Quantitative Tightening Is Not Biggest Threat To Global Yields

Authored by Simon White, Bloomberg macro strategist,

The Bank of England’s quantitative tightening program shows that unwinding central-bank bond portfolios, even with outright sales, need not be disruptive for markets. The greater risk for US and global yields comes from positive stock-bond correlations driving risk premia wider.

The BOE has been a pioneer and a thought leader in QT. While the Fed and ECB have only allowed bonds to run off naturally to help achieve their balance-sheet contraction goals, the BOE has sold gilts outright in addition to allowing bonds to mature.

So far, it has not led to any significant market disruption. This enabled the BOE Thursday to increase the pace of reduction in the Asset Purchase Facility (APF) from £80 billion last year to £100 billion over the coming 12 months from October (while holding Bank Rate steady). As colleague Ven Ram also noted, the schedule of maturing bonds next year allowed the bank to keep gilts sales unchanged from last year while increasing the total amount of the APF’s decrease.

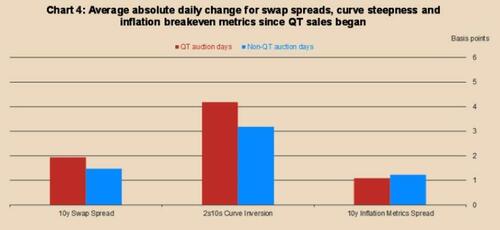

The QT watchwords from the bank are “gradual and predictable.” If gilt sales are conducted in such a way, then market disruption should be minimized. The chart below shows the BOE’s own assessment of the impact of bond sales on the market.

The BOE estimates that of the ~40 bps of term-premium increase since the MPC voted to begin QT in February 2022, about 10-15 bps comes from QT specifically – small in comparison to the overall rise in yields since that time.

QT or bond sales, though, are not the most critical risk facing bond prices in the current cycle. Rising and now positive stock-bond correlations threaten to lead to a structural rise in bond risk premium, and lower prices. The correlation is now positive in the US, Japan, and the UK.

In a positive stock-bond correlation world, bonds lose their portfolio-hedge and recession-hedge capabilities, and thus become less sought after. The penny has not fully dropped yet, but the negative term premium for bonds is increasing, and is prone to rising much higher as they become less desirable.

Yields of developed market countries are biased structurally higher, but QT is unlikely to be the culprit. Instead, it allows central banks to reload their capacity for a future time when they may need to restart quantitative easing, in order to stabilize the market from sharply rising term premia.

Tyler Durden

Fri, 09/22/2023 – 09:10

via ZeroHedge News https://ift.tt/7d3nUxk Tyler Durden