Yen Doesn’t Buy The BOJ Narrative Just Yet, But It Will

By Ven Ram, Bloomberg markets live reporter and strategist

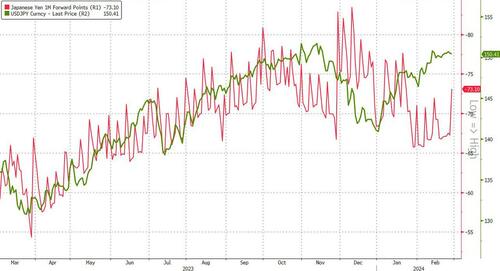

There seems to be growing conviction that Japan will exit negative rates in possibly just a couple of months, though the currency markets are underpricing that prospect.

Earlier Tuesday, data for January inflation showed not only faster-than-forecast headline numbers but also a core-core reading above 3% for a 13th straight month. The prints may convince the Bank of Japan that the sustainable inflation that it has long sought is here. Little wonder that overnight indexed swaps, which were assigning some 60% chance of a 10-basis point move from the BOJ in April, now reckon the probability is more like 80%.

The yen, though, hasn’t come to the party at all. Since the start of the year, the currency has slumped more than 6% against the dollar. That decline isn’t what is indicated by fundamentals, with the yen’s weakness looking completely out of sync with what ought to have happened.

A major part of what has happened with the yen is actually a dollar story. Fed fund futures, which were pricing a little more than three interest-rate cuts from the US central bank by June, are now wondering if policymakers will even deliver a single reduction by then. That has pushed up nominal and inflation-adjusted rates, sending the dollar far higher than reckoned.

There is also seasonality at play. The yen has weakened in four of the past five first quarters, except when the pandemic first struck the markets in 2020 and spurred investors to scramble for havens.

The Japanese currency is exceptionally undervalued at current levels, with its real-effective exchange rate near the cheapest it has ever been in history. Once the BOJ exits negative rates, expectations are that it will raise rates further and buoy the yen, although Japan won’t see any tightening anywhere on the scale that we have seen in in the other major economies as colleague Mark Cranfield notes.

The tide will turn decisively in favor of the yen whenever it becomes abundantly clear that inflation in the US is slowing to a crawl — allowing the Fed to cut rates as outlined in its December dot plot.

Tyler Durden

Tue, 02/27/2024 – 22:00

via ZeroHedge News https://ift.tt/luJC2P1 Tyler Durden