WTI Drops On Large Gasoline Build, Oil Demand Slump

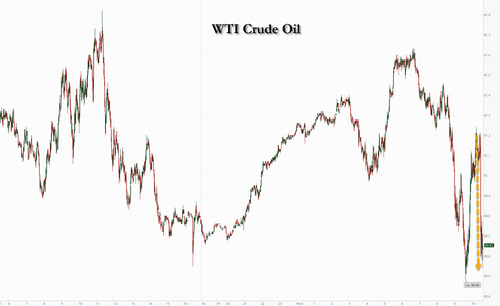

Crude prices have roller-coastered over the last 12 hours or so as last night’s API (large gasoline build) sparked selling, then buying waves hit during the late-Asia/early-Europe session, then selling returned with a vengance during the early US session as Kanda’s comments sparked dollar strength and sent commodities lower.

The dismal home sales print sparked dollar weakness and sent oil prices back up into the green ahead of the official inventory data.

API

-

Crude +914k (-200k exp)

-

Cushing -350k

-

Gasoline +3.84mm (-900k exp) – biggest build since Jan 2024

-

Distillates -1.18mm

DOE

-

Crude +3.59mm (-200k exp, whis +800k)

-

Cushing -226k

-

Gasoline +2.65mm – biggest build since Jan 2024

-

Distillates -377k

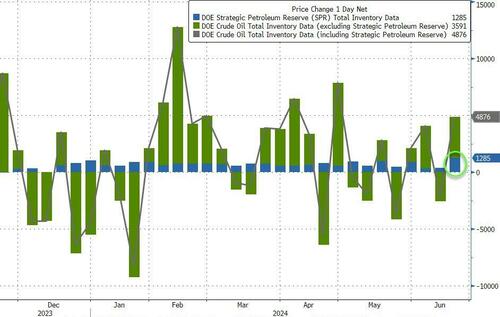

Confirming API’s report, the official data shows a considerable crude inventory build and the largest rise in gasoline stocks since January…

Source: Bloomberg

The Biden admin added a shockingly large 1.285mm barrels to the SPR last week – the largest since June 2020. Overall this was the biggest weekly increase in stocks in two months…

Source: Bloomberg

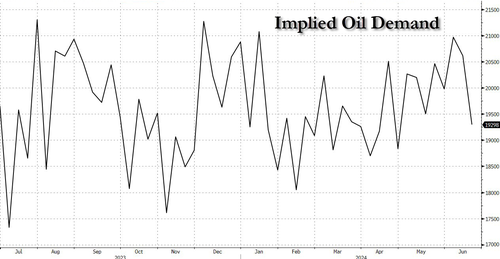

US implied crude demand plunged last week…

Source: Bloomberg

US Crude production was unchanged just shy of record highs as rig counts slipped south…

Source: Bloomberg

WTI was trading just in the green ahead of the official data, around $81.20; and dropped back towards the $80 level on the print…

As Bloomberg’s Lucia Kassai reports, it’s hard to see any saving graces in the EIA report of this week.

Overall we’ve seen surprise builds in crude oil and gasoline inventories, softer demand across gasoline, diesel and jet, and refineries reduced utilization rates in all PADD regions.

Tyler Durden

Wed, 06/26/2024 – 10:39

via ZeroHedge News https://ift.tt/W0k7VqG Tyler Durden