US Building Permits Stagnant In July As Mortgage Rates Topped 7%

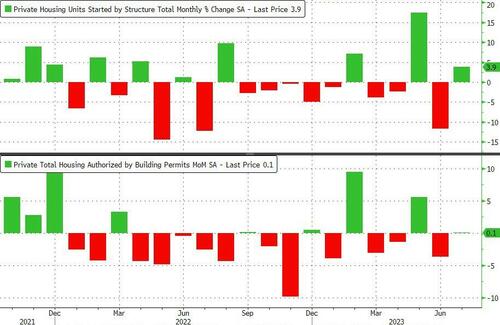

After last month’s surprisingly large declines, Housing Starts and Building Permits were expected to rebound modestly in July data released today (still losing altitude from May’s major surge). However, the picture was more mixed with starts rising 3.9% MoM (vs +1.1% exp), but that was impacted by a notable downward revision in June (from -8.0% to -11.7%). Building Permits rose just 0.1% MoM (well below the 1.5% MoM expected).

Source: Bloomberg

On a SAAR basis, Permits disappointed (1.442mm vs 1.463mm exp) while Starts were in line at 1.452mm (up from a significantly downwardly-revised 1.398mm in June)….

Source: Bloomberg

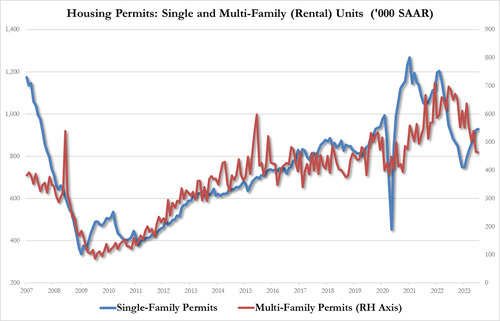

On the Permits side, single-family rose as multi-family fell:

-

Single-family up to 930K from 924K, highest since June 2022

-

Multi-family down to 464K from 465K, lowest since Oct 2020

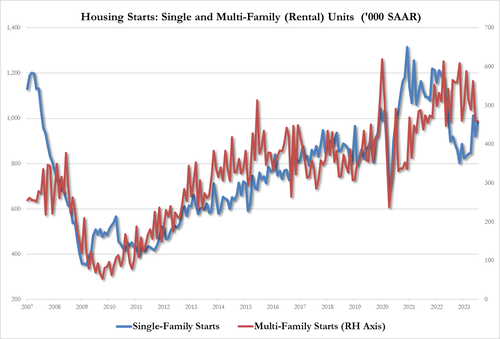

July Housing Starts data followed the same trajectory with rental units growth underperforming single-family:

-

single-family housing up 6.7% to 983K, up from 921K, highest since May

-

multi-family housing unch at 460K, tied for lowest since July 2022

Additionally, we note that while Housing Starts and Completions remain well off their 2022 highs, Construction Jobs remain very close to those highs…

Source: Bloomberg

Finally, we note that Mortgage Bankers Association data released earlier this morning showed applications for home purchases dropped again last week (back near 1996 lows) as the contract rate on a 30-year fixed mortgage surged above 7% (highest since Dec 2001).

Source: Bloomberg

This won’t end well.

Tyler Durden

Wed, 08/16/2023 – 08:40

via ZeroHedge News https://ift.tt/e0jbRZ8 Tyler Durden