‘Vol Genie’ Is Out Of The Bottle, Geopolitical Tensions Or Not

Authored by Simon White, Bloomberg macro strategist,

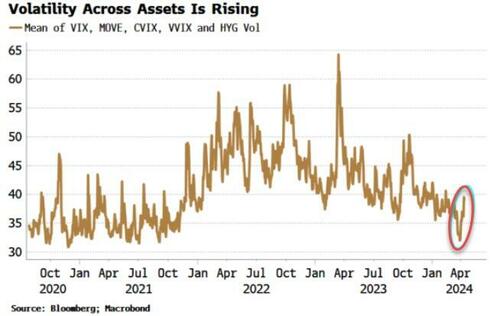

Equity, fixed-income, credit, commodity and even FX volatility are beginning to rise in unison.

The proximate cause may have been rising geopolitical tensions, but the underlying conditions were there long before, and cross-asset volatility is likely to stay elevated.

Volatility across the board had been trending down since October.

But recently it has been rising, particularly over the last week as tensions in the Middle East worsened.

Underlying conditions have favored a rise in volatility for a while.

First, the VIX has been exceptionally low versus other assets’ volatility.

In recent weeks, call skew has been falling relative to put skew, which is typically consistent with a rise in the VIX. Furthermore, index correlation is about as low as it can go, and any rise would take equity volatility higher with it, especially as the volatility of individual stocks has been rising. There has also been a recent surge in option volume on the VIX, with the VVIX (vol of vol index) also rising sharply.

Second, the MOVE index of fixed-income volatility has been falling despite the latent risk of resurgent price growth.

There was an eerie calm in bond markets, not reflective of the inflationary backdrop, which was finally punctured after last week’s higher-than-expected CPI print. Moreover, higher rate volatility leads to higher equity volatility through the vector of index correlation.

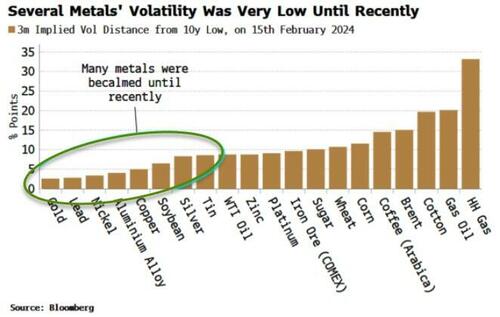

Third, the volatility of many metals was very low until very recently.

Gold and copper looked like they were coiling for a bigger move, with both metals rising since March. Silver has been posting some wild moves, and becoming more cocoa-like in its recent behavior.

FX vol has been a perennial laggard in the vol stakes, but even it has shown some life in the last few days. Higher rates volatility should feed through into FX volatility.

The recent spurt higher in cross-asset volatility has been driven by geopolitical concerns, but even if they fade, the genie is out of the bottle, and volatility across assets is primed to stay elevated for the time being.

Tyler Durden

Mon, 04/15/2024 – 15:40

via ZeroHedge News https://ift.tt/4bzm6q1 Tyler Durden