Solid 5Y Auction Tails Despite Highest Direct Award Since 2019

Following yesterday’s mediocre, tailing 2Y auction, moments ago the Treasury sold $43 billion in 5Y paper in another tailing – if somewhat stronger – auction.

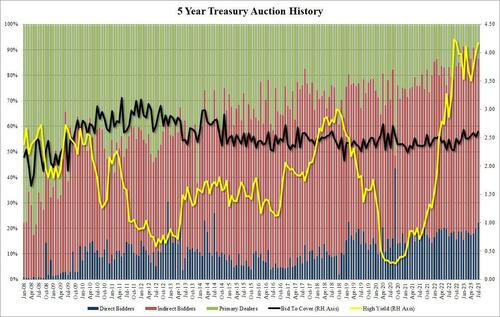

The high yield of 4.170% was well above last month’s 4.019% and was the highest since the 4.192% in October of last year; it also tailed the When Issued 4.166% by 0.4bps, the 2nd tail in a row.

The bid to cover was 2.60, the highest since January and clearly well above the six-auction average of 2.54.

The internals were mixed, with Indirects taking down 64.4%, the lowest since last September; this however was offset by the highest Direct award since February 2019. Finally, Dealers ended up with 13.5% of the auction, above last month’s 12.2% and also well above the 11.4% six-auction average.

Overall, this was another solid, if not stellar auction, and one which again took advantage of the selling concession in today’s session which has pushed the 10Y back to 3.90%

Tyler Durden

Tue, 07/25/2023 – 13:20

via ZeroHedge News https://ift.tt/MquGzSp Tyler Durden