VP Biden Linking Ukraine Loan To Prosecutor’s Firing Surprised State Department Officials, Emails Show

Authored by Mark Tapscott via The Epoch Times,

Key White House and National Security Council and State Department officials were caught by surprise when they learned in January 2016 that then-Vice President Joe Biden had abruptly changed U.S. policy to require the firing of Ukrainian Special Prosecutor Viktor Shokin as a condition for receiving $1 billion in U.S.-backed International Monetary Fund (IMF) loans, according to House Judiciary Committee Chairman Jim Jordan (R-Ohio) citing emails reviewed by The Epoch Times.

“There are State Department emails where they are, like, ‘Oh!’ surprised. There were people in the State Department saying, ‘Oh, Biden says they aren’t getting the money unless Shokin is fired,’ and they are surprised, saying, ‘Why did you do that, we didn’t talk about this; we didn’t plan that.’ So it was a total change from the consensus where the State Department was,” Mr. Jordan told reporters during a Monday question-and-answer session focused on the status of the House impeachment investigation of President Biden.

That probe is technically only an “inquiry,” but it is expected to be upgraded to an official House investigation with a vote next week in the lower chamber. Mr. Jordan told reporters Monday that he is confident the Republican majority will prevail in that vote despite having only a two-vote advantage over Democrats.

Whether the vice president was pushing for Mr. Shokin’s ouster to aid his son Hunter Biden’s business dealings is a focus of the impeachment inquiry. Hunter Biden sat on the board of Ukrainian energy firm Burisma, which was being investigated by Mr. Shokin.

Investigators with Mr. Jordan’s panel and the House Committee on Oversight and Accountability, chaired by Rep. James Comer (R-Ky.), and the House Ways and Means Committee, chaired by Rep. Jason Smith (R-Mo.), are focused on President Biden’s alleged participation in and benefitting from his family’s receipt of millions of dollars of income throughout a period of several decades from individuals, as well as corporate and state entities, in Ukraine, China, Russia, Kazakhstan, and Romania during and after the senior Biden’s years as Vice-President under President Barack Obama.

Surprise From Officials

In one of the State Department emails to which Mr. Jordan referred, Eric Ciaramella, a White House National Security Council (NSC) deputy national intelligence officer for Russia and Eurasia, expressed shock to three colleagues on Jan. 21, 2016, saying, “Yikes. I don’t recall this coming up in our meeting with them on Tuesday.”

Mr. Ciaramella, who did not respond to The Epoch Times’ request for comment, was reacting to an email sent earlier in the day from Elisabeth Zentos, an NSC colleague that was also addressed to Geoffrey Pyatt, U.S. Ambassador to Ukraine from 2013 to 2016, and Anna Makanju, who was then a Special Adviser to Mr. Biden for Europe and Eurasia. Mr. Ciaramella is now a Senior Fellow with the Carnegie Endowment for International Peace.

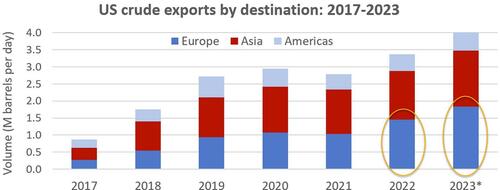

Mr. Pyatt, who is presently the State Department’s Assistant Secretary for Energy Resources, could not be reached for comment, according to a State Department spokesman, because he is in Dubai attending the COP28 Climate Change International Conference. Ms. Makanju, who is now Vice President for Global Affairs at San Francisco-based OpenAI, did not respond to The Epoch Times request for comment.

Mr. Pyatt responded to the Zentos email, saying, “Buckle in,” and adding, “We also need to readdress all the LG [loan guarantee] anti-corruption conditions … and at this stage, there’s only one that really matters.” Ms. Makanju did not respond in the email thread reviewed by The Epoch Times.

Mr. Jordan said State Department officials were surprised to learn of Mr. Biden’s ultimatum to Mr. Poroshenko because it was previously settled U.S. policy to pressure Ukraine to root out official corruption that had plagued the country since it declared its independence from the former Soviet Union in 1991.

But until Mr. Biden did so, the U.S. had not made Ukraine’s receipt of the IMF loan guarantees conditional upon Mr. Shokin’s removal. Briefing materials reviewed by the vice president during his December 2015 flight to Ukraine included planning for him to sign the U.S. agreement to back the IMF loans, with no reference to firing Mr. Shokin.

The judiciary chairman contends Mr. Biden’s abrupt reversal followed from the fact his son, Hunter Biden, was a member of the board of directors of the Ukrainian energy company Burisma, which was being actively investigated by Mr. Shokin regarding allegations of corruption.

Rep. Jim Jordan (R-Ohio) speaks to the press after coming out of the Hunter Biden special counsel David Weiss’s closed-door testimony to the House Judiciary Committee in Washington on Nov. 7, 2023. (Madalina Vasiliu/The Epoch Times)

‘Called An Audible’

Mr. Jordan noted that during a Dec. 4, 2015, meeting in Dubai between Burisma executives Mykola Zlochevsky and Vadym Pozharsky and Hunter Biden and Devon Archer, one of his business partners, the Ukrainians pleaded with the Americans to do something to relieve the “government pressure” they were receiving from the Shokin investigation of corruptions allegations against Mr. Zlochevsky.

Mr. Archer told the oversight committee during a closed-door transcribed interview that in response to those pleas, Hunter Biden “called DC,” referring to his father, the vice president. Three days later, the vice president, according to the Washington Post, “called an audible”—changed his plans—to reverse U.S. policy and demand Mr. Shokin’s firing.

In a summary timeline of the events, the oversight committee observed that “Devon Archer joined the Burisma board of directors in the spring of 2014 and was joined by Hunter Biden shortly thereafter. Hunter Biden joined the company as counsel, but after a meeting with Burisma owner Mykola Zlochevsky in Lake Como, Italy, was elevated to the board of directors in the spring of 2014.

“Both Biden and Archer were each paid $1 million per year for their positions on the board of directors. In December 2015, after a Burisma board of directors meeting, Zlochevsky and Hunter Biden ‘called DC’ in the wake of mounting pressures the company was facing. Zlochevsky was later charged with bribing Ukrainian officials with $6 million in an attempt to delay or drop the investigation into his company.”

The oversight panel has to date documented $6.5 million in income to the Biden family and their associates from their Ukrainian activities.

The Epoch Times has reached out to the State Department and National Security Council for comment.

Tyler Durden

Wed, 12/06/2023 – 15:20

via ZeroHedge News https://ift.tt/MivHuE7 Tyler Durden