Chair Powell will nod toward the “careful pace” of tightening he advocated in June, which we and others have taken to imply an every-other-meeting approach. We expect Powell to cautiously avoid implying that the FOMC has already reached an agreement but are confident that he does want to slow the pace and that the FOMC will end up skipping in September. While we expect a hike next week to 5.25-5.5% to be the last of the cycle, our Fed views remain more hawkish than market pricing on a probability-weighted basis. This reflects both our lower probability of recession and our expectations that the threshold for rate cuts will be fairly high and that cuts will be gradual.

Thursday, July 27

- 08:30 AM GDP, Q2 advance (GS +2.5%, consensus +1.8%, last +2.0%): Personal consumption, Q2 advance (GS +1.4%, consensus +1.2%, last +4.2%): We estimate that GDP rose +2.5% annualized in the advance reading for Q2, following +2.0% annualized in Q1. Our forecast reflects firm consumption growth (+1.4% qoq ar), solid business fixed investment growth (+5.1%), and a rebound in residential investment (+11.7%). We expect a positive contribution to GDP growth from inventories (+0.7pp) but a drag from net exports (-0.9pp).

- 08:30 AM Durable goods orders, June preliminary (GS +5.0%, consensus +1.0%, last +1.8%); Durable goods orders ex-transportation, June preliminary (GS +0.1%, consensus +0.1%, last +0.7%); Core capital goods orders, June preliminary (GS flat, consensus -0.2%, last +0.7%); Core capital goods shipments, June preliminary (GS +0.1%, consensus +0.1%, last +0.3%): We estimate that durable goods orders rose 5.0% in the preliminary June report, reflecting a jump in commercial aircraft orders. We forecast an unchanged core capital goods orders and a 0.1% rise in shipments, reflecting a pickup in US freight and global industrial activity and a continued drag from tighter credit.

- 08:30 AM Initial jobless claims, week ended July 22 (GS 230k, consensus 235k, last 228k): Continuing jobless claims, week ended July 15 (consensus 1,750k, last 1,754k)

- 08:30 AM Advance goods trade balance, June (GS -$92.0bn, consensus -$91.9bn, last -$91.1bn): We estimate that the goods trade deficit widened by $0.9bn to $92.0 in June compared to the final May report.

- 08:30 AM Wholesale inventories, June preliminary (consensus -0.1%, last flat)

- 10:00 AM Pending home sales, June (GS -1.0%, consensus -0.5%, last -2.7%)

- 11:00 AM Kansas City Fed manufacturing index, July (last -12)

Friday, July 28

- 08:30 AM Employment cost index, Q2 (GS +1.0%, consensus +1.1%, prior +1.2%): We estimate that the employment cost index (ECI) rose 1.0% in Q2 (qoq sa), which would lower the year-on-year rate by four tenths to 4.4%. We believe the Q1 ECI reading received a boost from start-of-year wage hikes, which argues for sequential slowing in Q2. Additionally, both the Atlanta Fed wage tracker and production and nonsupervisory average hourly earnings growth slowed in the spring, consistent with the significant progress achieved on labor market rebalancing. On the positive side, we assume continued strength in the ECI benefits component, as firms expand health insurance and supplemental pay programs in order to retain talent.

- 08:30 AM Personal income, June (GS +0.6%, consensus +0.5%, last +0.4%); Personal spending, June (GS +0.5%, consensus +0.4%, last +0.1%); PCE price index, June (GS +0.20%, consensus +0.2%, last +0.1%); Core PCE price index, June (GS +0.21%, consensus +0.2%, last +0.3%): Based on details in the PPI, CPI, and import price reports, we forecast that the core PCE price index rose by 0.21% month-over-month in June, corresponding to a 4.18% increase from a year earlier. Additionally, we expect that the headline PCE price index increased by 0.20% in June, corresponding to a 3.04% increase from a year earlier. We expect that personal income increased by 0.6% and personal spending increased by 0.5% in June.

- 09:00 AM University of Michigan consumer sentiment, July final (GS 72.7, consensus 72.6, last 72.6); University of Michigan 5–10-year inflation expectations, July preliminary (GS 3.0%, consensus 3.1%, last 3.1%): We expect the University of Michigan consumer sentiment index to increase by 0.1pt to 72.7. We expect the report’s measure of long-term inflation expectations to be revised down to 3.0%, reflecting net favorable news on disinflation.

Source: DB, Goldman, BofA

Tyler Durden

Mon, 07/24/2023 – 10:00

via ZeroHedge News https://ift.tt/Besf3C8 Tyler Durden