Boeing Doom-Loop Of Endless Crises Sends Shares Tumbling To Longest Losing-Streak In Five Years

Boeing shares tumbled to a 1.5-year low in New York on Friday afternoon after another scandal rocked the planemaker this week. The troubled planemaker has been trapped in an endless doom loop of scandals.

From door plugs ripping off Boeing jets to tires falling off, runway excursions, engine fires, hydraulic leaks, and pilot seat malfunctions, confidence in the planemaker has collapsed.

Just this week, The New York Times released a shocking report of a Boeing engineer turned whistleblower who revealed that sections of the 787 Dreamliner fuselage were improperly fastened together, posing structural integrity risks.

Next Wednesday, Senator Richard Blumenthal, a Democrat of Connecticut and the chairman of the Senate Homeland Security and Governmental Affairs Committee’s investigations subcommittee, will hold a hearing featuring the whistleblower to address concerns about the 787 Dreamliner.

The Boeing crisis recently led CEO Dave Calhoun to announce he will be stepping down later this year.

A crisis in confidence has spread to Boeing shares, down 61% since the peak of $440 in early 2019, around the time the first Boeing 737 Max crashed. In total, two Max jets crashed (March 2019 and December 2020), killing 346 people. The cause, as readers may recall, was a faulty flight stabilizing device called the “Maneuvering Characteristics Augmentation System.”

Since early Covid, shares have been bouncing between $95 and $269. Since the door plug ripped off the Alaskan Airlines 737 Max in early January, shares have slid from $264 to $170, or about a 35% drop in 3.5 months.

Bloomberg notes Boeing is the “second-worst performer on the S&P 500 Index” and is set to close down for the tenth consecutive session, putting it on track for its longest losing streak since November 2018.

The recent announcement that it delivered the lowest number of jets in the first quarter since mid-2021 added more gloom to the planemaker’s outlook. The 787 Dreamliner debacle could complicate things even more while Airbus deliveries soar and have recently been crowned the world’s aviation industry king.

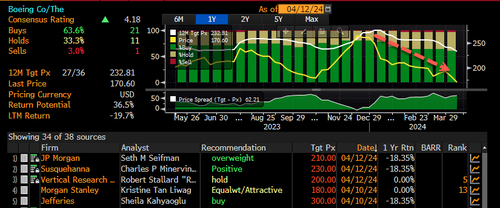

“Boeing’s first-quarter delivery announcement confirmed what the market has come to accept over the past two to three months, which is that the pace of activity at its Commercial Airplanes segment is slow,” JPMorgan analyst Seth Seifman told clients in a note on Thursday.

Seifman said, “The path forward on production is not very clear, and while demand should allow for significant growth over time, investors should keep nearer-term expectations in check.” He also lowered the price target on the company but said his buy-equivalent rating would remain.

According to Bloomberg data, the average price target set by Wall Street analysts on Boeing dropped from about $275 in early January to about $234 this week. Also, the percentage of “buy” recommendations with analysts has declined.

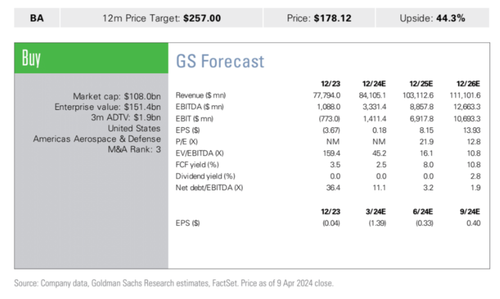

Goldman has a buy recommendation with a 12-month $257 price target.

At what point is Boeing a buy again?

Tyler Durden

Fri, 04/12/2024 – 15:20

via ZeroHedge News https://ift.tt/SWNwnOV Tyler Durden