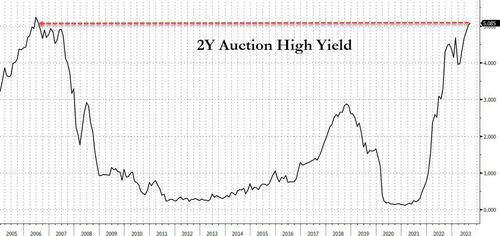

2Y Auction Prices At Highest Yield Since July 2006

With US debt issuance now in openly exponential mode, as the Trasury just added $100 billion in debt in just the past 5 business days after the US federal debt surpassed $33 trillion for the first time ever…

One week later: total US Debt surpasses $33.1 trillion for the first time. That’s $100 billion in 5 business days. https://t.co/tOrhqmkFXL pic.twitter.com/YqtJ522a0H

— zerohedge (@zerohedge) September 25, 2023

… moments ago the US did what it does so well and it issued another $48 billion in 2Y paper (the largest such offering since April 2022), in what was a well-received auction.

The first coupon auction of the week priced at a high yield of 5.085%, higher than last month’s 5.028% and the highest since the 5.09% yield of the July 2006 auction. Also, notably, the offering priced on the screws with the When Issued which also traded at 5.085% ahead of the pricing.

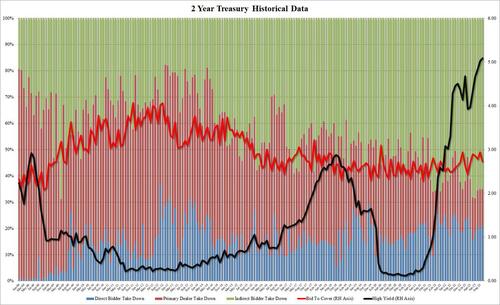

The bid to cover of 2.728 was less impressive, dropping from 2.942 in August and the lowest since April.

The internals were in line with last month, with Indirects awarded 65.02%, unchanged from the 65.01% in August, and with Directs taking down 20.99%, or just above last month’s 20.01%, Dealers were left holding 13.99%, below the 14.98% in August and also below the 16.7% six-auction average.

Overall, this was a solid, if not stellar 2Y auction, which in light of another concession day (2Y yields pushed higher along with the entire curve all day), was not surprising. After all, in a year or so, when the US is in a deep recession, many will be wishing they had another opportunity to lock in 2Y interest above 5%.

Tyler Durden

Tue, 09/26/2023 – 13:19

via ZeroHedge News https://ift.tt/bi34mDL Tyler Durden