This Next Bean Is Hyperinflating, And It’s Not Cocoa

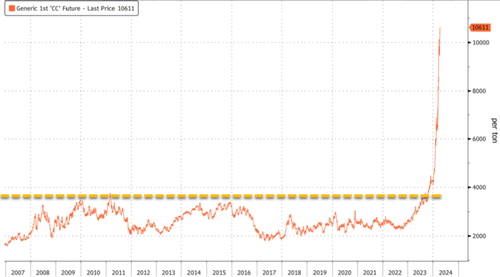

The next bean hyperinflating is Robusta coffee futures in London, hitting fresh record highs on Friday. This comes as poor harvests in Vietnam, the world’s second-largest producer of robusta beans, fuels concerns about global shortages. Also, arabica futures are erupting.

Futures for robusta, the cheaper coffee bean grown at lower altitudes and requiring less care than more expensive arabica, are up 2.6% to $3,945 per ton, a new record high based on data going back to 2008.

A new report from the chairman of Intimex Group, the country’s largest shipper, details how robusta exports for 2023-24 are expected to be lower than the prior growing season at 1.5 million tons.

Bloomberg quoted Rabobank analyst Carlos Mera as saying, “Speculators are drawing parallels between cocoa and coffee, which is a bit surprising.”

Mera said, “The big parallel that I can draw is all the coffee trees on average got older due to lack of field work and as a result we see the Vietnamese crop that is not growing.”

“The coffee market has also been supported as hedge funds exit the cocoa market — where big shortfalls have sent prices soaring — and pile into coffee,” Bloomberg noted.

A note this week from forecaster Maxar said there are concerns about Vietnam’s bean output in the next growing season.

And Rabobank’s Mera added that European deforestation rules could force buying before the end of the year.

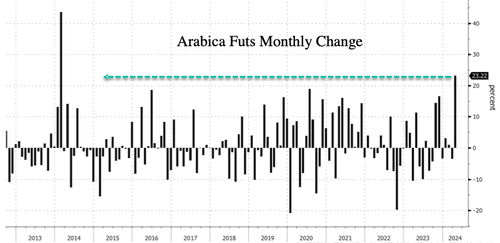

Last week, we detailed how Arabica coffee futures were beginning to erupt. Now, on the month, prices have risen 23%. If these gains hold, it will be the largest monthly gain since February 2014.

Also, last week’s Commodity Futures Trading Commission data for Arabica futures in New York showed data on futures and options, managed money-only long contracts hit a record high.

Central banks are powerless in a world where inflation continues to run rampant.

Tyler Durden

Sat, 04/13/2024 – 09:55

via ZeroHedge News https://ift.tt/h5NV6Kz Tyler Durden