Bitcoin, Bullion, & Black Gold Bid As Stocks & Bonds Shrug Off EU Elections

US stocks shrugged off early weakness driven by the right-regime-shift in European elections, treading water on Monday, at least on the surface, following Friday’s strong Payrolls report and ahead of a big macro Wednesday, featuring both the May CPI reading and the scheduled June FOMC meeting.

Small Caps had a wild day, swinging from considerable losses at the cash open to modest gains by the close. All the majors ended slightly higher on the day (with a new ATH for the S&P 500…

Goldman’s trading desk notes that overall activity levels are up +13% vs. the trailing 2 weeks with market volumes down -11% vs the 10dma. Our floor tilts +2% better to buy, largely driven by LOs as they continue to show up on the bid in our flows

-

LOs are +12% better to buy… this would be 6 straight sessions of net demand from this group. Demand fairly broad-based with Tech, Indust & HCare leading the charge. Just Comm Svcs, Staples & ETFs are net for sale

-

HFs are -3% better for sale. Supply is very concentrated in Tech with net supply here nearly 10x the net supply in Energy (2nd largest sector net for sale). Also selling HCare, REITs, Utes while Buying Fins, Indust & Cons Disc.

JPM’s forecast of gloom ensured the new ATH…

new ATH any second https://t.co/f9Iem4FhNs

— zerohedge (@zerohedge) June 10, 2024

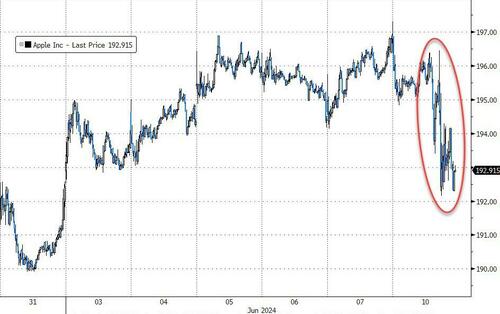

AAPL’s big AI announcement at its WWDC was a bit of a flop…

Source: Bloomberg

For some context…

$AAPL finished down 1.9%. Worst performance since 2010. 4th worst performance in the iPhone era. https://t.co/IhzdKMYNU5

— Walter Piecyk (@WaltLightShed) June 10, 2024

MAG7 stocks went sideways again (admittedly at record highs)…

Source: Bloomberg

Treasury yields modestly extended Friday’s payrolls spike higher with the long-end underperforming (30Y +4bps, 2Y unch on the day) which eft the yield curve (2s30s) unch from pre-payrolls…

Source: Bloomberg

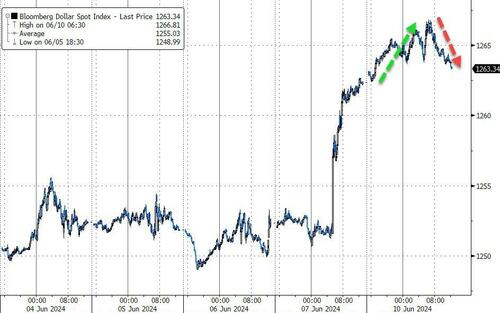

The dollar ended marginally higher, but gave back most of the day’s overnight gains during the US day session…

Source: Bloomberg

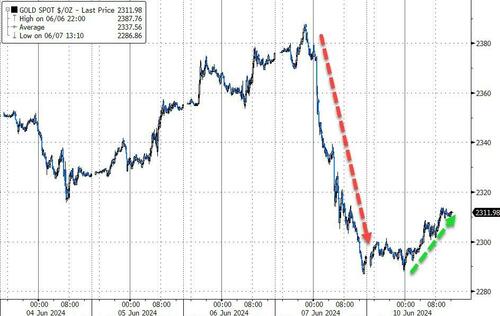

Despite the dollar’s modest gains, gold recovered some of Friday’s losses…

Source: Bloomberg

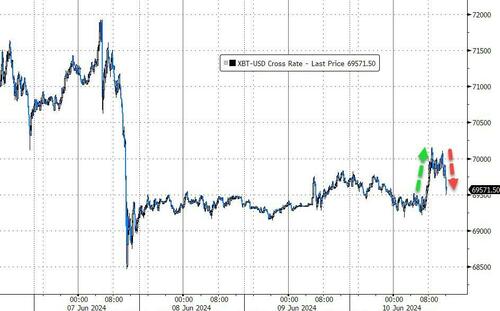

Bitcoin surged up above $70,000, but then was summarily slapped back down to unchanged…

Source: Bloomberg

Crude prices extended their most recent gains, with WTI rising to $78…

Source: Bloomberg

Finally, as we noted earlier, while the indices looks calm, under the surface things are not going great at all…

Source: Bloomberg

This is the biggest gap between the equal- and cap-weighted S&P indices since the peak in 2008/9.

Tyler Durden

Mon, 06/10/2024 – 16:00

via ZeroHedge News https://ift.tt/LRdgxlw Tyler Durden