Lousy Labor Data Sends Yields Lower; Bitcoin, Big-Tech, & The Buck Soar

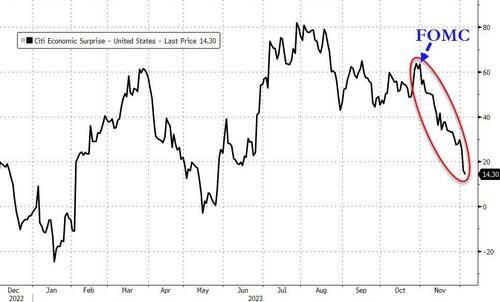

The post-November-FOMC plunge in US macro data continued today with bloodbathery hitting the labor market (JOLTs tumbled) but ISM Services beat providing another glimpse at ‘Goldilocks’ (especially with prices paid moderating too)…

Source: Bloomberg

The ‘bad’ news in JOLTs sparked a bid in bonds with the long-end outperforming (30Y -10bps, 2Y -5bps). The 10Y and 30Y yield is now below Friday’s lows while the 2Y yield remains above Friday’s lows…

Source: Bloomberg

…which flattened (further inverted) the yield curve (2s30s)…

Source: Bloomberg

Financial Conditions continue to loosen more and more dramatically – prompting some to fear this will force The Fed to act more hawkishly to reassert any sense of restrictive policy here…

Source: Bloomberg

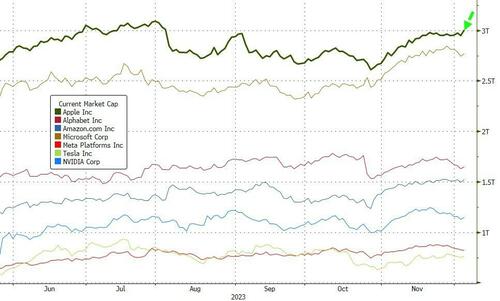

And lower yields are ‘good’ news for long-duration stocks as after four straight down days, the ‘Magnificent 7’ stocks surged higher today…

Source: Bloomberg

That rally managed to pull Nasdaq green on the day and leave S&P unchanged. Small Caps were the biggest loser, down over 1% after 4 straight days higher…

Apple’s market cap topped $3 trillion once again (the first time in four months)…

Source: Bloomberg

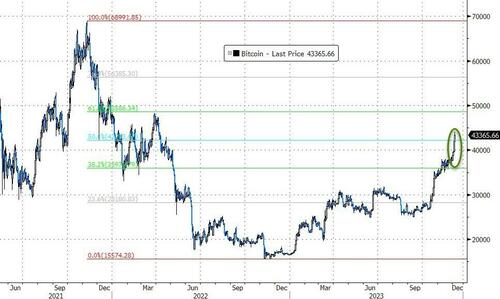

Bitcoin surged above $44,000 today – its sixth straight day higher…

Source: Bloomberg

…retracing half of the decline from the Nov 2021 to Nov 2022…

Source: Bloomberg

What happens next? Nobody knows but it looks a lot like 2020 for now…

Source: Bloomberg

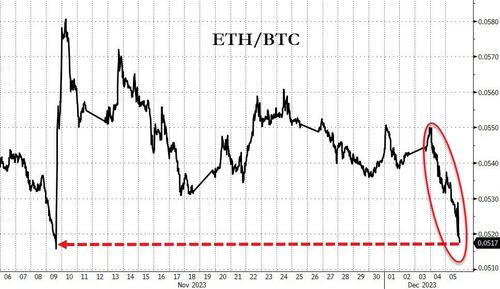

Notably, while ETH also rallied (topping $2300), it notably underperformed BTC as the SEC delayed its decision on the Ethereum Spot ETF…

Source: Bloomberg

The dollar rallied for the second day in a row to two-week highs…

Source: Bloomberg

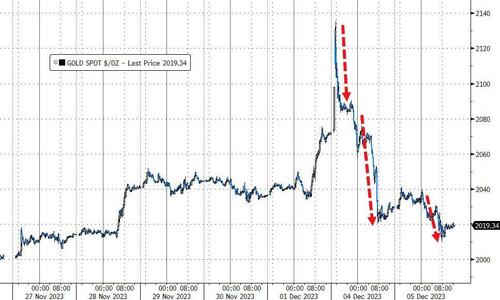

Gold (spot) leaked lower again after yesterday’s record high spike back to around one-week lows..

Source: Bloomberg

Oil prices slipped lower again, back to mid-Nov lows with WTI hovering above $72 ahead of tonight’s API inventory data…

Source: Bloomberg

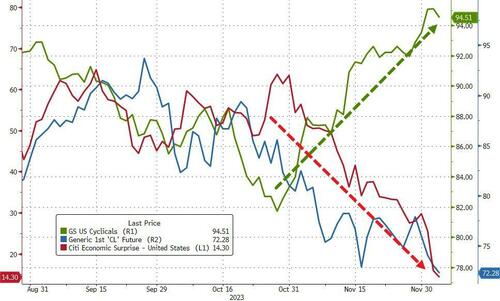

Finally, ‘Cyclical’ stocks have completely decoupled from the macro environment and oil market (with the latter agreeing on growth fears while for former have no fears at all)…

Source: Bloomberg

We bring this up because Goldman’s Bobby Molavi noted: “Another dynamic that worries me is the dislocations between leading indicators and market weighing machine.”

Corporates are increasingly pointing to softer consumer data and a weakening environment. We’re seeing that in a broad based manor through earnings (eg Mitchells and butler) but markets, at least at headline level, are shrugging this off. It sort of highlights the reality that the market is less of a pricing vehicle for the economy than it once was…as banks, industrials, oils, miners shrink as a share of the global markets in relation to tech, healthcare and luxury…

…we move towards a index’s that may be driven by fewer stocks (obvious statement i know given magnificent 7) but also perhaps less cyclical and less of leading indicator of the state of the economy.

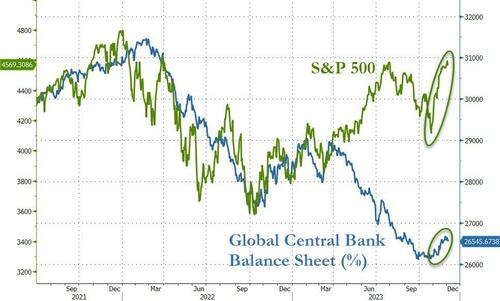

Especially when all that matters is ‘liquidity’…

Source: Bloomberg

Is this trend set to continue? Is this why gold and crypto is flying once again?

Tyler Durden

Tue, 12/05/2023 – 16:00

via ZeroHedge News https://ift.tt/EIHLCsS Tyler Durden