Rivian Soars 50% After $1 Billion Investment From Volkswagen, Record Shorts Squeezed

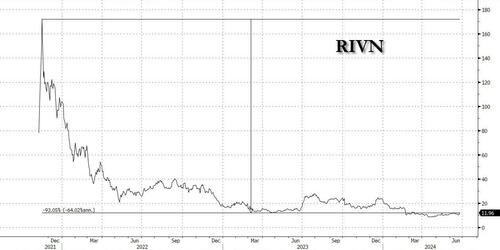

After soaring to a record high just days after its November ’21 IPO (at $78/share), the fate of EV maker Rivian had been a brutal one-way masterclass in disappointment after disappointment, with the price trading near record lows in recent months, and flirting with single digits, down 93% from the all time high of $172 hit in November 2021.

So one can almost feel happy for the long-suffering RIVN longs who saw their stock price surge more than 50% after hours when Germany’s largest car company Volkswagen announced it would invest $5 billion to form a joint venture with Rivian, throwing a lifeline to the struggling startup and giving the German automaker access to the American EV company’s technology.

As part of the investment, VW said it will invest $1 billion immediately in Rivian and an additional $4 billion over time. The new venture will be “equally controlled and owned” and aims to develop “next generation” battery-powered vehicles and software, VW and Rivian said in a joint statement..

The strategic alliance provides the cash incinerating Rivian with a much-needed source of new capital after the company has struggled to ramp up production and deliveries of its electric pickup and SUV models. It comes ahead of Rivian’s previously-scheduled investor day on Thursday. For VW, the German car giant gets access to the EV startup’s software and EV architecture after years struggling to roll out plug-in vehicles with efficiency and functionality on par with those from Tesla.

As part of the deal, Volkswagen will take an initial $1 billion equity stake in Rivian through an unsecured convertible note that will exchange into Rivian shares on or after Dec. 1. That would make Volkswagen the company’s second largest shareholder after Amazon.com, which will remain Rivian’s largest investor with a 16% stake valued at nearly $2 billion as of Tuesday’s close (and $3 billion following news of the venture).

VW will then invest an additional $2 billion in Rivian shares via two equal tranches in 2025 and 2026, and will put an additional $2 billion into the joint venture through a payment at the venture’s inception and a loan available in 2026.

On a conference call, Rivian Chief Executive Officer RJ Scaringe said he and VW CEO Oliver Blume, shared an “immediate realization” the two were aligned on product strategy soon after they initially met. That led to conversations about working together, he said.

This is exciting! Volkswagen Group CEO Oliver Blume and I are thrilled to announce the formation of a joint venture between our two companies. This partnership brings Rivian’s software and zonal electronics platform to a broader market through Volkswagen Group’s global reach and… pic.twitter.com/11XVNUo89J

— RJ Scaringe (@RJScaringe) June 25, 2024

“Through our cooperation, we will bring the best solutions to our vehicles faster and at lower cost,” Blume said in the companies’ statement. “We are strengthening our technology profile and our competitiveness.”

Rivian went public in November 2021 at the peak of enthusiasm for the speedy arrival of the EV future, seen as a potentially competitor to Tesla. Sure enough, an early rise in Rivian shares briefly gave it a market value exceeding that of Ford and General Motors, but since then, many of its fellow EV startups have fallen by the wayside as mainstream car buyers turned away from pricey EVs. Rivian has struggled to find a path to profitability and generate enough cash flow to fund its future.

That said, one would not be shocked if today’s tie up ends up in flames similar to the catastrophic JV between GM and the fraud that was Tesla, where Mary Barra did precisely zero diligence before investing millions in the soon to be defunct company. And indeed, Rivian has seen attempted partnerships with established automakers collapse before. In November 2021, it abandoned plans to jointly develop EVs with Ford, an early investor. And in December 2022, it shelved a deal to build electric vans with Mercedes-Benz AG.

For VW, the German automotive giant gets access to the EV startup’s software and EV architecture after years struggling to roll out plug-in vehicles with efficiency and functionality on par with those from Tesla Inc.

Both companies plan to introduce vehicles featuring technology created by the joint venture in the second half of this decade, according to the companies’ joint statement.

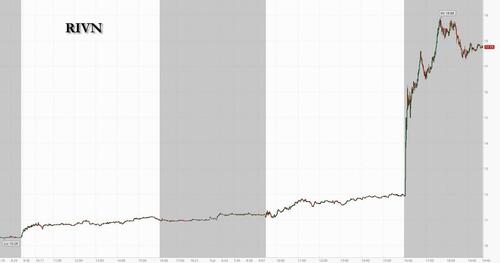

Rivian stock exploded after hours, surging as much as 55%…

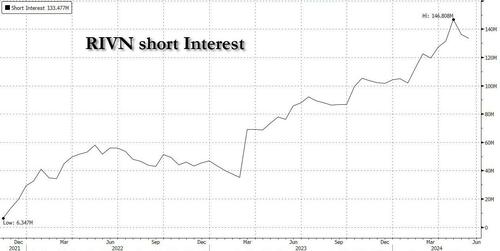

… on what is as much a kneejerk response to the news, as an epic short squeeze. As we noted earlier, some 133 million RIVN shares are currently short, just shy of the all time high, and some 16.4% of the float.

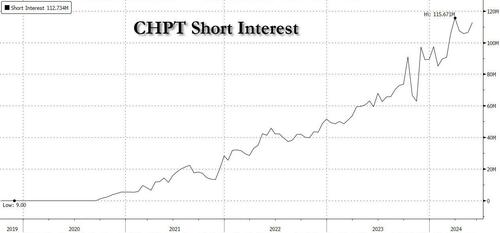

And if indeed Germany’s largest carmaker is aggressively expanding into EVs in the US, then is it time to look at downstream beneficiaries, where one name sticks out: with a record short interest of 112 million, or a whopping 28% of the float short, is Chargepoint, another name that has been largely left for dead (market cap of only $500 million), about to squeeze into the stratosphere next?

Tyler Durden

Tue, 06/25/2024 – 19:43

via ZeroHedge News https://ift.tt/KE0yTHg Tyler Durden