5 Ways Fed Medicine Is Worse Than The Disease

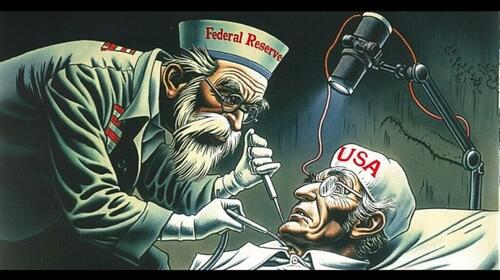

Central bank monetary tactics have proven to be a toxic remedy, amplifying rather than curing economic ailments. Like a surgeon whose operation only worsens the patient’s condition, central banks administer policies that do more harm than good. Here are five ways central banks leave a legacy of financial turmoil.

The following article was originally published by the Mises Institute. The opinions expressed do not necessarily reflect those of Peter Schiff or SchiffGold.

Central banks’ monetary policies are the most perverse government intervention. Their consequences are dire, last for a very long time, and people don’t perceive them as problems or don’t comprehend the damage they are doing. Monetary policy (monetary expansion and artificially low interest rates) has five main consequences that harm overall living standards.

1. Price Inflation

This is the most obvious consequence, and yet, it is very misunderstood by voters. If the money that is effectively circulating in the economy (i.e., M1 and M2, or for a better perspective, the true money supply) increases, price inflation tends to increase. The expansion of the money supply destroys consumer purchasing power and makes people poorer over time.

2. Bigger Government

Government spending and indebtedness are intensified due to expansionary monetary policies (since central banks buy government bonds). More resources are allocated to pay for politicians’ and bureaucrats’ luxurious lives and for government programs that, at their best, are more expensive compared to a free market solution. Governments don’t have an incentive to allocate the resources efficiently (since they can just raise taxes, go deeper into debt, or print money), so anything that it does ends up being more expensive than it would have been without monetary intervention.

3. Financial Assets Become Overpriced

Monetary policy is behind the major financial crisis and its precedent asset bubbles.

The stock market is overpriced because artificially low interest rates raise the present value of corporations’ future earnings, making their stocks go higher without having sound fundamental indicators. Artificially low rates also incentivize people to go into debt to buy stocks, which raises their prices. Plus, some central banks (like the Bank of Japan and the Swiss National Bank) have stocks on their balance sheets, which also appreciates their prices due to the artificial demand.

Real estate prices are inflated as well. Houses and buildings are what Rothbard would call “higher order” goods due to their very long capital structure. He notes,

The supply of funds for investment apparently increases, and the interest rate is lowered. Businessmen, in short, are misled by the bank inflation into believing that the supply of saved funds is greater than it really is. Now, when saved funds increase, businessmen invest in “longer processes of production,” i.e., the capital structure is lengthened, especially in the “higher orders” most remote from the consumer.

Overpriced real estate assets also turn houses, apartments, and commercial properties into an asset class (something to invest in and, in theory, protect oneself from the very inflation that caused the real estate prices to go up in the first place) rather than what they would be if it wasn’t for the government’s meddling: houses and apartments for living, and commercial properties for economic activities, either by renting or buying.

4. Economic Inequality

This one is linked to our previous argument. Thanks to loose monetary policy, financial assets appreciate without being backed by proper fundamentals. Richer people (the ones who have the most financial assets) get even richer not because their investments are improving companies’ productivity (providing more or better goods and services), but because their assets are being inflated by monetary policy.

The financial market turns out to be less accessible for the average Jane and Joe due to the following:

-

Stocks are more expensive and risky and therefore less attractive for one who can’t afford to lose a lot of money.

-

The bond market is also less attractive since their prices go higher due to the artificial demand from the new money supply; hence, its rates go lower. This makes the bonds attractive for people who want to buy them as a speculation on their price (if rates go even lower, their prices go up and the investor makes a profit). Alas, since bonds are expensive, average people can’t afford the risk.

-

Financial markets become more complex since there are a lot more tricky instruments (like derivatives) to deal with market volatility (which would be lower if not for government poking) or to increase returns (not without higher risks). And the use of such instruments by asset managers makes their expenses and fees go higher, which also increases their required minimal investments (excluding the less-fortunate people from the game). Side note: government regulations for financial markets, like the ones of agencies like the Financial Industry Regulatory Authority (yes, this is a private corporation, but it is a monopoly imposed by the government) and the Securities and Exchange Commission, also increase required minimal investments.

So, the average Jane and Joe have fewer tools to get richer. And this keeps getting worse as long as central banks keep up with their dovish monetary policy.

Housing also becomes less affordable, and average people must sacrifice a lot more (and for a much longer time) to save for buying a home. What would be a simple task turns into a long and tiresome effort. This diminished the number of first-time homebuyers, and young people had to delay it. But now, even people in their thirties are living with their parents or other relatives. And homelessness is increasing in major cities like Los Angeles and Lisbon (both foreigners and Portuguese people).

5. Higher Time Preference Equals Less Economic Growth and More Indebtedness

Artificially low interest rates destroy the incentive for savings. In many cases, even if price inflation is low, the return on savings does not compensate for the time that people didn’t use the money. The overall time preference gets higher. People are not willing to wait to spend their money. If there is no return, they might as well party right away.

Indebtedness also increases for consumption instead of being used for investments that would increase productivity and economic growth. This also makes prices go higher than they would be because higher productivity tends to lower prices, and this process is, best-case scenario, delayed by lower savings. In other words, governments don’t let deflation (which would make prices go lower over time) happen.

Price inflation itself also creates an incentive to spend right away (since the purchasing power gets lower every year), and artificially low interest rates make the money market (which would be an easy tool people could resort to for parking their savings) not attractive. And, since overall time preference is higher, most people don’t settle for just preserving their purchasing power (which sometimes can be achieved with gold). They want a fast and high return, a dangerous combination. So, they go to the stock market, which is overpriced thanks to a loose monetary policy, which was covered earlier.

Conclusion

Government interventions through central banks are the most destructive and yet the least understood by most people. It is a bad enough problem to deal with on its own, and even harder to do so when people fail to perceive its damage. Central banks are the source of most evils in the economy.

Tyler Durden

Sun, 06/02/2024 – 21:00

via ZeroHedge News https://ift.tt/7hSvDjF Tyler Durden