BRICS Will Change The World… Slowly

BRICS, the organization that is hardly noticed in the West, more than doubled its membership at the end of August – something is happening.

Introduction

It seems to be more a rule than an exception that the most important changes in the history of financial systems either go completely unnoticed or the vast part of the public – including financial experts and investors – does not grasp the importance of such transformations.

There are several examples for this claim: On December 23, 1913 the Senate passed and President Woodrow Wilson signed the Federal Reserve Act. The FED being as “federal” as “Federal Express”, a private bank whose shareholder register is not open to the public, rules the world since 1913. The date of December 23 was wisely chosen since the public and most politicians were too engaged in Christmas preparations to realize that this event would change the order of America and then the world forever.

When Richard Nixon, on August 15, 1971, “temporarily” closed the gold window, the Sunday afternoon TV shows got interrupted – among else the TV series “Bonanza” – to inform the American people of his decision. Although, this event was called the Nixon Shock, people did not seem to grasp the importance of this deed.

Lastly, the famously brilliant Henry Kissinger managed to make a deal with King Faisal of Saudi Arabia in 1974, which gave the US unlimited financial and, therefore, geopolitical power by creating the Petrodollar, banishing the danger stemming from a U.S. dollar that was backed by nothing, by backing it with U.S. military might in exchange for nearly unlimited investments in U.S. bonds.

Now, on August 22, BRICS, an organization, which does not gather a lot of attention in the Western media, announced that, apart from the five countries, whose initials gave it its name (Brazil, Russia, India, China, South Africa), BRICS welcomed six new members (Argentina, Egypt, Ethiopia, Iran, Saudi Arabia and the United Arab Emirates) to join BRICS by January 1, 2024; therefore, BRICS becoming BRICS 11.

In this article, let us first quickly look at some facts & figures of BRICS 11. Then, we shall explore the history of the current financial system and it’s becoming in detail in order to appreciate its importance to U.S. power in the period from World War II to the present. Then we shall look at the way the U.S. abused the inherent privileges of this system, which is one reason that led to the current rise of BRICS. Finally, we shall try to answer the question whether the events of August 2023 have the potential to change the world or whether it will be one more fruitless endeavor of emerging market nations to stand-up against the Collective West.

Origin of BRICS

The term BRIC was coined by Goldman Sachs economist Jim O’Neill in a 2001 paper where he explained the future economic potential of Brazil, Russia, India and China.

In 2006, the BRIC countries met for the first time on the fringes of the UN-General Assembly in New York. A first formal meeting took place in Yekaterinburg in 2009. The aim of this initially loose community was to improve cooperation among its members. In 2010, South Africa joined, which means that this organization has since been called BRICS. This August the number of its members more than doubled and we shall call it now BRICS 11.

Figures

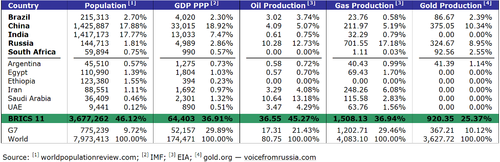

With regard to the most important economic indicators such as population, GDP (PPP), oil, natural gas and gold production, naked figures show that BRICS 11 is much stronger with regard to any of these indicators than G7 (Table 1).

These figures on their own should be a wake-up call to all the people, experts, politicians and investors who still seem to believe that it is sufficient to judge the financial world from a pure western perspective.

There are a few points I would like to draw the attention to of the readers regarding the way these naked figures could and should be read and interpreted. However, I am fully aware that I can only give you a glimpse at the reality and this exercise herein is of a very limited nature indeed.

Regarding GDP, I use purchase power adjusted figures. Why? – If you use the U.S. dollar as a tally to measure GDP, ask yourself the simple question: If I want to measure financial punch, does it matter whether, e.g., a Big Mac costs twice as much in U.S. dollar terms in one place than in the other? – In my opinion it does. The Big Mac Index should be reason enough to use PPP-adjusted figures when comparing GDP figures. The reason that Western outlets use the non-adjusted figures is pure marketing masking the debasement of the U.S. dollar and appearing stronger than one is – propaganda.

Regarding oil production figures, we should consider the following facts when assessing them: Firstly, although the U.S. is still the largest oil producer in the world with a share of about 18% of world production, the U.S. are also the largest oil consumer, using-up more than 20% of world consumption. Therefore, the U.S. are at this time not even able to cover their own consumption. Secondly, the large oil-producing members of BRICS 11 have a big influence – or better – control over OPEC. Therefore, BRICS 11 will also rule OPEC and, therefore, control the price and distribution of oil, which has not been given the nick name “Black Gold” without good reason. Thirdly, the production cost of U.S. oil are about 2.5 times higher than the production cost of Saudi oil.

Regarding natural gas one should note, that with the accession of Iran into BRICS, the two largest natural gas producers worldwide are joint members of BRICS: Russia and Iran. The largest non-BRICS gas producer is the (still) U.S. allied Qatar. BRICS is, therefore, also a powerhouse regarding natural gas indeed.

Regarding gold, it should shortly be mentioned that China and Russia are number 1 and 2 respectively regarding global gold production. Gold I mention in here since there is a rather good chance that – somewhere in the future – gold will again play a major role in future money systems, being the only manner to discipline central bankers who basically only did one thing since 1914 – printing money, debasing the U.S. dollar and cynically claiming to protect the currency. There are a lot of people in the West who actually claim that gold is a pet rock. These people do not understand the history of the past 4’000 years where gold was always king. The mere fact that Nixon abolished the gold standard in order to avoid bankruptcy is not a good argument against gold, but should be one in its favor.

Bretton Woods

In order to grasp the importance of the rather swift developments around BRICS and the rationale behind it, we shall look at the present system of the financial corset so imposed by the U.S. on the rest of the world. How did the U.S. achieve such dominance, how the hegemon behaved since, and finally the probability of a change of the system.

In 1944, the Americans reached the pinnacle of their power. They dominated the war effort together with the Russians, possessed 22,000 tons of gold, and the American industry produced 70% of the world’s manufactured goods. That is how complete dominance looks like: Military dominance, industrial dominance and gold – he who has the gold makes the rules.

On top of these facts, the Americans – as ever – being the undisputed masters of marketing, persuaded the Europeans to believe that it was actually the U.S. who liberated Europe from the evil Mr. Hitler. This was a diplomatic master stroke since cold facts and figures clearly showed that the Russians bore the largest chunk liberating Europe from the Nazis. The Russians decimated the German Wehrmacht in the East and – in this endeavor – killed around 5 times more German soldiers than all western allies together at the western front. This very ability of marketing and deception by the United States would serve them well until the present day.

Against such an overwhelming power, based on the three pillars of military might, industry and gold, the entire rest of the world – whether friend or foe – did not stand a chance to have any influence worth mentioning on influencing US intentions.

The Bretton Woods system was thus an emanation of absolute U.S. power and not – as portrayed in history books – a mechanism negotiated by the victorious powers of World War II in an atmosphere of friendly partnership.

Bretton Woods also sealed the demise of the British Empire by giving the Americans absolute power through pegging the currencies of 44 member states to the U.S. dollar, which in turn came out as the only currency of the world backed by gold.

The British Empire on which the sun finally set, proposed a system that involved the introduction of an international settlement currency called the Bancor. This idea by John Maynard Keynes foresaw the Bancor being used as an international unit of account to which participating currencies would have been pegged. The value of the Bancor itself was to be backed by gold. The gold-backed Bancor would have served as the unit of account. A fair system giving a chance to countries with merit, leading to a multipolar world. However, a multipolar world was the last thing the Americans intended to build – they wanted to become the hegemon and achieved their goal; the British had not a snowball’s chance in hell with their – in my opinion – great idea.

The Bretton Woods system gave all member states the contractual right to exchange the U.S. dollar they held for physical gold at a fix rate of U.S. dollar 35 per ounce of gold. Therefore, the Bretton Woods system should have forced the Americans to behave fiscally disciplined so that all member countries would keep confidence in the U.S. dollar believing that the U.S. dollar was indeed as good as gold.

The Americans, however, as the world power and hegemon, did not care one iota about the interests of their partners and, starting in the 1960s, printed more and more U.S. dollars to finance the Vietnam War and the Great Society project initiated by President Johnson. Both, the costs of the Vietnam War as well as the Great Society Project, the largest social program of the USA up to that time, whose main goal was to completely eliminate poverty and racial injustice, got completely out of hand.

The French were the first to realize that the U.S. dollar was losing value due to American money printing and began to exercise their contractual right to exchange their U.S. dollars for physical gold. Others followed suit. The Americans’ huge gold hoard melted away like butter in the sun. While the USA had more than 22,000 tons of gold at the end of the war, it was only over 8,000 tons in 1971.

On August 15, 1971, all major television stations in the U.S. interrupted their Sunday afternoon programming and President Nixon addressed the nation. He claimed that the speculators were waging an all-out war against the U.S. dollar and that he had thus ordered the U.S. dollar to be defended against these speculators. He informed the American people that he had instructed the treasury that the convertibility of the U.S. dollar into gold be temporarily suspended.

This all sounded very patriotic, but it was a complete lie. The speculators Nixon decried were actually member states of the Bretton Woods system who had realized that the Americans had ripped them off and were merely exercising their contractual right to exchange a debasing U.S. dollar for gold as stipulated in the Bretton Woods agreements. Nixon thus committed nothing less than breach of contract. The members of Bretton Woods were cheated and left sitting on their paper dollars being barred from getting their contractually stipulated gold.

Petrodollar – an exorbitant privilege

The deceived members of Bretton Woods decided not to hand over a declaration of war to the Americans, but kept silent like sheep and made a fist in their pockets. They probably believed that the Americans had dug their own grave by breaking the treaty.

However, they had not reckoned with the brilliant Henry Kissinger. The man was sent by Richard Nixon on Mission Impossible to save the Dollar. Kissinger convinced Saudi King Faisal to sell his oil exclusively in U.S. dollars and to invest the proceeds in American government securities. In return, smart Henry promised Faisal military protection. Other countries and commodities followed. Like Houdini, Kissinger freed the U.S. from a dire situation by making the impossible possible. Mission accomplished: The Petrodollar was born.

Now, if almost the entire world uses a single currency – the U.S. dollar – for almost all trading activities, all countries are obliged to hold this currency in reserve to pay their bills. These countries do not hold the reserves in cash, but invest them in American government securities to earn a return on their reserve holdings. In this way, the Americans managed to create the largest bond market in the world. It should be noted that the U.S. dollar is a product like any other, whose price is subject to the law of supply and demand. The U.S. dollar is not bought because it is a good investment in itself nor do most buyers purchase American products. No, U.S. dollars are required in order to buy nearly any product around the globe. This unjustifiably strengthens the price of the U.S. dollar. Why unjustifiably? – Other countries need to produce something worth buying that will hold up in the world market to keep their currencies valuable – the U.S. do not.

If now the whole world has to hold U.S. dollars and holds them in American government securities, the American government finances itself very cheaply because the price of American bonds does not depend on the strength of the American economy, but is based on compulsory buying due to the Petrodollar system – ingenious.

To put it bluntly, the U.S. could thus afford everything for over 50 years, because the bills were paid by others. Imagine a guy who goes shopping with a credit card that has not limit. He has a big mouth, buys everything he wants and never pays the credit card bill, but owes the money to those who sell him the goods, the latter never getting paid but receive an IOU only.

Only due to this – for the U.S. – brilliant system were the Americans able to increase their deficits to levels which can only be described as mind boggling: When Roland Reagan took office, US-debt was below 1 trillion, now it stands at over 33 trillion. Any other nation would have collapsed since nobody would dare to put money in such a black hole – but the whole world has to keep buying U.S. dollars due to the Petrodollar system. So, now we know how the U.S. could cultivate a lifestyle at the expense of others for over 50 years that in no way correlates with the performance of its economy. This great lifestyle is based only on the compulsion of the rest of the world to hold U.S. dollars. Giscard d’Estaing called this advantage an exorbitant privilege – rightly so.

Petrodollar, a geopolitical power tool abused by the U.S.

When it came to maintaining their privilege, the U.S. showed little squeamishness if anyone dared to break away from the Petrodollar regime. In recent history, two examples may be mentioned. We all remember the second Iraq war, when it was claimed that Saddam Hussein had weapons of mass destruction and that this put the USA in danger. Despite a unambiguous report from the UN that there were no weapons of mass destruction or even a single hint that they existed, the Americans attacked Iraq anyway in order to rid the world of the evil Saddam Hussein and bring peace and freedom to the Iraqis. A big lie. Weapons of mass destruction were not to be found in Iraq; half a million civilians were killed – their relatives were certainly thrilled about this kind of democratic gift that the U.S. forced upon them. The reason for the Iraq war was a different one: the Petrodollar. Saddam Hussein – we don’t need to dwell on his qualities as a human being here – wanted to sell his oil not only in U.S. dollars but also in Euros. That was his death sentence. Anyone who claims otherwise is either ill-informed, naive or lying. The facts are on the table.

President Gaddafi ruled Libya with a strong hand for decades. He made Libya the richest country in Africa with an excellent infrastructure. Whether Colonel Gaddafi was a do-gooder or not is also not a topic of this discussion. Gaddafi also had a plan to get away from the U.S. dollar: He wanted to create the Gold Dinar to free Africa from the shackles of the Petrodollar. This, too, did not go over well with the Americans. The result was a dead Gaddafi and a completely destroyed country.

These two examples bring us to the geopolitical might the U.S. draws from the Petrodollar. It is important to know that only the U.S. Federal Reserve can actually hold U.S. dollars. Every bank in the world that offers U.S. dollar accounts ultimately only has a booking entry for a U.S. dollar amount and a contractual claim against the US central bank. This also explains that any payment made in U.S. dollars goes through the U.S. Thus, the Americans can single-handedly cut off any party – be it a country or an individual – from the U.S. dollar or freeze or seize a party’s U.S. dollars holdings.

The U.S. has been using this tool systematically since World War II with countries deemed worthy of being punished or destroyed economically, e.g., the U.S. sanction Cuba for over 60 years or Iran for over 40 years.

This use of force was justified by the USA with flimsiest arguments like communism, terrorism, war crimes etc. Whether the accusations were or are true or not, is completely irrelevant, because the judge sits in the U.S. and the legal basis is force. Depending on the decade you live in, you gets the label of communist, terrorist, drug dealer if you have the audacity to disagree with the hegemon. And the lapdogs such as the European “rulers” agree with the empire and serve as its willing assistants.

When the Americans impose such sanctions, they regularly threaten any party that does business with the sanctioned party with sanctions as well. These so-called secondary sanctions work since most international business is transacted in U.S. dollars and the respective companies – banks, commodity buyers, industrial suppliers – have no choice, but to comply.

A lot of people in the world are of the opinion that the U.S. are not behaving fairly towards the rest of the world and completely abuse their exorbitant privilege they possess with the Petrodollar.

This concludes our journey into the world of the Petrodollar and brings us to the reasons why BRICS want to say goodbye to the U.S. dollar, as the U.S. has overstepped the mark. After the start of Russia’s invasion of Ukraine, the West, led by the U.S., not only slapped Russia with a flurry of sanctions that has no equal in history, but also froze the foreign currency reserves of the Russian Central Bank. Shortly thereafter, discussions began as to what the West intended to do with the funds. After the freeze, the robbery is now being discussed.

I strongly believe that with the freezing of the reserves of the Russian Central Bank, the U.S. triggered a reaction they did not expect. Huge nations like India and China became suddenly concerned that the freezing of Russian Central Bank assets set a precedent and could also happen to them, especially in the more than tensioned geopolitical situation of today where anybody who cares can easily observe that the strategy of weakening Russia is only a pre-course of the battle the U.S. will lead against China. This is also the reason that BRICS seems to speed-up the process. Apart from the current 11 members of BRICS around 40 further nations applied to join.

The trigger for the attack on the petrodollar

This concludes our journey into the world of the Petrodollar and brings us to the reasons why BRICS want to say goodbye to the U.S. dollar, as the U.S. has overstepped the mark. After the start of Russia’s invasion of Ukraine, the West, led by the U.S., not only slapped Russia with a flurry of sanctions that has no equal in history, but also froze the foreign currency reserves of the Russian Central Bank. Shortly thereafter, discussions began as to what the West intended to do with the funds. After the freeze, the robbery is now being discussed.

I strongly believe that with the freezing of the reserves of the Russian Central Bank, the U.S. triggered a reaction they did not expect. Huge nations like India and China became suddenly concerned that the freezing of Russian Central Bank assets set a precedent and could also happen to them, especially in the more than tensioned geopolitical situation of today where anybody who cares can easily observe that the strategy of weakening Russia is only a pre-course of the battle the U.S. will lead against China. This is also the reason that BRICS seems to speed-up the process. Apart from the current 11 members of BRICS around 40 further nations applied to join.

Consequences

We have now seen that the might of the U.S. and the fate of their economic well-being very much hinges on the Petrodollar and that the American leadership is very well aware of this fact, crushing anybody who dares not to use the U.S. dollar in international trade.

In my opinion, however, the U.S. government misjudges its own leverage to put fear into other nations at this time. The Petrodollar system only works as flawlessly as it did in the past as long as the U.S. were able to control the world with mere threats, which were – once in a while – kinetically executed as it was the case with Iraq and Libya. However, the embarrassing retreat from Afghanistan did not help the U.S. to be seen as the military force they like to portray. The loss of influence over Saudi Arabia and Iran is a painful geopolitical sign for U.S. foreign policy. The peace reached between Saudi Arabia and Iran and then between Saudi Arabia and Syria is not only an economic disaster to the U.S. regarding oil, but a geopolitical catastrophe regarding U.S. influence in the Middle East. With these peace makings, the U.S. have been deprived of their ability to play out the strategy of divide et impera since the U.S. cannot manipulate these countries anymore and it seems that the U.S. are not feared anymore. As a group the middle east nations became too powerful and do sell their commodities in other currencies other than the U.S. dollar – a scenario which was completely unthinkable just a few years ago.

BRICS 11 will have one immediate consequence: Their members will not use the U.S. dollar when trading among each other. This is a huge problem for the U.S. since these countries will reduce their U.S. dollar holdings and therefore, the refinancing of the U.S. budget becomes a problem, leading to higher interest rates, which will in turn lead to higher inflation and a further debasement of the U.S. dollar because what cannot be raised in the international markets has to be printed.

The much-discussed introduction of a new settlement currency based on gold within BRICS is not a necessary element to de-dollarization. Such introduction faces substantial hurdles also due to the heterogeneity of the BRICS members. However, the consequences for the U.S. dollar will be immediate and problematic to the U.S.

We explained the vast power of the United States since World War II. It is in my opinion a myth that the U.S. hegemony is based on its military might. Far more important is their financial hegemony which – at least until now – allowed the U.S. to more or less control the world with a relatively small army and 9 aircraft carrier groups who regularly, as a show of force, bomb the hell out of small countries which do not have air forces or air defense systems to stand a chance against U.S. force. The whole U.S. power is based on the Petrodollar – that is my belief.

Conclusion

There are authors who predict a quick demise of the Petrodollar and, therefore, of the American financial hegemony, which in turn will lead to the demise of the U.S. as the undisputed geopolitical world leader. Fact is, that a substantial part of the world will avoid using the U.S. dollar in trade. This development has already started. Therefore, the trend is set. However, it is in my opinion impossible to make any prediction as to the speed and timing of this trend. The proclaimed goal of BRICS and other organizations of the Global South, such as SCO, EEU, the Arab League and OPEC is to build a multipolar world. This seems to be a realistic goal. However, one should also take into consideration, that the larger these organizations become, the more heterogeneous they become and the difficulty of implementation of a common course of action will rise in line with the number of the respective members. Lastly, I would like to draw the attention to one historical fact a lot of people are not aware of. When the U.S. were at the peak of their might and forced Bretton Woods on the rest of the world, it still took 12 years until the U.S. dollar overtook the British pound in international trade in 1956. Some trends may be irreversible – but they take time.

* * *

This article appeared in English in the Gloom, Boom & Doom Report by Swiss financial expert Marc Faber and in abbreviated form on September 21, 2023 in the print edition of Weltwoche and on Weltwoche Online in German.

Tyler Durden

Mon, 09/25/2023 – 00:20

via ZeroHedge News https://ift.tt/BDpIGYl Tyler Durden