Bitcoin, Black Gold, & Big-Tech Rip To Start The Week

A mixed (tending towards awful) night of macro from China was somewhat offset (very modestly) by a better than expected Empire Fed Manufacturing print (but still negative) on a quiet macro day.

Bear in mind that Goldman’s economists pointed out that the Empire survey has been particularly volatile since 2022, swinging by at least 20 points in over half of instances as issues related to seasonal adjustment likely contributed to the month-over-month increase.

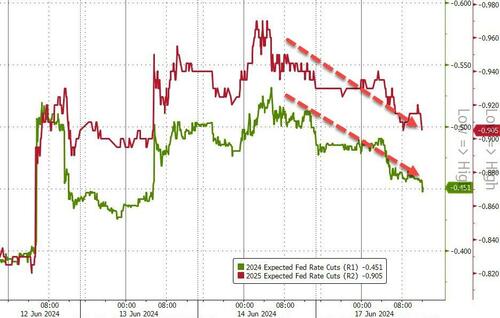

But overall, rate-cut expectations dipped (hawkishly) lower today

Source: Bloomberg

Treasury yields rose notably…

Source: Bloomberg

But stocks didn’t care as they all melted up as the US cash markets opened…

Source: Bloomberg

Nasdaq led the way, up over 1.5% before some late day profit-taking. The Dow was the laggard but all the majors were green on the day. NOTE – stocks went vertical once Europe closed…

On the back of yet more of a surge into MAG7 stocks…

Source: Bloomberg

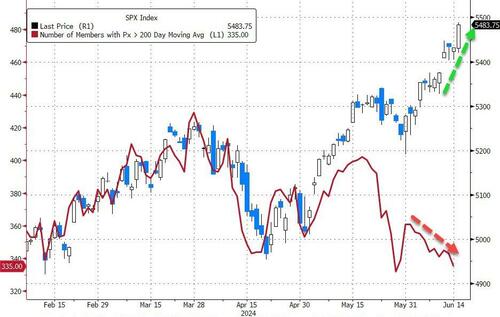

Breadth continues to worsen…

Source: Bloomberg

Goldman’s trading desk noted that overall activity levels are down -7% vs. the trailing 2 weeks with market volumes down -7% vs the 10dma.

Our floor tilts 5% better to buy, driven by demand from LOs while HFs tilt modestly for sale

-

LOs are +18% better to buy, running their streak of net demand to 10 straight sessions. Demand for Mega Tech is still quite prevalent. From a notional perspective, Tech $-net demand is more than 3x larger than HCare (#2) and 5x larger than Fins (#3). Supply from this group is modest across Staples, Materials & Energy.

-

HFs are -6% better for sale (82nd %-ile), using continued Tech strength to make long sales. HFs are modestly selling Fins, Utes, Energy, Macro Products & Energy while buying Staples & Industrials.

The dollar ended very marginally lower after rallying overnight and then losing those gains during the US session…

Source: Bloomberg

Crude prices ripped back up to almost $81 (WTI) a key resistance level…

Source: Bloomberg

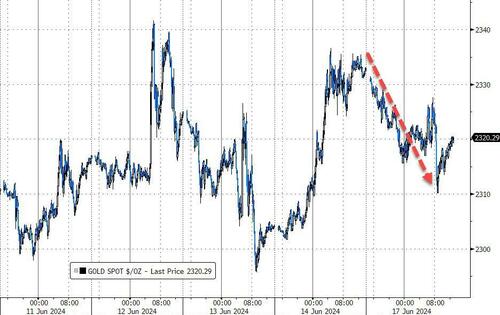

Gold limped back lower…

Source: Bloomberg

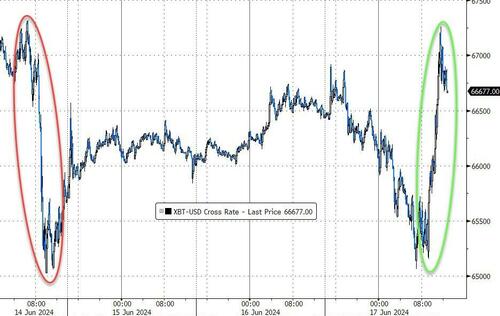

Bitcoin surged back above $67,000, erasing Friday’s plunge…

Source: Bloomberg

But Ether limped lower…

Source: Bloomberg

Finally, Mag7 stocks have added $2.3 trillion in market cap in Q2 so far… while the 493 other stocks in the S&P 500 have lost $720 billion…

Source: Bloomberg

Good luck with that!

Tyler Durden

Mon, 06/17/2024 – 16:00

via ZeroHedge News https://ift.tt/naC3eWd Tyler Durden