Futures Flat As Nvidia Slides For Third Day

Futures are flat, set for a muted open after erasing an earlier drop, and trading at record highs after three straight weeks of gains ahead of key inflation data later this week and the first debate between Joe Biden and Donald Trump, as well as the first round of the French snap elections. At 8:15am, S&P futures were unchanged while Nasdaq futures dropped 0.1% pressured by a 3% fall in Nvidia, which was set to extend losses for a third consecutive session, and poised to wipe out another $70 billion in market capitalization after news that ByteDance and Broadcom were discussing collaborating on a potential AI superprocessor. Bond yields are higher, and the Bloomberg Dollar Spot Index falls 0.2% after a five-week rally. Over the weekend, macro catalysts were relatively quiet. Oil prices have calmed after a drop last week, while iron ore futures sunk amid further fears about a recovery in the Chinese property market. Bitcoin tumbled on a report the MtGOX trustee will begin $9 billion in repayments in July. This week, traders will be focused on the release of the Fed’s favored inflation gauge, the core PCE, which is expected to show the slowest advance since late last year and open the door to possible interest rate hikes. Other key events include the first presidential debate on Thursday and earnings from Fedex (Tue), Micron (Wed) and Nike (Thu).

In premarket trading, megacap tech are mixed: GOOG/L +19bp, META +85bp; meanwhile, NVDA -96bp, TSLA -30bp; MU +68bp ahead of Wednesday’s earnings. Among single stocks, ByteDance and Broadcom have discussed a potential collaboration on an AI processor to help bolster the TikTok parent’s development of that technology Reuters reported. Here are some other notable premarket movers:

- Alnylam Pharmaceuticals’ (ALNY) soars 36% after the company said its heart drug vutrisiran succeeded in a late-stage trial.

- Altimmune (ALT) rises 11% after the drug developer presented data from a mid-stage trial of its experimental obesity drug, pemvidutide.

- Cryptocurrency-linked companies fell as Bitcoin extended losses amid cooling demand for the largest digital asset’s exchange-traded funds and uncertainty over monetary policy. Coinbase (COIN) -3.4%, Marathon Digital (MARA) -3.9%. Riot Platforms (RIOT) -3.5%,

- Nvidia (NVDA) slips 1.8%, with the stock set to extend losses for a third consecutive session, after already erasing over $220 billion in market capitalization.

- ResMed (RMD) sinks 11% as Citi downgrades the breathing-machine maker following additional clinical data from Eli Lilly that showed its weight-loss drug tirzepatide reduced the severity of obstructive sleep apnea.

- RXO (RXO) jumps 14% after agreeing to buy UPS’s asset-light freight brokerage business.

- Trump Media & Technology Group (DJT) advances 7% following an announcement late Friday that the firm expected to receive more than $69.4 million in proceeds from the cash exercise of warrants last week.

According to the latest Bloomberg Markets Live Pulse survey, the gains for the S&P 500 this year have likely peaked, with investors growing increasingly nervous on rich valuations in the stock market. One of the driving forces of the rally, Nvidia, is the most expensive stock in the index now. However, analysts and executives are struggling to quantify what its sales will actually be given the AI boom, making it hard to calculate whether the shares are pricey or not.

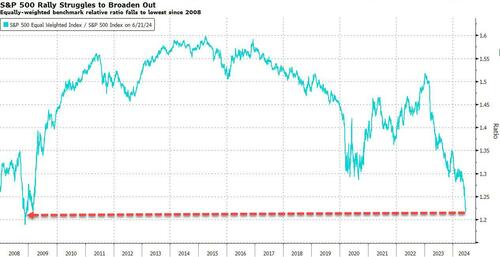

While the market’s narrow breadth is concerning to some, others expect the second half of the year to see equities supported by falling rates and strength from earnings.

“Macro indicators show there was broad economic growth in the second quarter and that should translate into earnings growth,” said Patrick Armstrong, chief investment officer at Plurimi Wealth LLP. He expects this will lead into a broadening of the rally.

Meanwhile, the economy’s neutral rate — the theoretical level when borrowing costs neither stimulate nor slow growth — looks to be much higher than policymakers are currently projecting. Later this week, the Federal Reserve’s key inflation gauges will offer clues over the direction of monetary policy.

“With CPI and PPI having been better behaved recently, it is reasonable to expect PCE to continue this narrative of inflation slowly coming down,” said Wei Li, global chief investment strategist at BlackRock Investment Institute on Bloomberg TV. She expects two cuts this year.

“The expectation is we will see confirmation that inflation has slowed and that’s a development the Fed should welcome. If we get more soft inflation prints, they could well signal over the summer they will cut rates in September,” said Lee Hardman, a strategist at MUFG Bank Ltd.

Europe’s Stoxx 600 Index gained 0.4%, led by auto shares which benefited from news that China and the European Union have agreed to start talks on the bloc’s plan to slap tariffs on electric vehicle imports. Eurofins Scientific SE plunged as much as 24% in Paris after the laboratory-testing company was targeted by Carson Block’s Muddy Waters Research.

Earlier in the session, Asian stocks fell, led by declines in tech shares, as risk-off sentiment prevailed ahead of key US inflation data this week that may shape the path of the Federal Reserve’s monetary policy. The MSCI Asia Pacific Index dropped as much as 0.6%, slipping for a third session. TSMC and SK Hynix were among the biggest drags. Benchmarks in Taiwan and mainland China dropped the most, while Japanese stocks bucked the region’s slump as the yen’s recent decline supported exporters.

- Hang Seng and Shanghai Comp. declined whereby the former retreated beneath the 18,000 level amid tech and property-related pressure, while the mainland index continued its descent after it recently breached the 3,000 level to the downside to print its weakest level since late February.

- Nikkei 225 initially swung between gains and losses as participants digested currency weakness and renewed jawboning but eventually bucked the overall trend owing to exporter strength.

- ASX 200 was led lower by the resources and mining-related sectors amid softer underlying commodity prices.

In FX, Bloomberg’s dollar index eased about 0.2%, having enjoyed a five-week rally. The other notable currency mover was the yen, which saw sharp moves around the 160 mark as Vice Finance Minister Masato Kanda said authorities are ready to intervene to support it 24 hours a day, if needed. The pair USD/JPY traded down 0.3% at 159.25 after touching 159.92 earlier

“In the event of excessive moves based on speculation, we are prepared to take appropriate action,” Masato Kanda, the nation’s top currency official, said “The market appears to be becoming less afraid of intervention now given the steadiness of the upside pressure on USD/JPY in the past two months,” Alvin Tan, head of Asia FX strategy at Royal Bank of Canada in Singapore, writes in a note. “I remain doubtful that there is a firm red line for Tokyo on USD/JPY, and new highs above 160 beckon”

In rates, Treasury yields are higher with US 10-year yields flat just shy of 4.27%. French government bonds rise, outperforming their German peers and narrowing the 10-year yield spread by ~3bps ahead of France’s snap legislative election on Sunday. Marine Le Pen’s far-right National Rally has made further gains, according to Bloomberg’s poll of polls. Options market signals that volatility on French vote is likely to last.

In commodities, oil prices advance, with WTI rising 0.5% to trade near $81.10 a barrel. Spot gold rises ~$6 to around $2,328/oz. Iron ore falls over 2% to the lowest since April.

Bitcoin and Ethereum continues to slip, with the pair both at session lows; BTC looking to test USD 61k to the downside after reports that the Mt. Gox Trustee would start Bitcoin & Bitcoin Cash repayments in July.

Looking at today’s calendar, US economic data slate includes June Dallas Fed manufacturing activity at 10:30am. Ahead this week are consumer confidence, final 1Q GDP revision, durable goods orders, personal income/spending (with PCE deflators) and University of Michigan sentiment. Fed officials scheduled to speak include Goolsbee (8:30am) and Daly (2pm)

Market Snapshot

- S&P 500 futures up 0.2% to 5,543.50

- STOXX Europe 600 up 0.4% to 517.05

- MXAP down 0.2% to 178.94

- MXAPJ down 0.5% to 564.94

- Nikkei up 0.5% to 38,804.65

- Topix up 0.6% to 2,740.19

- Hang Seng Index little changed at 18,027.71

- Shanghai Composite down 1.2% to 2,963.10

- Sensex up 0.1% to 77,314.51

- Australia S&P/ASX 200 down 0.8% to 7,733.69

- Kospi down 0.7% to 2,764.73

- German 10Y yield little changed at 2.40%

- Euro up 0.2% to $1.0711

- Brent Futures up 0.2% to $85.42/bbl

- Gold spot up 0.4% to $2,330.22

- US Dollar Index down 0.12% to 105.67

Top Overnight News

- China and the EU will enter into negotiations over the tariffs Brussels plans to impose on Chinese EV imports. Nikkei

- The yen traded a whisker away from the key 160 level against the dollar even as top currency official Masato Kanda said Japan is ready to intervene again at any time. IG Australia said it expects authorities to step in around 160.20. BBG

- Netanyahu says the most intense fighting in Gaza is nearing an end, but the war will continue until Hamas is eliminated (and any forces removed from Gaza will be shifted to the northern border with Lebanon given the rising risk from Hezbollah). RTRS

- French voters trust the far-right Rassemblement National more than any other party to manage the economy and public finances despite its unfunded tax-cutting and spending plans and lack of experience in government. FT

- French polls show National Rally still in first place at ~36% followed by the left-wing New Popular Front at ~27% and Macron’s coalition at ~20%. BBG

- A new French government led by Marine Le Pen’s far-right National Rally (RN) would end the decades-long practice of running high budget deficits and stick to the European Union’s fiscal rules, the party’s financial pointman told Reuters. RTRS

- ICE is angling to become a central clearinghouse for US Treasuries and repo agreements ahead of new regulations. The NYSE parent is seeking regulatory approval and is in talks with the SEC. BBG

- META has held talks about integrating its AI model into AAPL (Apple)’s Apple Intelligence (Apple is also talking to Google, Anthropic, and Perplexity). WSJ

- Apple Intelligence will only be available on its latest and more expensive devices and won’t show up in some major markets, like China and Europe, for a while. Business Insider

- EU’s Breton says they are taking further action against Apple (AAPL) to ensure compliance with the DMA, Co. has been squeezing out innovative companies and denying consumers new opportunities.

- EU Regulators says Apple’s (AAPL) requirements fall short of complying with EU tech rules; open investigation into Apple on its new contractual requirements for third-party app developers and app stores; Rules breach EU tech rules prevent app developers from steering consumers to alternative offers.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were predominantly subdued heading closer to month-end and US PCE data later in the week, with sentiment not helped by Friday’s mixed performance stateside and the lack of major macro catalysts. ASX 200 was led lower by the resources and mining-related sectors amid softer underlying commodity prices. Nikkei 225 initially swung between gains and losses as participants digested currency weakness and renewed jawboning but eventually bucked the overall trend owing to exporter strength. Hang Seng and Shanghai Comp. declined whereby the former retreated beneath the 18,000 level amid tech and property-related pressure, while the mainland index continued its descent after it recently breached the 3,000 level to the downside to print its weakest level since late February.

Top Asian News

- China’s MOFCOM said it resolutely objects to US planned curbs on investment in China and urged the US to lift investment restrictions on China.

- China’s ByteDance and Broadcom (AVGO) are working on developing an advanced AI processor which would use 5nm technology and manufacturing would be outsourced to TSMC (2330 TT), while it would be compliant with US export restrictions, according to Reuters sources.

- China’s Commerce Minister and EU Trade Commissioner agreed to launch consultations on EV tariffs, according to China’s MOFCOM. It was also reported that China’s state planner hopes that Germany will demonstrate leadership within the EU and do the correct thing, while China will take all measures to safeguard the legitimate rights and interests of Chinese companies, as well as noted that the average price of China’s main EV models overseas is higher than domestic prices.

- Germany’s Economy Minister Habeck said in Shanghai that EU Commissioner Dombrovskis informed him that there will be concrete talks on tariffs with China and their goal is a level playing field between China and Germany. Habeck stated that it is good to be export-oriented but not to use subsidies for it, while he sees some options to reach an agreement but that is the task of the Commission. It was also reported that Habeck said EU tariffs are not a punishment but intend to level the playing field, while he also commented that he does not want tariffs because he believes in open markets and stated there is time for dialogue until November between the EU and China on tariffs, according to Reuters.

- China is to create a fund to rescue financial companies in an effort to avert a financial crisis stemming from the property industry slump, according to Nikkei.

- BoJ Summary of Opinions from the June 13th-14th meeting noted that a member said the BoJ is expected to raise the interest rate if underlying inflation rises as projected and a member said they must consider a further adjustment to the degree of monetary easing given the chance of upside risk to inflation, while there was also the that the BoJ must raise the interest rate in a timely fashion without delay in accordance to heightening chance of achieving the price target. However, one member said BoJ can wait to shift the level of interest rate until it can confirm through data a clear uptrend in inflation and inflation expectations, while a member also said it is appropriate to keep easy policy for the time being due to a lack of strength in consumption and some disruption to auto shipments.

- Japanese Finance Minister Suzuki said he won’t comment on forex levels and that it is desirable for currencies to move in a stable manner reflecting fundamentals, while he added that excessive FX changes are undesirable and wants to respond appropriately as needed, while he replied no comment when asked if current FX moves are excessive.

- Japan’s top currency diplomat Kanda said he won’t comment on daily forex levels and will take appropriate steps if there is an excessive forex move, while he added there is no impact at all from the US report on forex monitoring and the US government suggests there is no problem in Japan’s forex intervention. Furthermore, he doesn’t have a specific forex level in mind and will respond to rapid forex moves by speculators but won’t comment if recent moves are excessive and said Japan is ready to intervene in the currency markets 24 hours a day if needed.

- India’s Finance Minister said they are to consider GST rate rationalisation in the next GST Council meeting in August, according to Reuters.

European bourses, Stoxx 600 (+0.5%) are entirely in the green, having initially opened on a tentative footing. Sentiment improved as the session progressed, though was then capped by poor German Ifo data, with indices currently just off best levels. European sectors hold a strong positive bias; Autos the clear outperformer, benefitting from EU/China consultations on EV tariffs. Retail is found at the foot of the pile, hampered by losses in Zalando (-6.6%), after a broker downgrade. US Equity Futures (ES +0.2%, NQ +0.2%, RTY +0.3%) are entirely in the green, with sentiment lifted in tandem to a pick-up in European equities. In terms of pre-market movers, Broadcom (+1.4%) gains on news that it is working with Bytedance to develop an advanced AI processor.

Top European News

- Manchester Airport in the UK was affected by a major power cut on Sunday morning which caused widespread disruption and the cancellation of a quarter of total flights from the airport. It was later reported that the airport was resuming operations and it is working on rescheduling flights in the coming days, while flights scheduled on Monday should be unaffected.

- Ipsos poll found that 25% of respondents had the most confidence that Marine Le Pen’s far-right RN to make the correct decisions on economic issues compared with 22% for left-wing NFP and 20% for French President Macron’s alliance, according to FT.

FX

- DXY is weaker and trading towards the bottom end of today’s 105.61-90 range, and well within the prior session’s confines. Continued pressure in the Dollar index will bring into play the low from 21st June at 105.53, with not much by way of support until the 50-DMA at 105.19.

- EUR is modestly firmer and holds above 1.07, largely benefitting from broader Dollar weakness. German Ifo data fell short of expectations across the board, which sparked very modest pressure in the EUR, though it has since continued its way higher.

- Cable is incrementally firmer vs the Dollar, and pivoting its 50-DMA at 1.2658. As it stands, markets have ascribed a 88% chance of a cut in September, and near-enough 2 full cuts by year-end.

- USD/JPY is flat after going as high as 159.92 overnight, before edging back towards 159.75. Continued upside in the pair will make traders increasingly more alert to the risk of intervention, particularly around the 160.00 mark.

- Antipodeans are both are firmer vs the Dollar, with very slight outperformance in the Aussie; AUD currently sits above its 20-DMA at 0.6639, though still some way off Friday’s best at 0.6669.

- PBoC set USD/CNY mid-point at 7.1201 vs exp. 7.2647 (prev. 7.1196).

In fixed income

- USTs are rangebound with a few fleeting ticks higher emerging on the German Ifo release but with just under 10 ticks to go to re-test Friday’s pre-PMI best. Fed’s Goolsbee & Daly are scheduled for later today, but this week’s focus will reside on US PCE on Friday. USTs currently trading around 110’16.

- Bunds were initially contained as a particularly poor Ifo only inspired a few fleeting ticks higher in Bunds, rising to a 132.72 peak. Since, Bunds have slipped off best levels and towards session lows at 132.33, though without a clear catalyst, but in tandem with a modest pick-up in other safe-haven assets such as the JPY & CHF.

- Gilts are incrementally outperforming but with specifics light. Upside potentially coming as the UK docket is devoid of catalysts and as such Gilts are taking the opportunity to pare some of Friday’s downside, whilst USTs and Bunds are mindful of this week’s key risk events/supply.

In commodities

- Crude is firmer and off worst levels, having traded rangebound overnight and throughout the majority of the European morning. Brent Aug currently holding just above USD 85.50/bbl.

- Precious metals are a touch firmer given the weaker USD and generally slightly soft yield environment; XAU in a USD 2317-2332/oz range, which is capped by the USD 2332/oz 21-DMA.

- Base metals followed the APAC tone and were subdued/lacklustre overnight. A narrative that has dissipated in the European morning given the improved tone and USD pullback.

- Iran set July Iranian light crude price to Asia at Oman/Dubai plus USD 2.60bbl, according to Reuters.

- Ukraine’s Energy Ministry said a Russian air strike on Saturday attacked a Ukrainian infrastructure facility in the west and that Ukraine planned record-high electricity imports following Russia’s air strikes, according to Reuters.

- Phillips 66 (PSX) reports a unit upset at the Wood River, Illinois refinery (173k BPD)

Geopolitics: Middle East

- “Cairo will not restart the Rafah crossing in the presence of Israel “, via Al Arabiya citing an Egyptian source

- Israeli PM Netanyahu said the phase of intense fighting against Hamas is coming to an end but added it does not mean an end to the war in Gaza and stated that once the intense phase of fighting ends in Gaza, it would allow the deployment of more forces to the northern border with Lebanon, according to Reuters.

- Israeli Defence Minister Gallant headed to Washington on Sunday where he will discuss Gaza and Lebanon during his US trip, according to Reuters.

- Security and political talks were reportedly underway in Israel to choose the right timing for action in the north, according to Israel’s Channel 12.

- Israel reportedly conducted an air strike on a UNRWA aid centre in Gaza which killed 8 people, according to witnesses cited by the Australian Broadcasting Corporation.

- US top general warned that an Israeli offensive in Lebanon could increase risks of a broader conflict that draws in Iran, according to Reuters.

- Yemen’s Houthis said they carried out two military operations in the Arabian and Red Seas in which it targeted the Trans World Navigator ship in the Arabian Sea and targeted US aircraft carrier Eisenhower in the Red Sea, according to Reuters.

- US Central Command said forces successfully destroyed three Iranian-backed Houthi unscrewed surface vessels in the Red Sea, while it added that Houthis launched three anti-ship ballistic missiles from a Houthi-controlled area of Yemen into the Gulf of Aden but there were no injuries or significant damage reported by US, coalition or merchant vessels.

- UKMTO announced an incident 65NM west of Yemen’s Hodeidah whereby a vessel was reportedly hit by an uncrewed aerial system which resulted in damage. UKMTO also announced an incident 96NM of Yemen’s Nishtun in which a vessel was reported to have suffered flooding that cannot be contained and the crew were forced to abandon ship but have been recovered by an assisting ship.

- Bahrain and Iran agreed to restart talks aimed at resuming political relations between the two countries, according to Bahrain’s state news agency.

Geopolitics: Other

- Ukrainian President Zelensky said Russia used more than 2,400 guided bombs against Ukraine in June alone including 700 against Kharkiv, while he added that they need the promised defence packages without delay so that their agreements with US President Biden can be carried out, according to Reuters.

- Ukraine said Russia launched an air attack on Kyiv and its region, while air defence systems engaged in repelling the attack. It was separately reported that Russian air defence systems destroyed 12 Ukraine-launched drones over Russia’s Bryansk region, according to the regional governor cited by Reuters.

- Shrapnel from an intercepted US-made missile fired by Ukraine hit a beach packed with sunbathing tourists in occupied Crimea on Sunday, according to The Telegraph. It was separately reported that Russia’s Defence Ministry said that responsibility for the shelling of Crimea’s Sevastopol lies primarily with the US and that there will be a response to the shelling, according to Reuters.

- EU reportedly devises a legal loophole to bypass a Hungary veto on support for Ukraine, according to FT.

- South Korea, the US and Japan said Russian President Putin’s visit to North Korea triggered grave concern and they strongly condemn the deepening of North Korean and Russian military cooperation, while they will further strengthen security cooperation to counter threats by North Korea, according to South Korea’s Foreign Ministry.

- US envoy for East Asia Kritenbrink said the US-Vietnam partnership has never been stronger and only Vietnam can decide how best to safeguard its sovereignty and advance its interests. Kritenbrink also commented that the current situation is deeply concerning and they will stand with Filipino allies, as well as noted that China’s actions, especially around the Second Thomas Shoal in the South China Sea have been irresponsible aggressive, dangerous and deeply destabilising. Furthermore, he said they have made it clear to Beijing that mutual defence treaty obligations the US has to the Philippines are ironclad, according to Reuters.

- Philippines President Marcos said they are not in the business of instigating war and refuse to play by the rules that force them to choose sides in a great power competition, while he added they would like to settle all issues peacefully and have never yielded to any foreign power, according to Reuters.

- Russia expressed “demarche” to the US envoy over the missile attack on Crimea, via Tass.

US Event Calendar

- 09:00: Bloomberg June United States Economic Survey

- 10:30: June Dallas Fed Manf. Activity, est. -15.0, prior -19.4

Central Bank Speakers

- 03:00: Fed’s Waller Gives Opening Remarks

- 08:30: Fed’s Goolsbee Interviewed on CNBC

- 14:00: Fed’s Daly Gives Remarks on Economy, Policy

DB’s Jim Reid concludes the overnight wrap

The French election on Sunday (part one) will be the main event this week with some indication of how it’s gone as we go to print this time next week. The opinion polls over the weekend generally saw the far-right National Rally party continuing to see their support edge up with the latest poll of polls showing support at 33%, versus the 27% for the far-left New Popular Front (NPF) and 20% for Macron’s movement. As an interesting aside one of the NPF members Eric Coquerel, who was chair of the finance committee prior to the dissolution of parliament two weeks ago, said that his party’s alliance would raise the top marginal rate of income tax to 90% if it were elected. The top rate is currently 45%. While the constitutional court may well prevent this if they were in power, it is more evidence of the potential consequences of this election.

Staying with politics, it will also be fascinating to see the first televised debate between Biden and Trump on Thursday evening in the US. There is plenty of scope for big headlines and for the candidates to gather some momentum or see it go into reverse.

In terms of data the main event is Friday’s US core PCE. Friday is a big day for inflation elsewhere as the European flash CPI is out after Tokyo CPI in Japan earlier in the day.

Other highlights this week by day are the German IFO today; US consumer confidence, Japan PPI, Canadian CPI tomorrow; US new home sales, Australia CPI and a 5yr UST auction on Wednesday ; US trade, durable goods, and a 7yr UST auction on Thursday; and with Friday bringing German unemployment, and the final UoM US consumer sentiment alongside the inflation data mentioned above. The day-by-day calendar at the end gives a fuller dairy of events.

Previewing Friday’s US core PCE deflator, our economists’ believe it should increase +0.17% (vs. +0.25% previously), which would have the effect of lowering the year-over-year rate by 12bps to 2.63%. One note of caution is that their estimate does not include the -10.2% plunge in the seasonally-adjusted PPI for international scheduled passenger air transportation. Their estimate would be about 5bps lower if the BEA does not smooth through this drop. Thus, risks are skewed to the downside which is certainly one to watch.

Moving on to European inflation, our European economists’ inflation previews Friday’s flash releases here.They expect Eurozone HICP to come in at 2.40% YoY (2.57% in May). Across countries, their forecasts are 2.4% (2.8%) for Germany, 2.5% for France (2.6%), 0.8% for Italy (0.8%), and 3.4% for Spain (3.8%).

Another thing to watch is Nvidia and tech. Nvidia became the largest company in the world on Tuesday night before Wednesday’s holiday. It then opened over 3% higher on Thursday. However from this peak it fell around -10% into Friday’s close. Is this a brief hiccup, or the start of some air being let out of the ballon? Interestingly our very prescient equity strategists have put out a note over the weekend arguing for a breather in US markets partly due to stretched positioning and a buy back black-out starting next week ahead of Q2 earnings. See their note here.

Asian equity markets are mostly trading lower this morning, with Chinese markets leading losses with the Hang Seng (-1.03%) emerging as one of the biggest underperformers while the CSI (-0.38%) and the Shanghai Composite (-0.67%) are also trading lower. Elsewhere, the KOSPI (-0.89%) is also nursing losses with the S&P/ASX 200 (-0.76%) also falling. Meanwhile, the Nikkei (+0.62%) is bucking the trend. S&P 500 (-0.11%) and NASDAQ 100 (-0.08%) futures are slightly lower.

On China-EU tariffs, trade chiefs from both sides discussed the topic on a call over the weekend and agreed to hold further consultations in the coming weeks. Provisional EU duties of up to 38.1% on imported Chinese-made EVs are set to kick in by July 4 with the tariffs set to be finalised on November 02 at the end of the EU anti-subsidy investigation.

Earlier this morning, the BOJ’ summary of opinions from its June monetary policy indicated that board discussed the possibility of raising interest rates further amid concerns over lingering inflationary pressure. Meanwhile, the Japanese yen is fluctuating in a tight range, trading fractionally higher (+0.08%) to trade at 159.66 against the dollar but is still near its weakest level in 34 years even after more verbal warnings from the top currency official Masato Kanda where he emphasised that authorities stand ready to intervene in currency markets 24 hours a day if necessary.

Now recapping last week, the S&P 500 gained +0.61%, supported by solid data releases earlier in the week, although the index slipped -0.16% on Friday. Last week’s rally was broad based, with the equal-weighted version of the S&P 500 rising +1.12% (+0.12% on Friday) and the small cap Russell 2000 gaining +0.79% (+0.23% on Friday). On the other hand, the tech-heavy NASDAQ was flat on the week (-0.18% on Friday). Nvidia led the tech underperformance, falling -4.03% (and -3.22% on Friday). The semiconductor giant briefly overtook Microsoft to become the world’s most valuable company on Tuesday, before falling back into third place at the end of the week after a difficult couple of days after Wednesday’s holiday.

The performance of US equities was subdued on Friday even as the June flash PMIs came in better-than-expected. Most notably, the flash services PMI rose to 55.1 (vs 54.0 expected), its highest level since April 2022. The manufacturing PMI also improved to 51.7 (vs 51.0 expected), bringing the composite index to 54.6 (vs 53.5 expected). This activity improvement came even as the composite output price index eased to a 5-month low of 53.5 (vs. 54.3 prev.), so the release was firmly on the soft landing side of the ledger.

The moves in European and US markets were more in line last week as the political uncertainty originating in France was better digested by markets. European equities made decent gains, with the STOXX 600 up +0.79%. The index did sell off on Friday (-0.73%), driven mostly by weaker-than-expected flash PMIs for June. The euro-area composite PMI fell to 50.8 (vs 52.5 expected), ending a run of 5 consecutive monthly gains. The story was similar for the national equity indices, as the CAC 40 and DAX rose +1.67% and +0.90% last week respectively despite a sell-off on Friday (-0.56% and -0.50%). Elsewhere, the MSCI EM index rose +0.93% (and -0.81% on Friday).

Whilst equities recovered, bonds struggled last week. The 10yr Franco-German spread widened +3.1bps on Friday (and +3.4bps last week) to 80bps, its widest since 2012, after the French left-wing alliance announced aggressive spending plans ahead of the French election. Against this backdrop, sovereign bonds lost ground across the board. 10yr bund yields rose +4.9bps, despite a -2.3bps decline on Friday following the weaker PMI release. 10yr OAT (+8.3bps), BTP (+1.2bps) and gilt (+2.7bps) yields were also higher on the week. Over the Atlantic, 10yr Treasury yields were up +3.5bps to 4.26% (-0.4bps Friday).

Tyler Durden

Mon, 06/24/2024 – 08:21

via ZeroHedge News https://ift.tt/0bURalF Tyler Durden