Stocks Inch Higher As Fearless Vol-Sellers Continue To Push Ahead Of NVDA/FOMC Mins

It’s quiet… too quiet…

Small Caps lagged on the day but the rest of the majors struggled to gain any momentum as long gamma and low vol compressed the ranges. Some early hawkish (though nothing new) remarks from Fed’s Waller (“…in the absence of a significant weakening in the labor market, I need to see several more months of good inflation data before I would be comfortable supporting an easing in the stance of monetary policy…”) sparked a little risk-off but as soon as cash markets opened, BTFDers resumed their game – but could not push ahead of unch.

A late lift flattered an otherwise ‘meh’ day…

As Goldman’s Chris Hussey notes, a peak under the surface of the S&P 500 reveals a somewhat defensive tilt with Pharma, Staples and Utilities outperforming, and Consumer Discretionary, Semis, Transport and Builders lagging the index. Consumer discretionary is particularly underperforming, being dragged down by negative reactions to earnings from AZO and LOW.

Source: Bloomberg

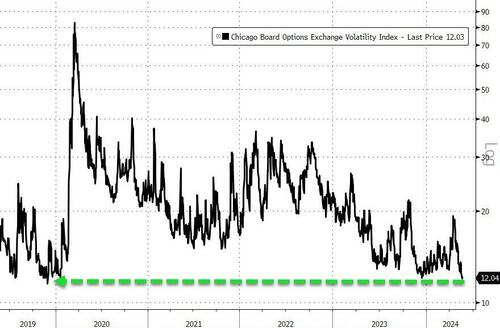

Anemic implied vols persist – despite the event risk catalysts this week – with VIX pushing a 11 handle…

Source: Bloomberg

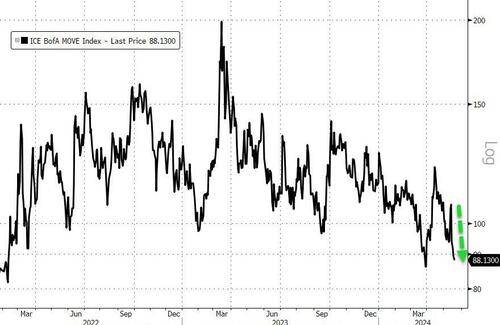

…and bond vol also compressed…

Source: Bloomberg

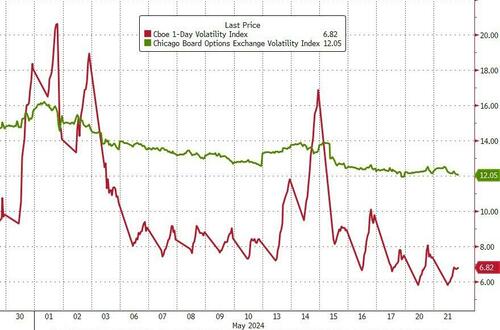

We note there is some anxiety on the very short-end… but still a 13 handle is not exactly ‘risk averse’…

Source: Bloomberg

The risk, as SpotGamma explained earlier, in these very low IV’s, are the very low IV’s themselves.

If traders are pricing in 30bps of movement for a given trading day, any move that pushes the market past 30bps (up or down) could lead to a short vol cover and a jumpy stock move. This suggests to us that while you maybe can’t find a reason to buy short dated SPX options, shorting them at these IV levels seems like a poor risk-reward (we’re looking at you 0DTE traders!).

On that note we think that a cleaner way here for basic “short vol” trades may be owning puts/short call spreads in VXX/UVXY or long SVXY calls/short put spreads. This is because you catch some of the roll decay, and you don’t have the strike-risk in 0DTE.

0DTE vols are extremely low but we would expect a jump (as we saw around last week’s CPI)…

Source: Bloomberg

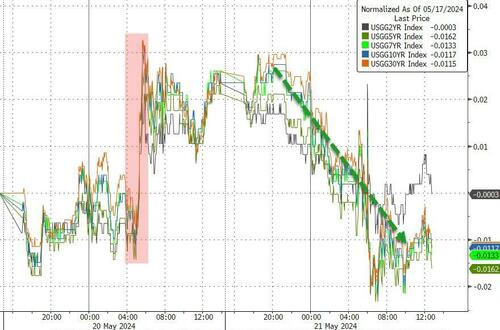

Treasury yields slipped lower today, erasing most of yesterday’s spike higher with the short-end lagging (2Y -2bps, 30Y -4bps)…

Source: Bloomberg

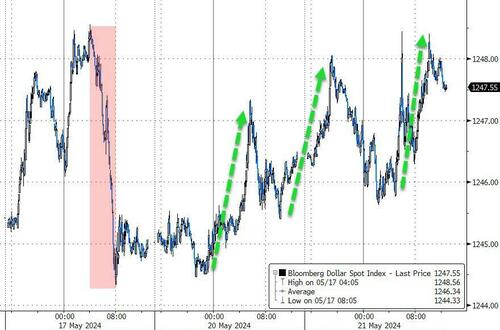

The dollar pushed higher again, erasing Friday’s losses…

Source: Bloomberg

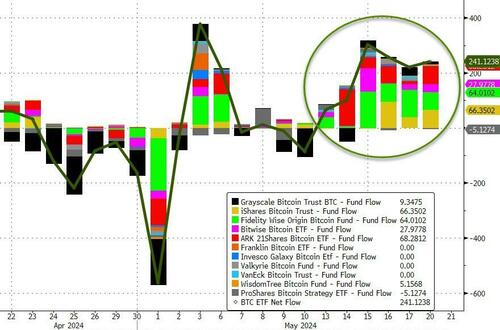

Bitcoin slipped back from its overnight surge back up near $72,000 to end basically flat on the day…

Source: Bloomberg

…which follows the sixth day on net inflows to BTC ETFs (and fourth day of inflows in a row to GBTC)…

Source: Bloomberg

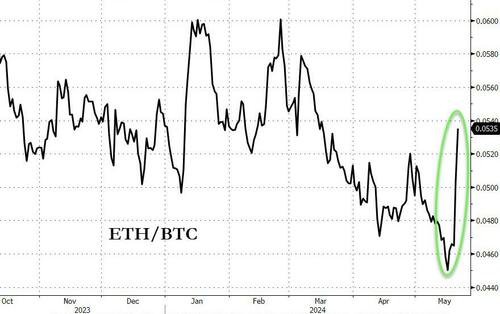

Ethereum outperformed once again as ETH ETF hopes continued to build amid an apparent about-face from the Biden admin’s anti-crypto army…

Source: Bloomberg

For context, ETH is now at its strongest relative to BTC since mid-March..

Source: Bloomberg

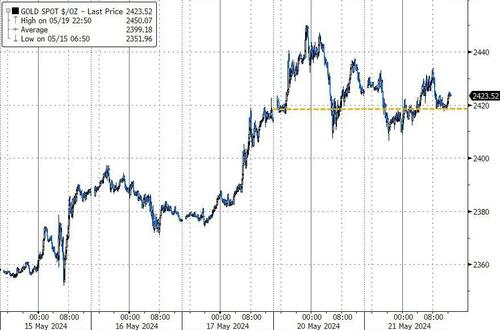

Gold chopped around and ended flat today…

Source: Bloomberg

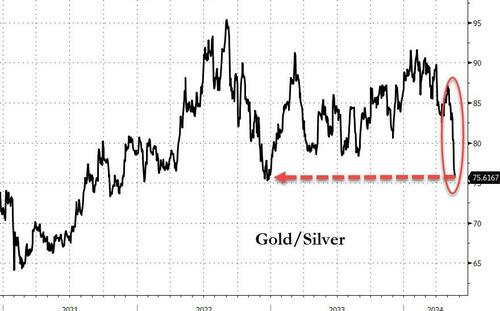

Silver continues to outperform gold, now at its strongest relative to the yellow metal since Dec 2022…

Source: Bloomberg

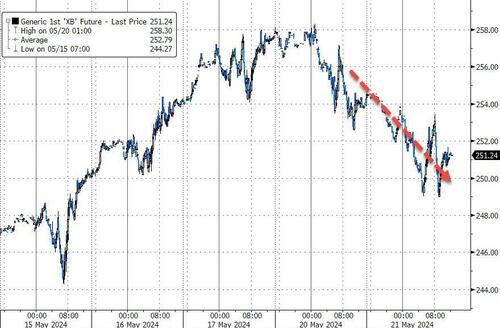

Finally, wholesale gasoline prices fell today after the Biden admin announced a release of its strategic gas reserve (not for political reasons of course)…

Source: Bloomberg

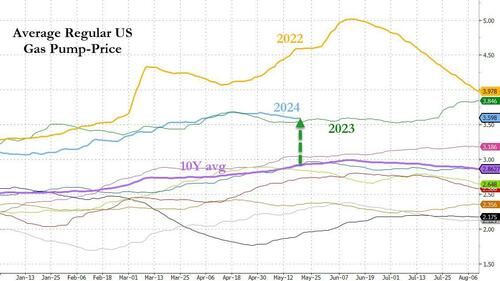

Which is noteworthy because gas prices going into Memorial Day are at their second most expensive in a decade…

Source: Bloomberg

Tyler Durden

Tue, 05/21/2024 – 16:00

via ZeroHedge News https://ift.tt/hnwfxAC Tyler Durden