Jefferies Downgrades Nike, Footlocker, Urban Outfitters As Student Debt Payment Restart Set To Spark Spending Pullback

Analysts at Jefferies have downgraded athletic apparel giant Nike, in addition to footwear and clothing retailers Footlocker and Urban Outfitters, on mounting headwinds from a massive slowdown in China to a deteriorating US consumer amid restarting student loan repayments. This follows a must-read note from JPM’s Market Desk that warned last week: “Sentiment Is Turning Very Negative On The US Consumer” (available to pro subs).

Beginning with Nike, analyst Randal Konik told clients Monday that a slowdown in China, coupled with the bank’s latest US consumer survey, presents a worrisome outlook for demand from one of the world’s largest athletic apparel companies.

“We see incremental risk ahead for NKE as the wholesale channel is likely to remain pressured and growth in China faces macro headwinds. Meanwhile, our consumer survey results indicate that US consumers are likely to reduce spending ahead, with apparel and footwear being the most likely areas of pullback,” Konik said.

Here’s more from the report:

Wholesale Channel to Remain Pressured… While retail inventory levels have improved industry- wide (down 5% YoY in 2Q23), we think tight inventory mgmt through at least the end of the year is likely to reduce replenishment orders and pressure NKE’s wholesale channel. Meanwhile, NKE’s ongoing focus on increasing DTC sales penetration is likely to expand margins over time, but we think the current consumer environment could push out the timing of this expansion (44% in F’23 vs. 60% LT target), putting NKE’s F’25 target of high-teens Op margin (vs. 11.5% in F’23) at risk.

Near-Term Growth in China Could be Challenged. While trends in China have been okay in recent quarters, we believe growth remains challenged given the macroeconomic headwinds in the region. We think NKE’s sales trends in this region could be choppy given the recent slowdown in apparel retail sales in China (see herein), and we are modeling 7% growth in F’24 vs. cons. of 12%.

Konik’s warning about a US consumer slowdown:

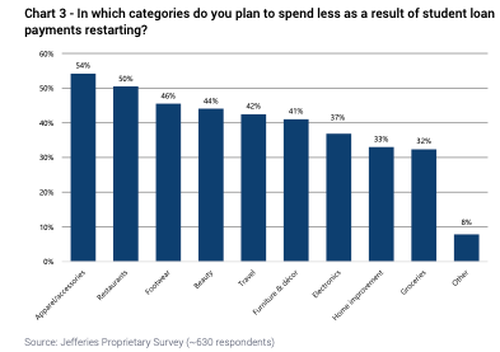

Survey Results Point to Slowdown In US Consumer Spending Ahead… Our survey indicates that most US consumers with student debt are concerned about meeting all their monthly expenses (87%) and that apparel/accessories and footwear are likely to be areas of reduced spending ahead. To this end, 54% of respondents plan to spend less on apparel/accessories and 46% plan to spend less on footwear, while 51% plan to buy fewer items or shop less frequently in apparel/accessories (48% in footwear). As a result, we expect US consumer spending to be pressured ahead.

And Higher Price-Point Products Could Witness Headwinds. Notably, 39% of survey respondents plan to buy cheaper alternatives in apparel/accessories and 35% in footwear. We believe these results suggest that NKE could face incremental headwinds in higher-priced areas of its assortment.

Mounting pressures forced Konik to lower his fiscal 2024 estimates for Nike while downgrading the stock from a “buy” to a “hold,” and shifted a new price target for the stock down to $100 from $140.

As a Result, We are Adjusting Estimates and Our PT Moves to $100. We are lowering our F’24 revenue and EPS estimates to $52.1B and $3.45 (vs. cons. of $53.6B and $3.72). Specifically on 1Q, we are now forecasting sales of $12.8B and EPS of $0.72 (vs. cons. of $13.0B and $0.75). Our new PT of $100 is based on ~26x F’2 P/E of $3.90, below the ~29x 5-year avg.

Expanding on the consumer, Konik noted that nearly 90% of respondents with student loan debt were “concerned about meeting all their monthly expenses, while apparel/accessories is likely to be a key area of reduced spending ahead.”

He said, “To this end, 54% of respondents plan to spend less on this category, 51% plan to buy fewer items or shop less frequently, and 39% plan to buy cheaper alternatives.”

In a separate note, Barclays economist Adirenne Yih recently warned that restarting student loan payments will be around a $15.8 billion monthly headwind – or $190 billion per year – to US spending.

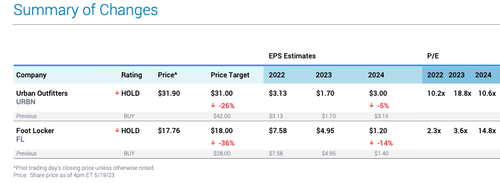

The slowdown in US consumer spending also forced Jefferies Corey Tarlowe and Konik ( in a separate note) to downgrade clothing retailers Footlocker and Urban Outfitters on Monday morning.

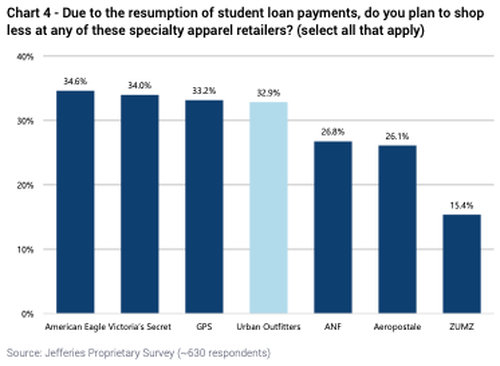

“We believe US consumers are likely to curtail spending ahead, with apparel & footwear being the most likely areas of pullback. With the resumption of student loan repayments, we believe this could be a catalyst that weighs further on already soft sales at some of our specialty apparel coverage. To this end, we believe URBN and FL could be affected and are downgrading to Hold & lowering our PT’s,” the analysts said.

Citing the bank’s consumer survey, they said:

Recent Survey Results Point to Potential Slowdown in Discretionary Purchasing… We recently ran a survey for US consumers with outstanding student loan debt for either themselves or their children (see note here) and found that ~54% and ~46% of respondents plan to spend less on apparel/accessories and footwear, respectively, as a result of student loan payments restarting. Additionally, 51% plan to buy fewer items or shop less frequently for apparel/accessories items, with 48% of respondents feeling the same about footwear.

They added:

- With Our Apparel and Footwear Coverage Likely to be Significantly Impacted... ~33% of respondents plan to shop less frequently at Urban Outfitters (which is already experiencing headwinds due to the banner’s skew towards lower-income individuals). The enterprise witnessed record 2Q sales, primarily driven by its Anthropologie brand (growing from 39% of sales in 2Q22 to 46% in 2Q24). As Anthropologie broadens its assortment to attract younger customers, we believe difficulties could arise due to the resumption of student loan payments. Additionally, with the less-than-favorable results for our footwear coverage, combined with ongoing pressures in the wholesale channel and macro headwinds to growth in China, we see incremental risk ahead for NKE. In a recent note, Jefferies’ Greater China consumer discretionary analyst John Chou noted that the basketball category witnessed weak sell-through and that running and fitness footwear performed better, but generally have lower ASPs and margins. We believe these headwinds could flow through to FL, which currently has ~64% Nike penetration.

As a result, they downgraded Footlocker and Urban Outfitters:

- Coming into this year, we believed FL’s new mgmt would help to reaccelerate the business, but the turnaround has been slower than we anticipated. In regard to URBN, we see headwinds to its top-line that could persist through F’25.

Here’s what changed:

Morgan Stanley’s Michael Wilson also echoed the same tune on Monday, warning consumer stocks are in trouble: “This price action is picking up on slowing consumer spend, student loan payments resuming, rising delinquencies in certain household cohorts, higher gas prices and weakening data in the housing sector.”

To summarize: Jefferies’ downgrades of Nike, Footlocker, and Urban Outfitters are the latest warning signs big Wall Street banks are quickly losing faith in the consumer.

Tyler Durden

Mon, 09/25/2023 – 15:45

via ZeroHedge News https://ift.tt/Xxdq0Hj Tyler Durden