Swiss-Yen Has More To Fall As Central Banks Change Tack

Authored by Simon White, Bloomberg macro strategist,

The Swiss franc is poised to continue falling against the Japanese yen as the Swiss National Bank shifts its focus from inflation to growth, while the Bank of Japan moves closer to tightening policy.

The Swiss-yen is a great macro FX pair that has risen relentlessly in this cycle – to near all-time highs – as the policies of the respective central banks diverged.

But at its meeting last week, the SNB unexpectedly held rates steady, while emphasizing growth concerns. It also reduced its 2025 inflation forecast to under 2% from 2.1% previously, intimating it now believes current policy settings are sufficient to bring inflation back to target.

This will give the SNB more leeway with the currency. While accelerating inflation was a concern, FX weakness was not tolerated, but now the SNB may be happier to allow some weakening in the franc.

Sight deposits at the SNB – since liquidity support for Credit Suisse ended – continue to show broad downwards momentum, suggesting the SNB is not heavily intervening to support the franc.

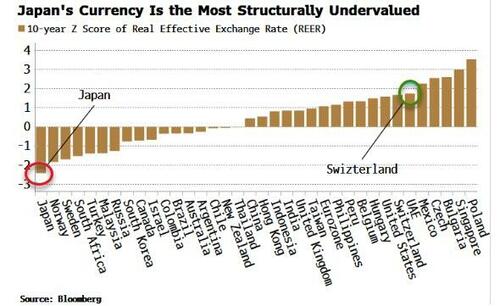

The Swiss central bank, though, is unlikely to let the franc fall too much against the euro, but there is less of a constraint versus the yen. Not only has the Swiss currency rallied strongly against it over the last three years, on a long-term REER basis the franc is one of the most structurally undervalued currencies, while the yen is the most structurally undervalued. The scope for the currency pair to converge to long-term underlying values is large.

The BOJ has not yet exited its negative interest-rate policy, but it is heading in that direction as inflation and inflation expectations remain uncomfortably high. When it does so, the yen is biased higher, as domestic yields become incrementally more favorable.

Swiss-yen bounced on Friday after the BOJ decided not to raise rates, but notably the pair is now below the lows when the SNB held rates steady on Thursday.

That’s suggestive the upwards trend is over, with potentially significant downside ahead as the BOJ and the SNB’s policies become less divergent.

Tyler Durden

Wed, 09/27/2023 – 05:00

via ZeroHedge News https://ift.tt/h6U7kOB Tyler Durden