Fed Policies Turn The Wealth Gap Into A Chasm

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

In an op-ed for the Washington Post on November 5, 2010, Ben Bernanke did a victory lap, praising the Fed’s efforts in stemming the financial crisis. In the article, he discusses how QE and other Fed policies eased financial conditions, bolstering investor confidence.

And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion.

If Bernanke wants credit for his Fed policies that boosted stock prices, he should also take responsibility for the costs. Those same monetary policies, which have been repeated many times since 2008, have played an important role in exacerbating the wealth gap in America. Accordingly, we should question his use of the term “virtuous circle” to describe how modern monetary policy works.

Graphing The Wealth Gap

Inspiration for this article comes from our recent article, Wealth Gap and the Road to Serfdom.

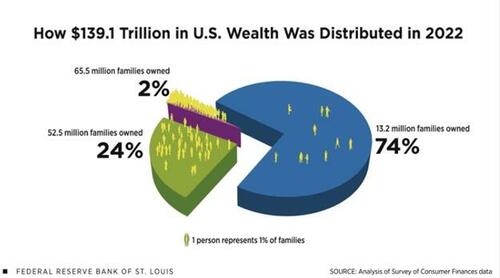

Before discussing the Fed’s role in widening the wealth gap, we put context to the problem. The graphs and quote below are from the article.

For 80% of Americans, the end game of too much debt, an aging demographic, and the push for “socialistic policies” is the continued extraction of wealth from the “middle class” to the “rich.”

Trickledown Economics and Monetary Policy

“Trickledown economics” was coined by John Kenneth Galbreth in 1982 and made famous by President Ronald Reagan. The expression is another name for supply-side economic policy. The policy theorizes that the populace benefits when government interference in the economy is minimal. For example, lower taxes and reduced regulations should promote economic activity and prosperity for the entire populace.

The theory is logical, but politicians have done a poor job enacting it.

In 2008, the Fed took a page from the supply-side economic playbook to stem the financial crisis. From that point forward, the Fed’s modus operandi has been trickle-down monetary policies.

Does QE Trickle Down?

Ben Bernanke wasn’t the first Fed Chair or central banker to use QE. But he did make it a household name and seemingly a permanent tool in the Fed’s toolbox.

QE has two significant impacts on the financial markets and the banking system.

First, removing assets from financial markets alters the supply-demand balance in favor of higher prices. Additionally, when investors believe QE is positive for asset prices, as is the case, demand increases, which provides even more impetus for higher asset prices.

Second, the Fed buys bonds from the banks with reserves. Reserves are a form of money that is only viable in transactions between banks or with the Fed. Reserves support bank loans and asset purchases. Therefore, when more reserves are available, banks can more easily make loans and buy assets. Further, some bank loans, specifically margin or repo loans, generate additional demand for assets.

The scatter plot below shows the positive correlation between the one-year percentage change in margin debt and the Fed’s balance sheet.

Higher stock and asset prices coupled with more leverage is a winning combination for investors.

The Graph of All Graphs

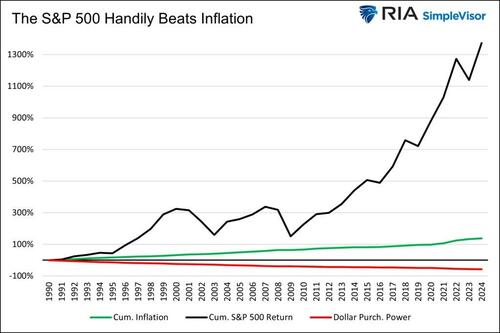

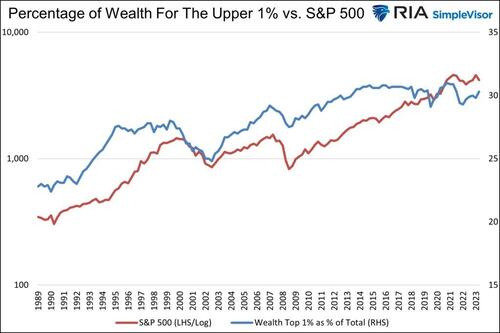

With that explanation of how trickledown monetary policy bolsters asset prices to accomplish the Fed’s goals, we share a graph explaining why the Fed’s policies widen the wealth gap.

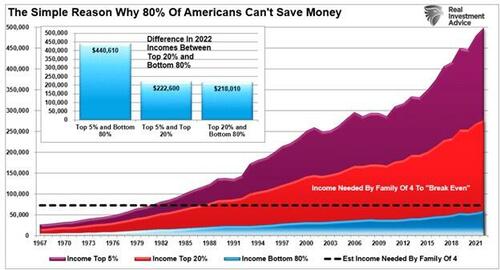

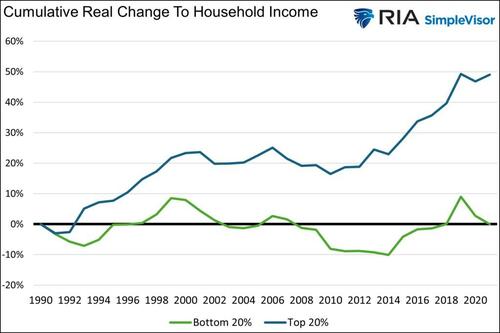

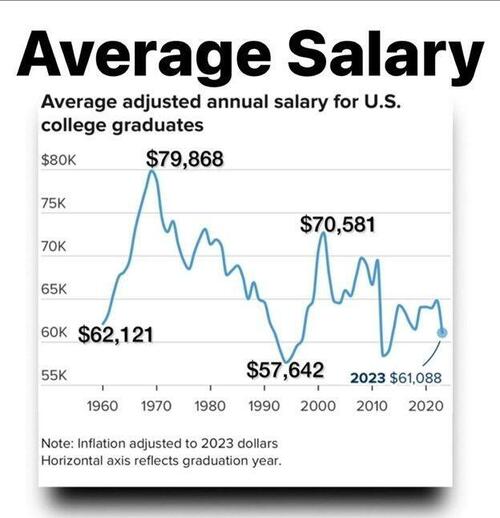

Since 1990, the dollar’s purchasing power has declined by over 50%. At the same time, the S&P 500 has risen by over 1,300%. Those with a sufficient portfolio of stocks could more than offset the decline in the dollar’s purchasing power. Those without stocks are left behind.

Further, it doesn’t help that real household income for the lowest 20% has been unchanged since 1990. Over the same period, they have risen by about 50% for those in the upper 20% of incomes.

Share Of Wealth

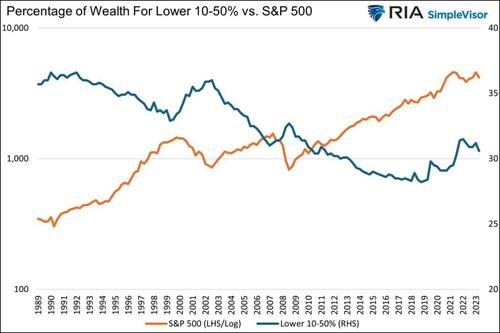

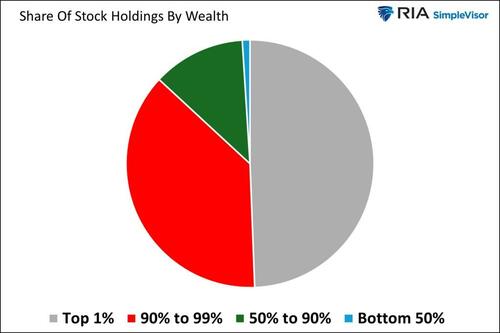

The wealthier have seen their wages and the value of their financial assets rise much more than inflation. At the same time, the lower wealth and income classes have seen marginal real income gains at best and little in the way of benefits from rising stock prices.

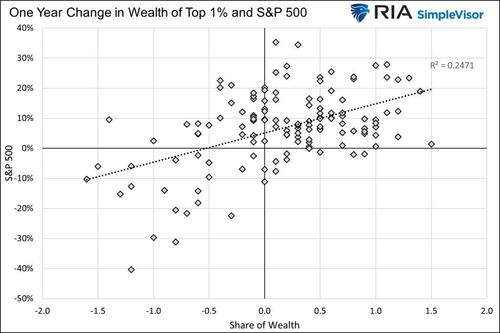

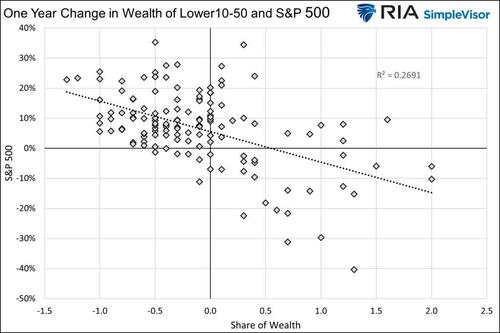

The two graphs below show how the percentage of the wealth owned by the top 1% and the change in the S&P 500 are well correlated.

On the contrary, the aggregate wealth of much of the bottom half of the nation, as a percentage of total wealth, has a negative relationship with the S&P 500.

There is a straightforward explanation as to why the correlation between the share of the wealth of the rich versus that of the rest of the population has opposing correlations to the S&P 500. 10% of the population holds nearly 90% of the stocks.

Trickledown Monetary Policy Handicaps Capitalism

QE and other Fed policies may help the economy on the margin and save some jobs. However, there is little evidence that, over the longer term, the economic benefits increase the prosperity of most of the populace. Further, as we share, there is compelling evidence it further exacerbates the wealth gap.

Capitalism has proven to be the best economic system for growing the wealth of the entire population. A key tenant of capitalism promises financial incentives for those who work hard and have unique skill sets. That incentive results in productivity gains, which benefit economic growth and allow for higher wages and a broad distribution of wealth.

Unfortunately, when financial incentives are not only a function of capitalism but also an offshoot of government and Fed policies, the benefits of capitalism are reduced.

For example, Elon Musk is extraordinarily wealthy and should be rewarded handsomely for everything he has accomplished. However, how much of his wealth is based on his hard work and ingenuity, and how much was gifted to him by the Fed via their stock-boosting monetary policies. While slightly off-topic, we should also question how much of his wealth is attributable to government subsidies for electric vehicles.

Summary

President Biden’s poll numbers on economic confidence are poor despite robust economic growth and a historically low unemployment rate. While there are many reasons for the odd divergence, we think it’s fair to say that the benefits of the post-pandemic growth spurt have disproportionately accrued to those in higher-income classes and those with stocks. Those left behind, representing a large majority of the population, are not confident in Biden’s handling of the economy and suffer from higher prices.

Most Americans continue to see wages that cannot combat inflation and have little to no wealth invested in the stock market. Can you blame them for lacking confidence?

QE may have served as an emergency way to add bank reserves to the system and boost confidence. However, its continued use, even during economic prosperity periods, only makes the wealth gap wider.

Tyler Durden

Wed, 05/01/2024 – 11:30

via ZeroHedge News https://ift.tt/Utw0zOs Tyler Durden