Thailand Joins China In Driving Gold Bull Market

By Jan Nieuwenhuijs of Gainesville Coins

Shedding its long-standing price sensitivity to the price of gold, Thailand is currently a gold buyer driving the price up, just like China. Present changes in the global gold market, in which pricing power is shifting East, could be a precursor to a transformation in the international monetary order. Possibly, trade in the East will settle through a system connecting local CBDCs, while any remaining imbalances are transferred in gold.

Introduction

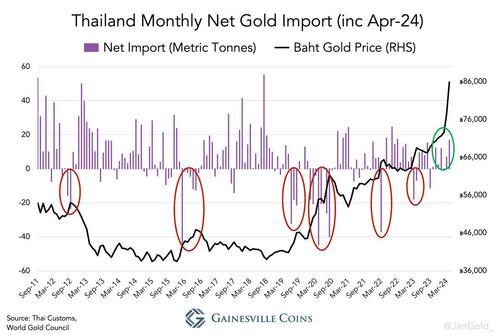

Up until 2021, many countries in Asia were gold price sensitive for nearly a century: they bought when the gold price was steady or declining but swiftly turned into sellers when the price increased. During this period the price of gold was set in the West and the East dampened volatility, best demonstrated in my article “The West–East Ebb and Flood of Gold Revisited.”

After the war in Ukraine broke out in 2022 things started changing in the global gold market, which I have described in “The West Is Losing Control Over the Gold Price” (August 2023), and “China Has Taken Over Gold Price Control from the West” (March 2024). As the titles of the articles suggest, the war, and the resulting sanctions on Russia, set in motion large scale gold purchases by the Chinese, who flipped from being price sensitive to price drivers.

International trade statistics show Thailand has followed China since November 2023. Instead of steadily accumulating and selling into rallies, Thailand was a solid net importer while the gold price went up 20% from ฿72,100 Thai baht per ounce in October 2023 to ฿85,700 in April 2024 (from $2,000 to $2,300).

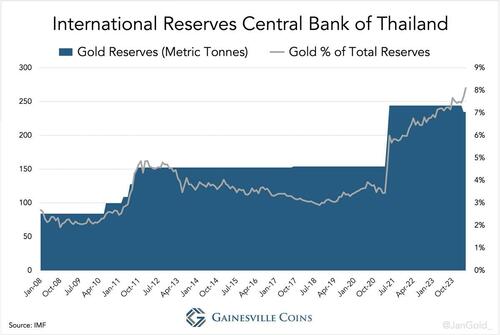

The consensus is that elevated demand in Thailand is due to geopolitical tensions. Next to a long history of saving in gold, the Thai people are stimulated to buy gold as their central bank is accumulating the precious metal too.

Since the Great Financial Crisis, the central bank of Thailand (BOT) increased its gold reserve nearly threefold from 84 tonnes to 236 tonnes. Late October 2023, BOT Deputy Governor of Monetary Stability, Alisara Mahasandana, said in an interview that gold is a relative safe haven in an era of high inflation and growing geopolitical risks. “We need to create a resilient portfolio against all shocks and changes around us… [Gold] is a hedging tool during high inflation and political uncertainty as well as geopolitical events. It’s good for risk diversification,” she said. Adding that bonds of countries previously perceived to be safe bets face an uncertain outlook.

Then, in April 2024, the Thai Government Pension Fund (GPF) stated to “adjust investment proportions by reducing assets that could be affected by war and increasing investments in alternative assets such as gold and oil, which help to mitigate risk.”

Enter mBridge and Gold Recycling

Although I don’t know exactly who are the buyers of the gold we see going into Thailand, I can’t help but think the country’s change in gold buying behavior could be related to mBridge, an international payments project coordinated by the BIS Innovation Hub in Hong Kong, and the Gold Recycling theory suggesting that nations interested in parting with the dollar store trade surpluses in gold.

The earliest participants that started developing mBridge are Thailand, the UAE, China, and Hong Kong. According to the BIS the project “aims to explore a multi-central bank digital currency (CBDC) platform shared among participating central banks and commercial banks, built on distributed ledger technology (DLT) to enable instant cross-border payments and settlement.” A common technical infrastructure has significant potential to improve the current system and allow cross-border payments to be more efficient, immediate, and cheaper. In addition, no dollars are needed in mBridge, and, needless to say, many countries in Asia favor non-dollar trading for political reasons.

On May 21, 2024, the central banks of Thailand and China discussed “strengthening banking and financial cooperation, including the promotion of local currency usage as well as cross-border payment and settlement.” A memorandum of understanding was signed for a Cooperation Framework for Bilateral Local Currency Transactions. This was a few days before mBridge reached Minimum Viable Product stage, on June 5, 2024. Saudi Arabia—that historically played an important role in the petrodollar system—also announced to join mBridge as a full participant on June 5.

MBridge now counts 5 participants and more than 26 central banks as observing members. According to Ledger Insights, “mBridge uses an Ethereum compatible DLT network, the mBridge Ledger, developed by China’s Digital Currency Research Institute.” Because China is in charge of the backbone of the system it will be resistant to Western sanctions.

But mBridge is not a panacea for the dollar centric monetary system. Participants of mBridge are bound to have imbalances (trade surpluses and deficits) with each other which are difficult to settle in their respective currencies due to illiquid financial markets and capital controls, among other reasons. The Gold Recycling theory holds that countries store their surpluses in gold, not US Treasuries. When combined, mBridge and Gold Recycling allow for non-dollar trading and storing surpluses in non-dollar assets: de-dollarization.

In the gold industry it’s an open secret that the central bank of Saudi Arabia is covertly buying gold. The fact that it has joined mBridge, together with China and Thailand that are obviously buying gold hand over fist, could be a game changer.

Russia is not part of mBridge yet, though in 2023 its central bank mentioned it’s setting up a digital currency trade relationship with the UAE. This June, Anatoly Aksakov, Chair of the Financial Markets Committee of the State Duma, said Russia aspires to perform its first cross-border payments using the digital ruble within 18 months. “I’m confident that it will be common practice within five years,” Aksakov said.

In my view, a lot of blanks still need to be filled in. For example, liquidity in currency pairs connected to mBridge (or will they all use the renminbi as trade currency?). A little patience will confirm in what direction the international monetary order is progressing.

Tyler Durden

Thu, 06/20/2024 – 10:05

via ZeroHedge News https://ift.tt/LxMS7c0 Tyler Durden