With Most Central Banks Ending Their Tightening Cycle, The BOJ Remains Too Terrified To Even Start

With a growing number of central banks either ending their hiking cycle (BOE, SNB, Riksbank, and absent an oil price shock, the Fed too), or even actively easing (PBOC, Brazil), Japan remains the glaring monetary policy outlier it has been for the past 30 years, and despite soaring inflation that has been above the 2% inflation target since April 2022 (and even above US CPI at times) overnight the BOJ once again refused to even begin its long overdue policy tightening, when despite growing speculation that the central bank will at least set the groundwork for an end to YCC if not NIRP to tame the imploding Japanese lira yen, the BOJ voted unanimously to maintain its current policy as expected, with its 10-year JGB yield target at about 0%, the policy balance rate at -0.1% and kept yield curve control unchanged.

And in a slap to the face of those expecting the central bank to at least hint that it is catastrophically behind the curve when it comes to controlling inflation, It also left its forward guidance unchanged, and noted “extremely high uncertainties” over prices and the economy and forecast inflation to decelerate.

The BOJ also made no changes to its assessment of the economy and prices, which were revised upward in the previous Outlook Report. Specifically, its statement maintained the view that “Japan’s economy has recovered moderately.” In terms of individual items, it again stated that “consumption has increased steadily at a moderate pace,” and that business fixed investment has also “increased moderately.”

On the inflation front, it adjusted its assessment of core CPI inflation, which has started to slow recently, to “has been at around 3 percent recently,” from “has been in the range of 3.0-3.5 percent.” Its view on inflation expectations was unchanged, as “have shown some upward movements again.” The BOJ also made no revisions to its view on risk factors, reiterating that “it is necessary to pay due attention to developments in financial and foreign exchange markets and their impact on Japan’s economic activity and prices.”

During his press conference following the policy announcement, governor Ueda, asked about his recent comments alluding to the possibility of confirming a virtuous inflation trend by year-end, a condition for policy normalization — clarified that the “distance to ending negative rates” hasn’t really changed. He explained he had simply wanted to avoid ruling anything out and limiting the BOJ’s options.

Ueda also reiterated that when the goal of sustained 2% inflation is in sight, the BOJ will consider ending its YCC policy as well as raising interest rates. He reiterated that inflation should slow more clearly in coming months, although the recent deceleration was less than previously expected.

Kuroda’s successor said that the BOJ has long placed a greater emphasis on the risk of tightening too soon over the possibility of being behind the curve in raising rates. He says there’s no change to this “risk management” tendency.

Speaking of the currency, Ueda said it’s desirable for currency rates to reflect economic fundamentals and for them to move in a stable fashion, although he declined to comment on “short-term” currency moves, which have seen the yen plunge as the worst performing major this year.

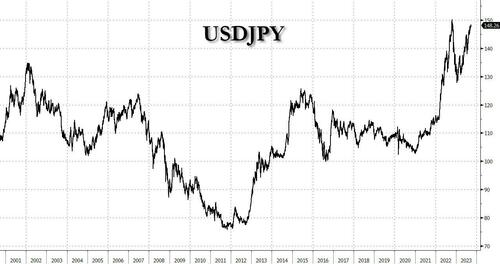

Of course, the yen – which has been the Developed World’s Turkish lira this year as it has cratered from 130 to 148, weakened even more on what was widely seen as a dovish BOJ stance, sliding 0.5% to about 148.3 per dollar. The drop may have been restrained by comments from government officials that they are ready to act on sharp moves.

And indeed, while some were expecting the USDJPY to immediately spike above 150 after anything except a hawkish BOJ statement – with rate differentials to the US entering nosebleed territory – the contained drop may have been explained by what National Australia Bank noted was a warning that the BOJ is ready to intervene in the FX markets on the Ministry of Finance’s behalf at a moment’s notice.

“There is an addition of a paragraph in the BOJ statement that was not there in July, which concludes ‘it is necessary to pay due attention to developments in financial and foreign exchange markets and their impact on Japan’s economic activity and prices’,” says Ray Attrill, strategist in Sydney.

“Intervention is of course MOF’s not BOJ’s call, but BOJ will evidently be fully onside with this should MOF so choose” Attrill said adding that “taken together with Mr Suzuki’s comments earlier, I think its pretty clear we should expect a burst of FX intervention one side or other of 150.”

“As such, risk-reward doesn’t favor being long USD/JPY at current levels”, although with the USDJPY fast approaching 150, it appears that many disagreed.

Ultimately, the question of when the BOJ intervenes will be a political one: there is only so much inflation Japan’s long-suffering population can sustain, and at some point – quite soon – they will make it very clear that they will demand a different PM if the current one is willing to risk currency collapse just to preserve fake bond market stability for a few months longer.

Stocks were also down, however, despite the sliding yen with the Topix closing 0.3% lower and the Nikkei 225 posting a 0.5% decline. JGBs rose, with 10-year futures up 16 ticks to 145.46. Cash bonds were mostly flat, with the 10-year yield holding at 0.745%, the highest since 2013.

Tyler Durden

Fri, 09/22/2023 – 07:39

via ZeroHedge News https://ift.tt/IBn9SKw Tyler Durden