Cannabis Bears Squeezed On Report DEA Is Preparing To Reclassify Marijuana

The Associated Press has learned the US Drug Enforcement Administration is moving to reclassify marijuana to a less dangerous drug category. Shares of cannabis-related companies erupted on the news.

Here’s more from AP news:

The DEA’s proposal, which still must be reviewed by the White House Office of Management and Budget, would recognize the medical uses of cannabis and acknowledge it has less potential for abuse than some of the nation’s most dangerous drugs. However, it would not legalize marijuana outright for recreational use.

The agency’s move, confirmed to the AP on Tuesday by five people familiar with the matter who spoke on the condition of anonymity to discuss the sensitive regulatory review, clears the last significant regulatory hurdle before the agency’s biggest policy change in more than 50 years can take effect.

Once OMB signs off, the DEA will take public comment on the plan to move marijuana from its current classification as a Schedule I drug, alongside heroin and LSD. It moves pot to Schedule III, alongside ketamine and some anabolic steroids, following a recommendation from the federal Health and Human Services Department. After the public-comment period the agency would publish the final rule.

Following the news, Tilray Brands Inc. shares jumped 22%, while Canopy Growth Corp shares are up 26%.

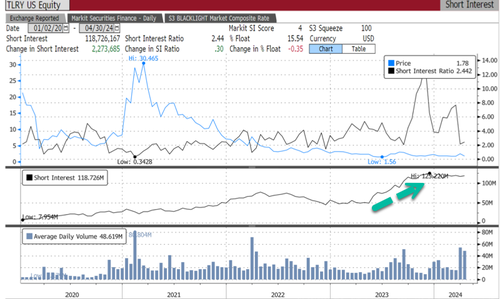

Tilray’s float is about 15% short, equivalent to about 118 million shares short.

Canopy’s float is 12% short, equivalent to 9 million shares short.

Meanwhile, AdvisorShares Pure US Cannabis ETF and Amplify Alternative Harvest ETF are broadly higher and appear to be rounding a multi-year bottom.

It’s an election year, and the Biden administration is getting desperate.

Tyler Durden

Tue, 04/30/2024 – 14:40

via ZeroHedge News https://ift.tt/zopNaZx Tyler Durden